TL;DR

- Cardano (ADA) has officially confirmed a death cross, signaling a potential continuation of bearish momentum after weeks of steady decline.

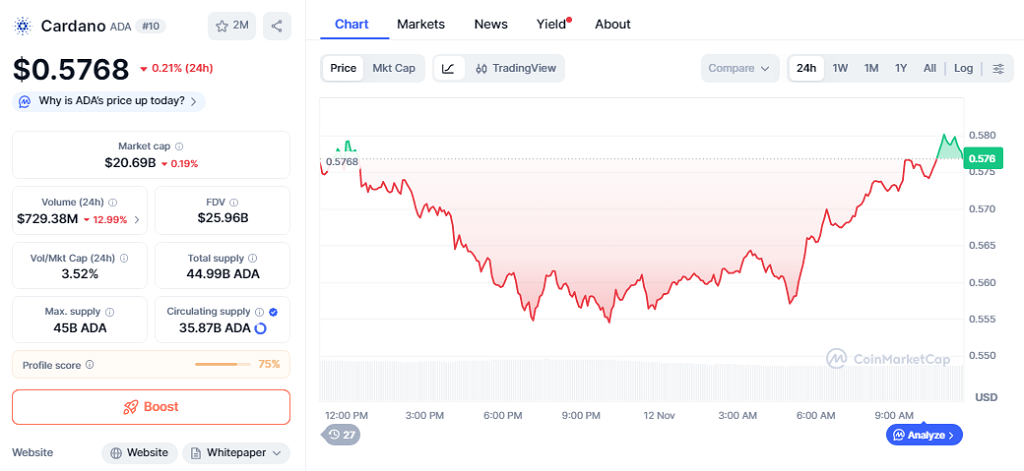

- The token trades near $0.5768, down 0.21% in the past 24 hours, with a market capitalization of $20.69 billion.

- Despite short-term weakness, technical indicators hint at stabilization if broader market sentiment improves.

Cardano (ADA) is facing renewed selling pressure as its daily chart confirms a death cross pattern, a well-known bearish signal in technical analysis. The move follows a multi-week slide, raising doubts about near-term recovery prospects. ADA currently trades at $0.5768, posting a slight 0.21% decline in the last 24 hours, according to CoinMarketCap. The asset’s market capitalization stands at $20.69 billion, keeping it among the top ten cryptocurrencies by value.

Technical Breakdown Shows Persistent Weakness

The latest death cross appeared when the 9-day simple moving average (SMA) crossed below the 26-day SMA. Historically, this formation has often preceded extended correction phases across digital assets. Cardano’s chart shows that the short-term SMA at $0.5627 slipped beneath the long-term SMA at $0.5666, confirming weakening momentum.

TradingView data shows ADA’s price retreating from a recent high near $0.610 to its current range below $0.58. Analysts view the next support zone between $0.55 and $0.56 as crucial for avoiding deeper losses. Meanwhile, the Relative Strength Index (RSI) remains neutral near 55, suggesting room for further downside before an eventual rebound. A push above 60 could signal renewed bullish strength if market sentiment improves.

ADA’s Long-Term Outlook And On-Chain Dynamics

On-chain data indicates that Cardano whales have been actively reducing their exposure, selling roughly 140 million ADA in recent weeks. This activity has amplified short-term volatility and increased downward pressure on price action. However, Cardano’s ecosystem remains one of the most actively developed in the blockchain space, with ongoing upgrades to smart contracts and scaling solutions like Hydra.

Despite the bearish formation, some analysts argue that ADA’s current levels could attract accumulation if Bitcoin stabilizes after its recent 8% monthly drop. Broader risk appetite and liquidity returning to the market may provide the necessary catalyst for ADA to regain the $0.60 threshold.

In summary, the validation of the death cross on ADA’s chart strengthens the near-term bearish view, but structural progress in Cardano’s network development continues to offer a longer-term positive outlook for investors focused on fundamentals.