TL;DR

- Robert Kiyosaki urged investors to prioritize Bitcoin and Ethereum as a way to preserve personal financial independence amid expanding government influence.

- He linked recent political trends in the United States with a gradual erosion of free-market values and warned that traditional banking may no longer guarantee security.

- He believes Bitcoin could climb toward 180,000 dollars by late 2025, supported by rising adoption and distrust in centralized systems.

Financial educator and author Robert Kiyosaki has renewed his message to global investors, encouraging them to safeguard their savings through Bitcoin and Ethereum. The Rich Dad Poor Dad author suggested that digital assets give individuals control over their money at a time of increasing state involvement in the economy. His comments on X reached millions and quickly sparked discussion across financial circles, especially among younger investors seeking alternatives to banks and bonds.

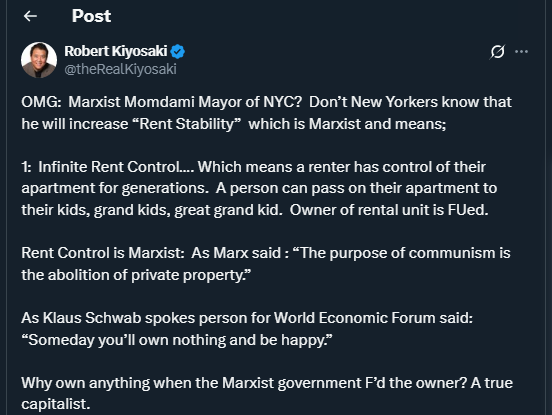

Kiyosaki referred to the recent New York mayoral election as a symbolic sign of shifting priorities in the United States. He argued that the outcome reflects a wider change that could reduce incentives for entrepreneurship and personal responsibility. According to him, this environment rewards dependency and increases the likelihood that governments attempt to influence financial decision-making. He encouraged individuals to strengthen their financial education and avoid relying solely on the traditional financial system.

Bitcoin And Ethereum As Tools For Personal Control

Kiyosaki has long supported gold, silver, and Bitcoin as ways to protect savings from inflation and debt-driven monetary policy. He now places Ethereum in the same category, highlighting its role in decentralized finance, tokenized assets, and smart contracts. He believes that both cryptocurrencies are more than investments. In his view, they represent a path toward personal control of wealth without interference from political agendas or central authorities.

He remains optimistic about future price performance. His current expectation suggests Bitcoin could approach 180,000 dollars before the end of 2025. He linked this projection to weakening confidence in the U.S. dollar, combined with an accelerating movement toward decentralized financial solutions and growing institutional demand for digital assets.

Shift Toward Decentralized Wealth Management

Kiyosaki maintains that relying on salaries, pensions, or traditional portfolios may no longer guarantee long-term prosperity. He promotes a model focused on independent learning, asset ownership, and exposure to decentralized technologies. He framed digital assets as part of a modern financial toolkit that enables individuals to build wealth beyond the reach of bureaucratic systems.

Although some analysts view his warnings as excessive, his influence among retail investors remains strong.