TL;DR

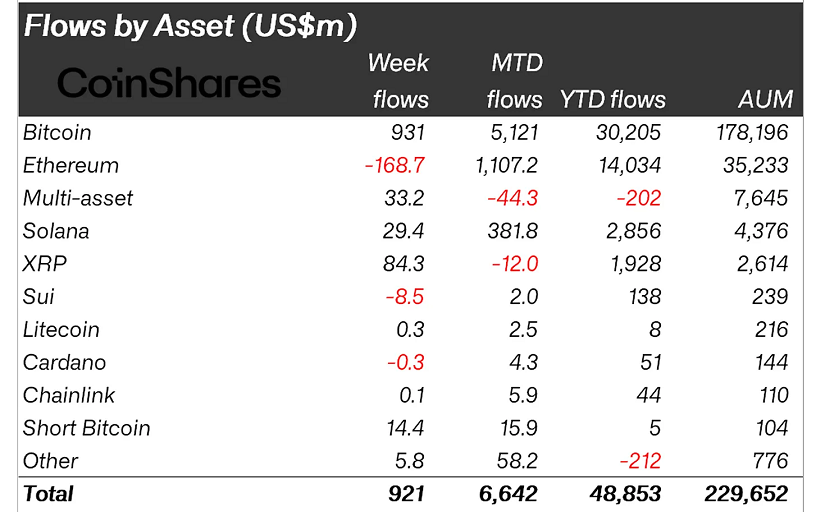

- Digital asset funds recorded $921 million in inflows last week, signaling renewed institutional confidence amid rate-cut expectations.

- Bitcoin funds dominated with $931 million in inflows, while Ethereum products saw $169 million in outflows after weeks of growth.

- U.S. and German investors led the surge, reflecting the expanding global appetite for crypto as a legitimate asset class.

After weeks of uncertainty, the crypto investment landscape is once again attracting large-scale capital. According to new data from CoinShares, digital asset investment products managed by global firms such as BlackRock, Fidelity, and Grayscale amassed $921 million in net inflows over the past week. This marks a sharp reversal from the previous week’s $513 million in outflows.

Market observers attribute this rebound to growing optimism over potential interest rate cuts in the United States. Recent inflation data came in lower than expected, giving investors renewed confidence that the Federal Reserve will continue easing monetary policy through the end of the year. As traditional markets remain cautious, institutional players appear increasingly willing to diversify into digital assets.

Bitcoin Leads Institutional Flows

Bitcoin investment products captured the lion’s share of the movement, recording $931 million in inflows. Since the Federal Reserve began cutting rates, total inflows into Bitcoin funds have reached nearly $9.4 billion. Year-to-date, inflows now stand at $30.2 billion, maintaining strong momentum despite last year’s record of $41.6 billion.

BlackRock’s IBIT ETF once again dominated activity with $324 million in weekly inflows, reinforcing its growing leadership among spot Bitcoin exchange-traded funds. The data suggests that major institutions continue to view Bitcoin as a strategic hedge and a long-term store of value rather than a speculative instrument.

Ethereum, on the other hand, saw a brief pullback. Products tied to the asset experienced $169 million in outflows, primarily driven by U.S.-based funds.

Global Interest Strengthens Beyond the U.S.

The United States remains the dominant source of inflows with $843 million, but Europe showed surprising strength. Germany-based funds attracted $502 million, one of their largest weekly totals on record. Switzerland, meanwhile, recorded $329 million in outflows, though this was mostly linked to asset transfers rather than selling pressure.

Overall, weekly trading volumes in crypto ETPs remained robust at $39 billion, significantly above the 2025 average of $28 billion. This sustained activity reinforces the perception that digital assets are no longer a niche market but a core part of diversified institutional portfolios, a shift that continues to reshape the global financial landscape.