TL;DR

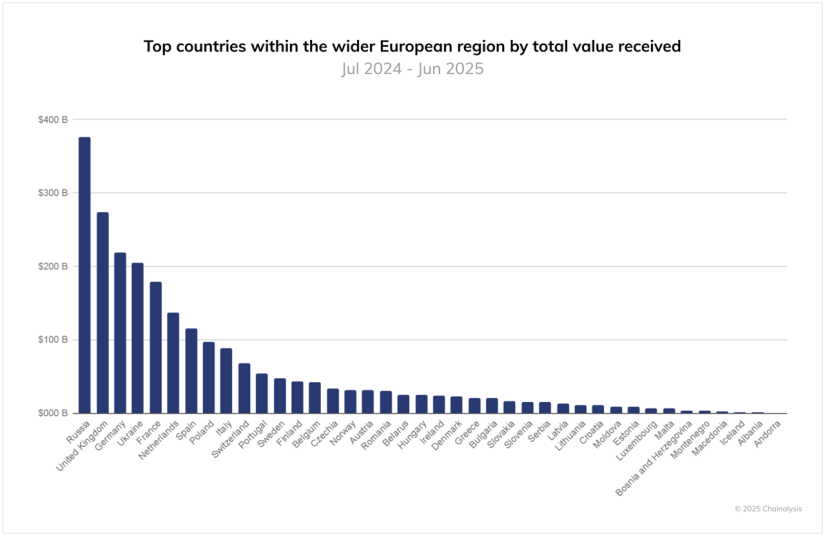

- Russia ranks as the leading country for crypto adoption in Europe, surpassing the United Kingdom and Germany, according to Chainalysis.

- Between July 2024 and June 2025, crypto activity in the country increased by 48%, driven by the expansion of DeFi and an 86% growth in institutional transfers.

- The ruble-pegged stablecoin A7A5, issued in Kyrgyzstan, reached a market capitalization of $500 million and facilitates cross-border payments.

Russia emerged as the top European country in crypto adoption, overtaking economies such as the United Kingdom and Germany, according to the latest Chainalysis report.

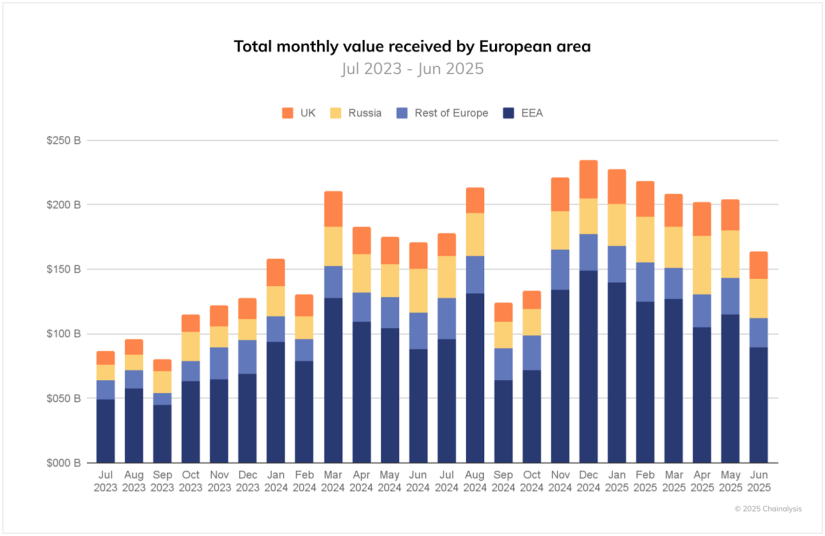

Between July 2024 and June 2025, the country received $376.3 billion in cryptocurrencies, a 48% increase from the previous year, fueled by both the growth of decentralized finance (DeFi) and a notable rise in high-value institutional transfers. This growth occurred amid sanctions and increased regulatory scrutiny.

The rise of the DeFi sector in Russia has been particularly notable: in early 2025, activity increased eightfold compared to previous levels, while large institutional transfers—defined as transfers over $10 million—rose 86% year-over-year, nearly double the average growth observed in the rest of Europe. Both retail and institutional segments are adopting crypto faster than their European peers, reflecting a growing integration of cryptocurrencies into the local economy.

Russia Uses a Ruble-Pegged Stablecoin: A7A5

A key element in this expansion is the A7A5 stablecoin, pegged to the ruble and issued in Kyrgyzstan, which reached a market capitalization of $500 million by late September 2025, becoming the largest non-US dollar stablecoin.

A7A5 enables cross-border payments for institutions and businesses, although it has been criticized by the European Union for potential use in sanctions evasion and linked by the US to illicit activities involving ransomware and money laundering.

Russia serves as an almost exemplary case of crypto adoption. The market structure is being reshaped, payment execution is evolving, and regulatory discussions are gaining importance. Despite current limitations, all indications point to a gradual deepening of this integration