TL;DR

- The number of companies holding Bitcoin in their treasuries rose 38% in Q3, reaching 172 firms and more than 1.02 million BTC.

- Strategy leads the chart with 640,250 BTC, followed by MARA, XXI, Metaplanet, and Bitcoin Standard Treasury.

- Although adoption slowed 95% since July, BTC has become a structural asset on corporate balance sheets worldwide.

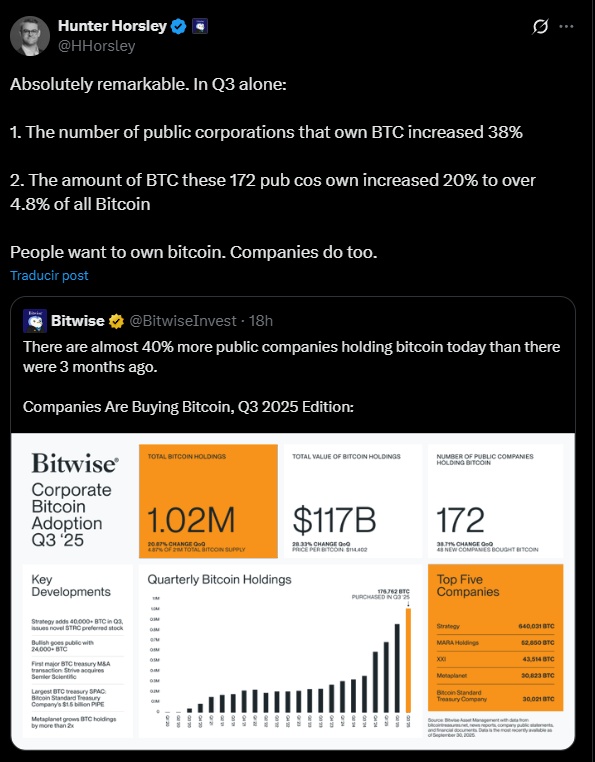

The number of public companies holding Bitcoin in their treasuries increased 38% during Q3 2025, from 124 to 172, according to a report by Bitwise Asset Management. Between July and September, 48 new firms joined the list, marking one of the largest corporate adoption surges in Bitcoin’s history.

Over 1 Million BTC Held by Companies

Data shows that corporations now hold more than 1.02 million BTC, equivalent to 4.87% of the total supply. The combined value of these holdings has reached $117 billion, a 28% rise from the previous quarter, driven by price gains and steady accumulation.

Bitwise estimates that during Q3 alone, companies purchased an additional 176,762 BTC, suggesting adoption is spreading beyond the early pioneers. Strategy, formerly MicroStrategy, remains the clear leader with 640,250 BTC — 62% of all corporate holdings. It is followed by MARA Holdings with 52,850 BTC, XXI with 43,514, Metaplanet with 30,823, and Bitcoin Standard Treasury Company with 30,021.

More companies are gaining exposure to Bitcoin through share offerings, IPOs, or direct acquisitions. Bullish entered the market holding over 24,000 BTC on its balance sheet, while Strive completed the acquisition of Semler Scientific, one of the first firms dedicated to BTC treasury management. According to Bitwise, this structural demand removes coins from circulation and reduces sell-side liquidity, increasing price sensitivity during demand spikes.

Bitcoin Enters the Realm of Conviction

For many analysts, this quiet accumulation reflects conviction rather than speculation. Companies are not seeking short-term profits but positioning themselves for a shift in how value is stored and transferred. However, this corporate phenomenon is also showing signs of strain: one in four Bitcoin-holding companies now trades below the value of its assets, including Metaplanet, NAKA, and Twenty One.

At the same time, the pace of adoption has slowed sharply — corporate purchases have dropped 95% since July. Even so, Bitcoin’s presence on corporate balance sheets has become a stable and structural component of the market