TL;DR

- Perpetual futures DEXs surpassed the $1 trillion mark in monthly volume, hitting $1.226T in September, up 48% from August.

- Aster led with $493.61B and nearly half the market, followed by Hyperliquid with over $280B and Lighter DEX with $164.4B in private beta.

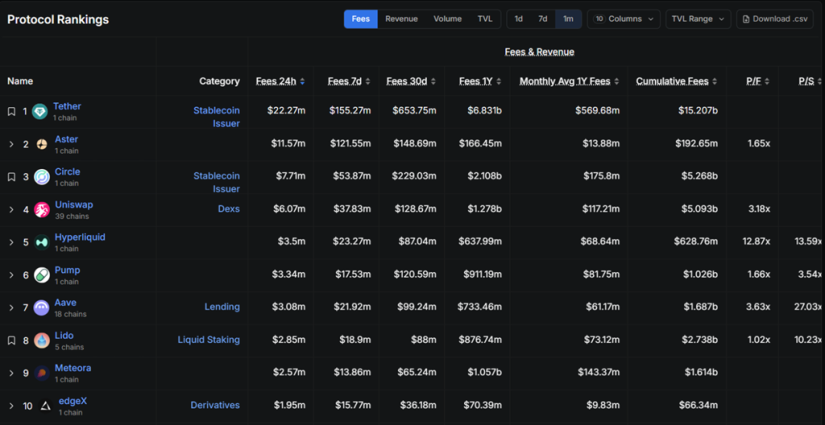

- Aster generated $121M in fees in just one week, outpacing Circle and closing in on Tether, while Hyperliquid added $23M.

Decentralized perpetual futures exchanges crossed the $1 trillion monthly volume threshold for the first time, underscoring the market’s rapid expansion.

According to DeFiLlama data, perpetual trading platforms in the DeFi space processed $1.226 trillion over the past 30 days, a 48% increase from the $707.6 billion recorded in August.

Aster Leads Market Activity

The surge was fueled by Aster and Hyperliquid, which became the central drivers of onchain derivatives activity. Aster took the lead with $493.61 billion, nearly half of the entire market, while Hyperliquid recorded more than $280 billion over the same period.

Lighter DEX, still in private beta, surprised observers after reaching $164.4 billion and securing third place. Other projects such as EdgeX, Pacifica, and Bybit-affiliated Apex Protocol contributed a combined $116 billion.

In terms of fee generation, Aster outperformed Circle and closed in on Tether. Over the past week, it brought in $121 million, compared to Circle’s $56 million and just $34 million short of Tether. Hyperliquid generated $23 million and remained among the top five revenue-generating protocols in the market.

Formerly known as APX Finance, Aster rebranded after merging with Astherus and with the backing of YZi Labs. Positioned as a Binance-adjacent perp DEX, it attracted significant liquidity and pushed its token to a fully diluted valuation of $14.6 billion, currently trading at $1.82.

Hyperliquid Remains the Dominant DEX

Despite Aster’s rapid rise, Hyperliquid continues to dominate with roughly 70% of the perp DEX market share. The platform has consistently posted record-breaking activity, including $248 billion in 24-hour trading volume in May and $106 million in revenue in August — the highest figure across DeFi protocols. Its HYPE token trades at $49.63 with a fully diluted valuation of $49.5 billion.

The growth of perpetual DEXs also puts them in direct comparison with Binance, the leading centralized exchange. Over the last 24 hours, Binance Futures reported $83 billion in trading volume, while Aster and Hyperliquid combined for $78 billion despite being barely a year old, compared to Binance’s six years of operation