TL;DR

- Approximately 11 million XRP, worth around $31.7 million, were withdrawn from the Upbit exchange into private wallets, signaling potential long-term holding.

- Technical analysis shows XRP forming a bullish double-bottom pattern, supported by key trendline levels.

- Meanwhile, Bollinger Bands suggest a favorable scenario that could push XRP toward $3.50 if momentum sustains, highlighting positive market dynamics and growing investor confidence.

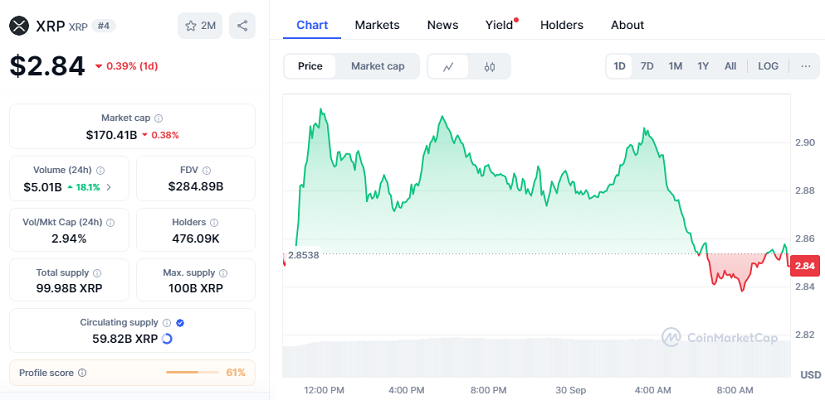

The crypto market is currently navigating a delicate balance between pressure and opportunity. XRP is trading at $2.84, slightly below the daily midline near $2.94, which shows some short-term bearish pressure, yet the weekly chart presents a different perspective, as the token remains above the midband at $2.73. Historically, defending this level has led to rallies toward the upper Bollinger Band, currently around $3.56. On the monthly scale, XRP continues to hold above its central line near $1.57, maintaining a constructive long-term trend. These mixed signals suggest that while short-term caution is warranted, the market could still favor an upward move if momentum strengthens.

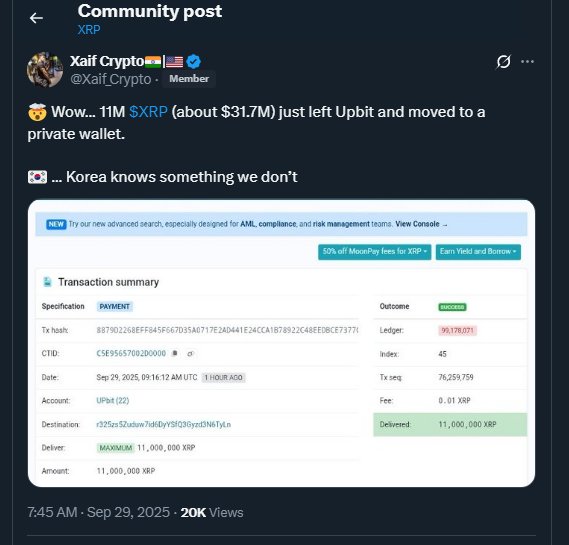

Strategic Wallet Transfers Reflect Growing Investor Confidence

The withdrawal of 11 million XRP from Upbit is being interpreted as a strategic move by investors, reflecting a preference for long-term holding rather than immediate trading. Market commentator Xaif Crypto notes that institutional and high-net-worth investors increasingly manage their XRP holdings directly, reducing counterparty risk while taking advantage of staking, liquidity, and DeFi opportunities. Such transfers often indicate proactive engagement with features on the XRP Ledger, such as mXRP and emerging decentralized finance protocols, which provide multiple avenues for yield and strategic deployment of capital.

From a technical standpoint, XRP has formed a clean double-bottom pattern near key support between $2.76 and $2.82. Market analyst Lingrid highlights that this formation signals a potential trend reversal and a stair-step climb toward higher lows. A sustained break above the $2.94–$3.00 resistance could propel XRP toward $3.15–$3.25, with the potential to reach $3.50 if momentum continues. The controlled recovery emphasizes structural stability and suggests that buyers are gradually gaining confidence while selling pressure weakens.

Currently, XRP is priced at $2.84 with a 24-hour performance of -0.39%, a market capitalization of $170.41 billion, and a 24-hour trading volume of $5.01 billion, reflecting an 18% increase. The combination of large-scale withdrawals, a confirmed double-bottom pattern, and supportive Bollinger Band indicators points to renewed optimism for the token. Investors who monitor trendlines and higher lows may view these conditions as favorable for potential gains while maintaining a disciplined approach to risk.