TL;DR

- FTX Token (FTT) jumped 60% after a “gm” post from Sam Bankman-Fried’s X account, hitting an intraday high of $1.21.

- The surge occurred alongside FTX Recovery Trust’s $1.15 billion lawsuit against Genesis Digital Assets.

- Despite lacking utility, FTT continues to attract speculation as bankruptcy proceedings plan a $1.6 billion payout to creditors.

FTX Token (FTT), the native token of the collapsed FTX exchange, saw a dramatic price surge early Wednesday, rising 60% to reach $1.21 following a short “gm” post on X linked to Sam Bankman-Fried, the jailed former CEO. While SBF is behind bars, a friend clarified that the post was made on his behalf, attracting nearly 4 million views and triggering intense market speculation. Traders and retail investors reacted quickly, highlighting how social media remains a powerful force in crypto price dynamics.

FTT PRICE MOVEMENT REFLECTS SPECULATIVE TRADING

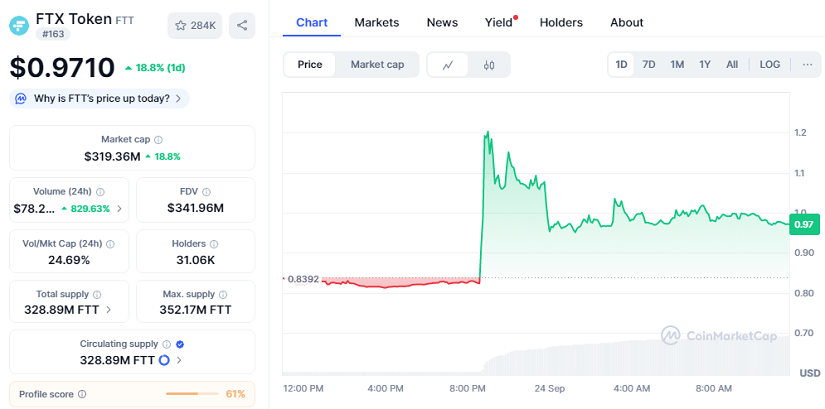

The token’s trading volume spiked by over 829% to more than $78 million, reflecting renewed attention from investors drawn to volatility rather than utility. FTT’s market capitalization now stands at $319.36 million, with a current price around $0.9710 and a 24-hour gain of 18.8%. Despite its dramatic rise, FTT remains far below its all-time high of $85, showing the long-term risk still embedded in its trading. Some traders speculate that minor social cues can rapidly drive price swings in tokens with limited real-world use.

FTX TRUST LAWSUIT AGAINST GENESIS DIGITAL DRIVES INTEREST

Adding to market activity, the FTX Recovery Trust filed a $1.15 billion lawsuit against Genesis Digital Assets. The case seeks to reclaim funds allegedly misappropriated by Genesis in connection with FTX’s 2021–2022 operations. Some traders interpreted SBF’s post as signaling potential updates in bankruptcy settlements, while others viewed it as a reminder of FTX’s lasting influence in crypto markets. The legal developments are closely monitored by hedge funds and institutional investors, who may adjust positions in anticipation of asset recoveries.

FTT FUTURE AND MARKET OUTLOOK

While FTT no longer has a functional role, analysts suggest it could remain volatile, potentially revisiting $1.21 or higher amid speculative momentum. The token’s ongoing use in settlements for FTX’s $1.6 billion creditor payout adds another layer of complexity. Investors are reminded that while the rally captures attention, the long-term viability of FTT is uncertain, and its trajectory largely depends on legal developments and market sentiment.

FTT’s recent surge demonstrates how even small actions linked to high-profile figures like Bankman-Fried can move markets significantly, reinforcing crypto’s speculative dynamics and the persistent interest in FTX’s legacy assets.