TL;DR

- Avalon Labs has completed a $1.88 million buyback and burn that eliminated 37% of AVL’s circulating supply.

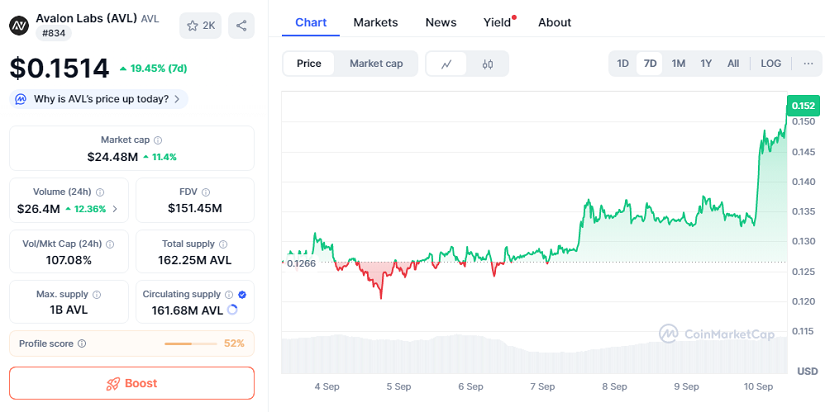

- The token price climbed 8% in one day, now trading at $0.1514 with a market cap of $24.48 million.

- Over the past week, AVL delivered a 19.45% gain, signaling growing investor interest. The burn was financed exclusively with protocol revenue, reinforcing long-term sustainability.

Avalon Labs confirmed the permanent removal of 13,955,164 AVL tokens from circulation, part of a buyback and burn program initiated in June 2025. Funded entirely from the company’s protocol revenue rather than external capital, the move underscores a strategy aimed at reducing supply while strengthening token stability.

The program involved depositing 1.88 million USDT on Bybit to repurchase AVL at an average cost of $0.1347. According to blockchain data, Avalon has now burned a cumulative 93,955,164 tokens, aligning with its broader mission of building an on-chain capital market for Bitcoin and reinforcing investor confidence in its native asset.

Market Performance And Technical Signals

AVL has shown resilience despite broader market stagnation. The token currently trades at $0.1514, reflecting a 19.45% gain over the past seven days. With a market capitalization of $24.48 million, AVL still remains about 70% below its March peak of $0.70, leaving considerable room for recovery if bullish momentum continues.

On the daily price chart, the RSI points to steady buying interest without reaching overbought conditions, suggesting further upward potential. Meanwhile, the Bollinger Bands are widening, a classic indicator of increased volatility. The token recently touched the upper band, hinting at possible continuation of the trend if volume persists. Short-term support is visible near $0.1347, the average repurchase level, with additional cushions around $0.13 and $0.12. Traders and analysts alike are watching whether AVL can sustain momentum above these levels, which would validate the effectiveness of Avalon’s recent supply reduction strategy.

A Strategic Step Toward Sustainable Growth

Launched in February 2025 after its airdrop, AVL has only 16.6% of its total 1 billion supply unlocked, with more releases scheduled in the coming months. By implementing aggressive supply reductions early in its lifecycle, Avalon Labs is positioning AVL as a leaner and potentially more valuable asset.

The recent burn demonstrates how disciplined tokenomics, paired with consistent revenue generation, can fuel investor optimism in a highly competitive crypto landscape. Long-term holders are increasingly viewing AVL as a project combining scarcity-driven mechanics with utility-focused development, a balance that could allow the token to capture greater adoption over time.