TL;DR

- US spot Ether ETFs have seen over $3 billion in net inflows in the first half of August, marking one of the strongest months on record.

- Daily inflows have averaged around $700 million, with some days exceeding $1 billion.

- The total assets under management across these ETFs reached a record $29.22 billion, reflecting strong investor interest in regulated Ethereum exposure and robust performance of ETH itself.

US spot Ether ETFs have attracted significant attention in August, recording more than $3 billion in net inflows during the first two weeks. ETF inflows have averaged above $700 million per day, with Monday seeing the highest single-day inflow exceeding $1 billion. The strong capital movement pushed total assets across these funds to a record $29.22 billion. This trend highlights growing investor confidence in Ether as a regulated investment vehicle, with institutional participants showing increased interest and contributing substantially to the inflows.

Ether Hits Yearly Highs, Fueling ETF Growth

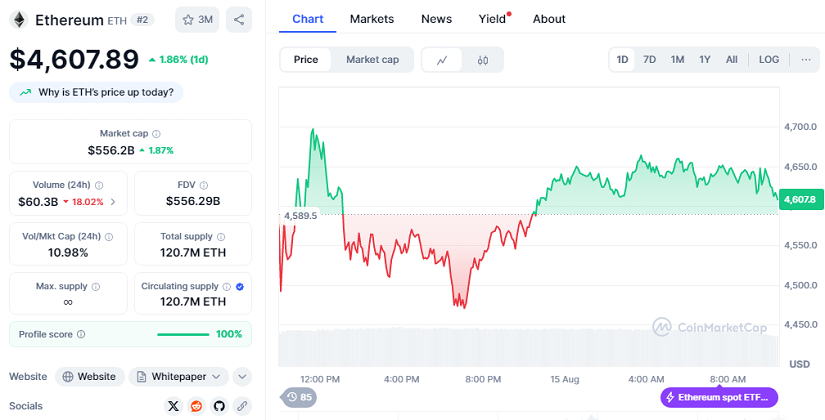

The inflows coincide with ETH’s strong performance in August. On Thursday, ETH surged to a yearly high of $4,765.83 before briefly dropping below $4,500, later recovering to $4,607.89 at the time of writing. Over the past 24 hours, ETH has gained 1.86%, with a market cap of $556.2 billion and 24-hour trading volume of $60.3 billion, down 18.02% from the previous day. The price momentum has clearly supported ETF demand, drawing investors looking for exposure to Ether’s upside potential. The combination of price resilience and investor enthusiasm suggests sustained demand could continue into September.

Spot Ether ETFs Maintain Multi-Month Inflow Streak

According to data from SoSoValue, spot Ether ETFs have accumulated $12.73 billion in net inflows since launch and are on track for a five-month consecutive inflow streak entering September. BlackRock’s iShares Ethereum Trust led daily inflows with $519.68 million, followed by Grayscale Ethereum Mini Trust at over $60 million and Fidelity Ethereum Fund at nearly $57 million. Wednesday recorded $729 million in inflows, marking the second-largest single-day inflow for these products. Analysts note that growing adoption of regulated crypto funds is reinforcing Ether’s investment appeal, strengthening the market’s stability.

Market analysts are bullish on Ether’s medium-term outlook. Thomas Lee from Fundstrat called ETH the “biggest macro trade” over the next decade, while the firm’s digital asset head, Sean Farrell, suggested ETH could reach between $12,000 and $15,000 by year-end. With the combination of strong ETF inflows and a robust underlying market, Ether continues to attract both institutional and retail interest.