TL;DR

- Traders are aggressively hedging against a potential drop to $100,000, as Bitcoin options on Deribit show a sharp increase in put contracts.

- Short-term economic and geopolitical risks, including Trump’s foreign policy stance and inflation fears, are heightening uncertainty.

- Despite the caution, Bitcoin ETFs recorded over $216 million in daily inflows, signaling continued institutional interest and strong underlying demand.

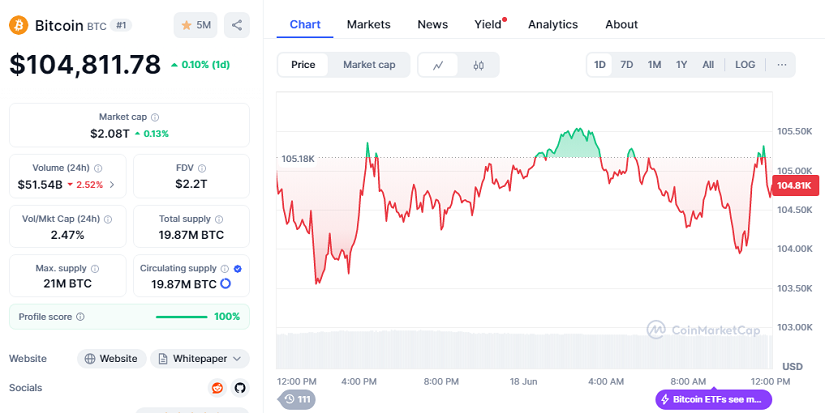

As Bitcoin trades around $104,811.78 with a modest 0.10% gain over the past 24 hours, a wave of hedging activity is drawing attention. On Deribit, the largest crypto options exchange, the put-to-call volume ratio has jumped to 2.17, showing that more traders are preparing for a potential move downward. Open interest for Friday’s options is concentrated at the $100,000 strike price, where puts are now more popular than calls by a ratio of 1.16.

Market Signals Suggest Possible Correction

This pattern reflects growing unease over a range of macroeconomic factors. While Bitcoin remains up over 50% since Donald Trump’s reelection in November and recently touched an all-time high of $111,980, short-term risk sentiment has shifted. Tensions in the Middle East, combined with new U.S. tariff threats, are weighing on global asset classes. Crude oil prices have risen sharply, with Brent at $76 and WTI at $74, while global shipping costs are climbing once again.

Analysts also point to technical pressure. BTC has pulled back from $110,500 to $104,000, forming a double-top pattern with a neckline near $100,300. This setup, together with a drop below the 50-period Exponential Moving Average and a negative MACD crossover, supports the view that $100,000 could soon be tested. If that level fails, the next key support lies at $97,560. In such a scenario, broader risk assets could also face renewed volatility.

Institutional Inflows Continue Building Support

Still, not all signs are bearish. On Tuesday alone, U.S.-based spot Bitcoin ETFs attracted over $216 million in new funds, pushing cumulative inflows to $46.26 billion. This inflow, largely driven by institutional investors, shows conviction in Bitcoin’s long-term outlook.

The broader crypto market holds a total capitalization of $2.08 trillion, underscoring the asset class’s growing weight in the global financial system. While traders brace for short-term turbulence, long-term adoption trends and capital allocation toward Bitcoin remain robust. A clear policy signal from the Federal Reserve could determine whether the $100K level acts as a solid support or gives way to deeper corrections.