TL;DR

- Stablecoin market capitalization surpassed $250 billion, driven by clearer regulations and steady DeFi adoption.

- The U.S. Senate approved the GENIUS Act, requiring liquid reserves and annual audits for issuers with over $50 billion.

- Major banks like JPMorgan and Citi are negotiating a joint stablecoin launch, while DeFi now accounts for 25% of global spot trading volume.

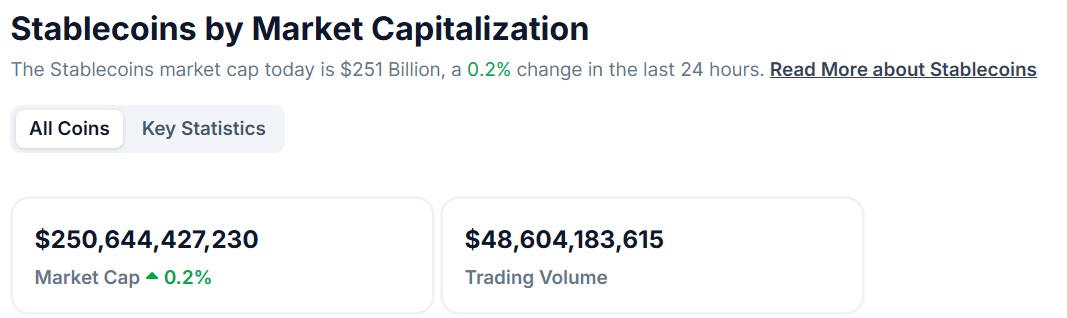

The total stablecoin market capitalization has exceeded $250 billion for the first time. This growth comes from the combination of clearer regulatory frameworks and increasing adoption in decentralized finance applications.

According to CoinGecko, the current market value stands at $250.644 billion, with $245.5 billion belonging to U.S. dollar-backed stablecoins.

Tether (USDT) remains the market leader with a capitalization above $153 billion, followed by USDC, issued by Circle, at $60.9 billion. Despite Tether’s clear dominance, some analysts expect rising competition in the coming months, fueled by new initiatives from both public and private sectors.

GENIUS Act Approved in the Senate

In the United States, the Senate moved forward with the approval of the GENIUS Act, a bill setting requirements for issuers of U.S. dollar-backed stablecoins. This legislation would require companies to hold cash or highly liquid assets as reserves and undergo annual audits if they have over $50 billion in circulation.

It also introduces rules for foreign issuers seeking to operate within U.S. territory. At the same time, Hong Kong passed its own regulation on May 21, establishing a licensing regime for issuers of fiat-backed stablecoins.

Major Banks Prepare to Enter the Stablecoin Market

Clearer regulation has opened the door for new projects from the traditional financial sector. Large U.S. banks, including JPMorgan, Bank of America, Citi, and Wells Fargo, are in talks to create a jointly issued, dollar-backed stablecoin. This growing interest marks an expansion of the sector beyond native crypto issuers.

Meanwhile, DeFi platforms continue growing steadily. The total value locked surpasses $113.17 billion, with increased activity on decentralized exchanges, staking services, and cross-chain trading platforms. In May, DEXs reached a 25% share of the global spot trading volume, their highest recorded participation against centralized exchanges.

Kronos Research projects that stablecoin market capitalization could double by 2026. It also expects a broader issuer landscape, with emerging alternatives like USD1 — linked to Donald Trump — and new bank-issued digital currencies