TL;DR

- Berkshire Hathaway made a $250 million profit by gradually selling off its stake in Nubank between 2024 and 2025.

- The exit wasn’t driven by Nubank’s performance, as the company posted record earnings and steady growth in recent quarters.

- Buffett continued scaling back financial sector exposure and raised Berkshire’s cash reserves to $347.8 billion, prioritizing U.S. Treasury bonds.

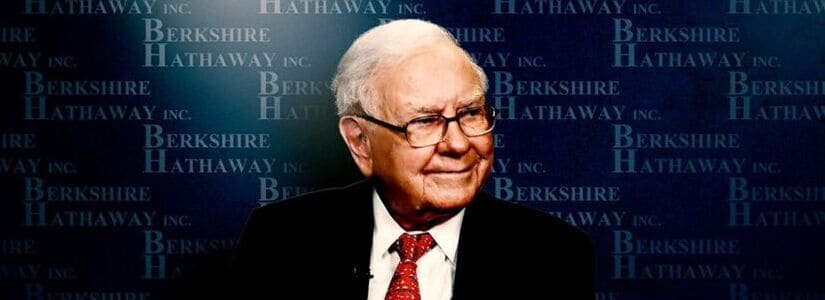

Warren Buffett decided to fully divest his stake in Nubank, one of Latin America’s most crypto-friendly digital banks. The move earned Berkshire Hathaway, his investment firm, a $250 million profit after progressively selling its position in Nu Holdings over recent quarters.

Filings submitted to the U.S. Securities and Exchange Commission confirmed that Berkshire sold its remaining Nubank shares during the first quarter of 2025. This divestment was part of a broader series of similar operations across the financial sector.

The company also exited Citigroup and cut its position in Bank of America, offloading over $2.1 billion in traditional banking stocks. These sales increased Berkshire’s cash reserves to $347.8 billion, with a significant portion invested in short-term U.S. Treasury bonds.

Why Did Buffett and Berkshire Hathaway Make This Move?

What stands out about this decision is that it wasn’t based on Nubank’s financial performance. The company is currently experiencing its strongest period since going public. In the first quarter of 2025, it reported a net profit of $557.2 million, a 47% increase compared to the same period the previous year. Adjusted earnings rose 37%, and by the end of 2024, the bank posted an annual net income of $1.97 billion, up 91% from 2023.

Nubank’s Strong Performance

Nubank has become one of Brazil’s most active digital banks in the crypto services market. Through its app, it offers trading in Bitcoin, Ethereum, XRP, and other digital assets. In 2022, it allocated 1% of its net assets to Bitcoin, indirectly exposing Buffett to a cryptocurrency he has publicly criticized on multiple occasions.

Berkshire’s withdrawal from Nubank aligns with its broader strategy to scale back exposure to the financial sector while reinforcing liquidity positions. The decision to leave the Brazilian bank wasn’t tied to its business outlook but rather to Buffett’s consistent strategy of reducing financial holdings, regardless of how solid their balance sheets might appear