TL;DR

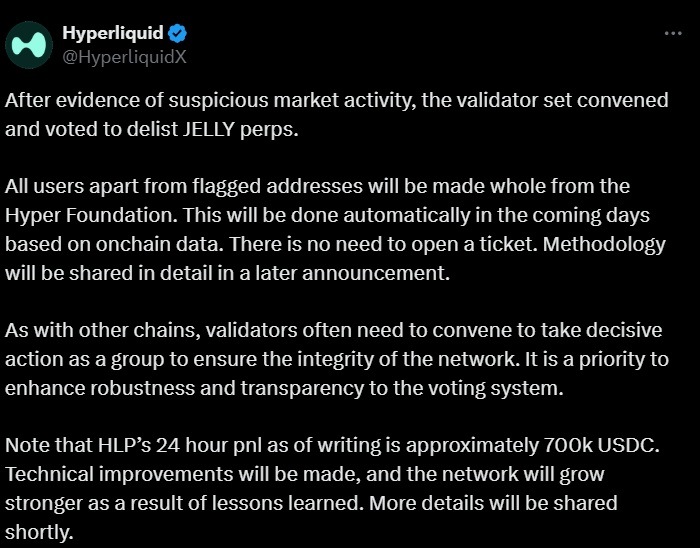

- Hyperliquid removed the perpetual futures contracts linked to the JELLY token after detecting price manipulation by a trader to self-liquidate.

- The Hyper Foundation has committed to automatically reimbursing the users affected by the losses, based on on-chain data, except for flagged addresses.

- Despite this incident, Hyperliquid reported a net income of $700,000 in its liquidity pool HLP and has implemented additional measures to prevent a recurrence of this episode.

Hyperliquid has decided to remove the perpetual futures contracts linked to the JELLY token after identifying suspicious market activity involving these instruments.

This measure was adopted after detecting that a trader opened a $6 million short position on the token and then manipulated its price upwards to self-liquidate. This behavior could have triggered a total liquidation of the platform, which led Hyperliquid to take the precaution of closing these operations immediately.

Hyperliquid Assured It Will Reimburse Affected Users

As part of its measures to remedy the situation, the Hyper Foundation, an entity associated with the platform, has committed to reimbursing most of the users affected by the losses caused by this incident. The reimbursements will be automatic and will occur in the coming days, based on on-chain data, except for the addresses flagged by the platform.

Despite this setback, Hyperliquid’s platform reported a positive performance in its liquidity pool, known as HLP, which generated a net income of approximately $700,000 in the last 24 hours. This pool is crucial to ensure the stability of the platform’s operations, especially during periods of high volatility.

JELLY Succumbs and Loses a Significant Portion of Its Market Capitalization

The JELLY token, launched earlier this year by Iqram Magdon-Ismail, co-founder of Venmo, has been experiencing significant volatility. Initially, it reached a market capitalization of around $250 million, but then experienced a drastic drop, currently stabilizing around $25 million.

Hyperliquid has implemented additional measures to avoid similar issues in the future. Since mid-March, the platform has raised margin requirements for traders, aiming to reduce the impact of large positions that may affect the market.