TL;DR

- The SEC has dropped its lawsuit against Ripple, clearing the legal path for the approval of an XRP ETF.

- According to Nate Geraci, an ETF expert and president of ETF Store, a financial advisory firm, a futures-based XRP ETF could launch very soon, followed by a spot ETF in the near future.

- Institutional interest could rise significantly, boosting XRP’s market liquidity and stability.

Following the official withdrawal of the lawsuit by the U.S. Securities and Exchange Commission (SEC) against Ripple, many experts now see a high likelihood that an XRP ETF could be approved in the coming months. One of the key voices highlighting this is Nate Geraci, president of ETF Store, a financial advisory firm that specializes in exchange-traded funds (ETFs), and one of the most respected figures in the ETF space. According to Geraci, the door is now open for a futures-based XRP ETF to debut very soon, with the possibility of a spot ETF shortly after.

According to recent statements from Ripple CEO Brad Garlinghouse, there are currently 11 active XRP ETF applications awaiting SEC approval. While the first ETF is expected to be futures-based, much like what occurred with Bitcoin and Ethereum, the ultimate goal is to achieve approval for a spot ETF.

XRP Braces for an Institutional Surge

The potential approval of an ETF represents more than just a legal win, it’s a gateway to institutional capital. Much like what happened with Bitcoin following the launch of its ETFs, XRP is expected to gain broader visibility and legitimacy among investment funds, banks, and large financial players. The removal of regulatory barriers could also pave the way for XRP to be more easily integrated into regulated financial products and traditional investment strategies.

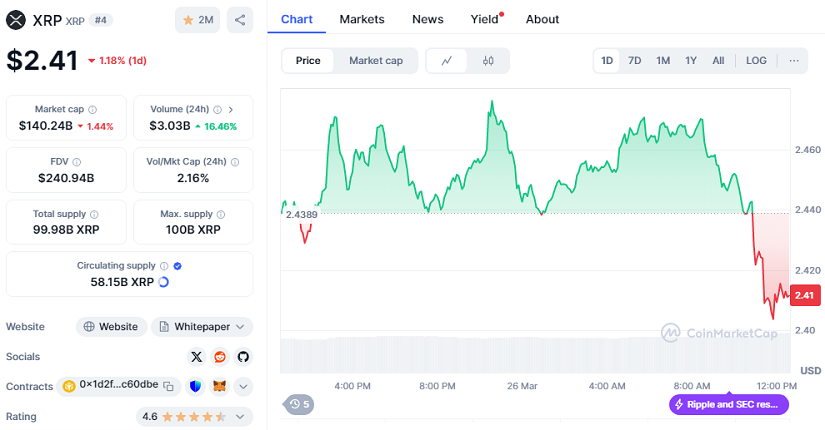

On the market side, XRP is currently trading at $2.41, with a market capitalization of $140.24 billion and a daily trading volume of $3.03 billion, according to CoinMarketCap data. While the token has seen a 21.93% decline over the past 60 days, the new legal context could serve as a catalyst for a trend reversal.

Technology, Legality, and Trust: The Success Trifecta

The combination of legal clarity, technological advancement, and a more crypto-friendly regulatory environment could position XRP as one of the most attractive digital assets of the decade. As the market waits in anticipation, crypto advocates see this potential ETF not just as a form of validation, but as a real opportunity to democratize access to XRP through safer and more accessible financial tools.