TL;DR

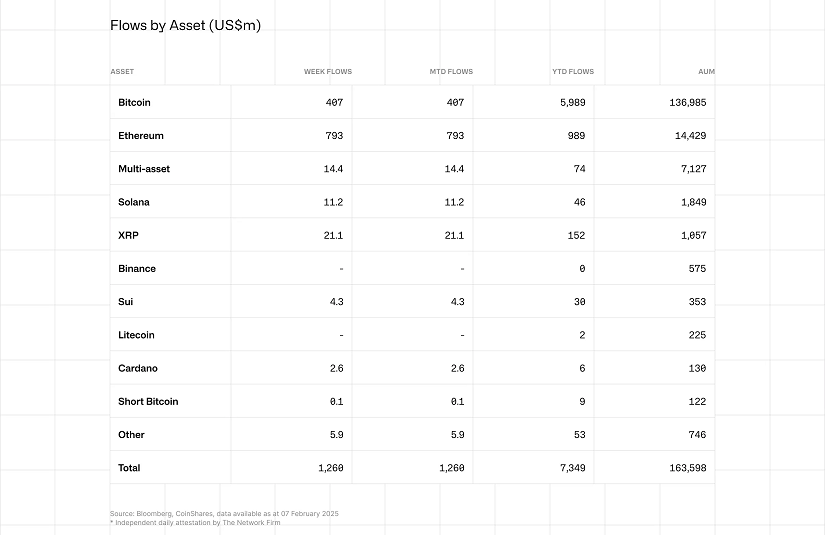

- Crypto investment funds recorded net inflows of $1.3 billion last week, nearly doubling the previous figure and marking five consecutive weeks of growth.

- Despite volatility caused by Trump’s tariff announcements, Bitcoin and Ethereum showed significant recoveries after initial declines.

- Ethereum led investments with $793 million in net inflows, surpassing Bitcoin for the first time this year, while XRP and Solana also performed well.

The crypto investment market continues its positive trend, with financial products based on digital assets registering their fifth consecutive week of net inflows. According to CoinShares, $1.3 billion in capital flowed into these funds last week, almost double the $747.4 million recorded the previous week. This growth remains strong despite the recent price drop triggered by uncertainty surrounding Trump’s tariff policies, which have fueled speculation and increased market sensitivity to political developments.

Investment Momentum Outpaces Volatility

Trade tensions escalated as new tariffs of 25% on Canadian and Mexican imports, along with a 10% levy on Chinese goods, led to a sharp decline in Bitcoin. On February 3, BTC fell more than 10% to a low of $91,500. Ethereum and other cryptocurrencies suffered even more, with ETH plunging 36% to $2,100 and the GMCI Meme Index dropping 40% within days.

However, the market demonstrated remarkable resilience. Bitcoin rebounded above $100,000 after reports suggested that tariffs on Mexico and Canada might be delayed by a month due to diplomatic negotiations. Nevertheless, volatility returned when China responded with 15% tariffs on U.S. coal and liquefied natural gas, as well as 10% tariffs on crude oil and agricultural machinery. The unpredictability of these measures continues to impact investor sentiment and short-term trading strategies.

Currently, Bitcoin is trading around $97,817, while Ethereum is at $2,647, showing signs of stability despite global economic tensions.

Ethereum Leads Institutional Investments

One of the most significant developments of the week was Ethereum’s dominance in institutional inflows. With $793 million in net investments, ETH surpassed Bitcoin for the first time in 2025, highlighting strong institutional interest in the second-largest cryptocurrency. U.S.-based Ethereum ETFs accounted for $420.2 million of that total.

Among other assets, XRP-based funds registered $21 million in inflows, while Solana funds attracted $11 million. Regionally, the U.S. led with $1 billion in net inflows, followed by Germany ($61 million), Switzerland ($54 million), and Canada ($37 million).

Despite macroeconomic turbulence, investor interest in crypto remains strong. The steady capital inflows into these products indicate that investors are looking beyond short-term volatility and betting on the long-term adoption of digital assets.