TL;DR

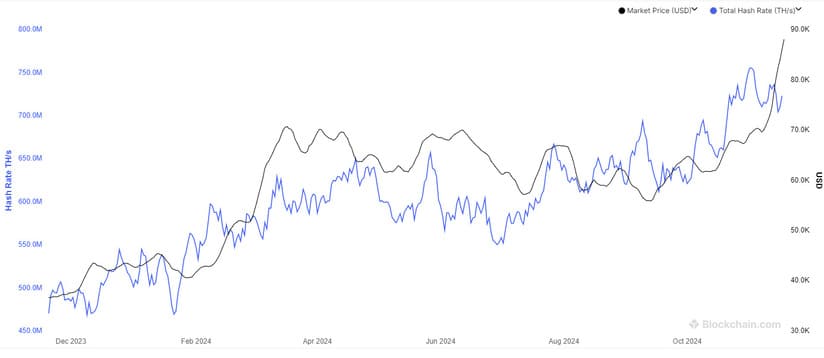

- Bitcoin’s hashrate fell by 4% after reaching an all-time high of 755 million TH/s, currently standing at 723 million TH/s.

- The decrease in hashrate could reflect doubts among miners about the sustainability of the current bullish rally.

- Despite Bitcoin hovering around $92,000, the hashrate continues to show signs of deceleration rather than growth.

Bitcoin’s hashrate, a key indicator reflecting the total computational power dedicated to the network, has declined after reaching an all-time high.

Earlier this month, the hashrate reached about 755 million terahashes per second (TH/s), but since then, it has dropped by more than 4%, currently standing at approximately 723 million TH/s. The decline has sparked speculation about miners’ expectations regarding the future of the market.

Unexpected Trend

The hashrate is often a reflection of miners’ confidence in the profitability of their operations. An increase in this indicator means that more miners are joining or expanding their activities, generally driven by a bullish market that raises the value of rewards in US dollars. On the other hand, a decrease can be interpreted as a sign that some miners are shutting down their rigs, either due to difficulties in covering operational costs or due to the perception that the market might face a correction in the short term.

The relationship between Bitcoin’s price and miners’ revenues is a determining factor. Miners earn profits primarily through two channels: transaction fees, which are variable, and the block subsidy, which remains constant in BTC terms until the next halving.

While rewards in BTC are predictable, their value in USD is directly tied to the price of the asset. During Bitcoin’s recent price hikes, which currently hover around $92,000 with a rise of more than 5.75% in the last week, a rise in the hashrate would have been expected. However, the current trend suggests a more complex scenario.

Do Bitcoin Miners Anticipate the End of the Rally?

This behavior could indicate that miners are expecting a slowdown in the current bullish rally, even as the price continues to reach new highs. The inherent volatility of the market and the costs associated with mining, such as energy consumption and network difficulty, are factors that may be influencing these decisions.

The performance of the hashrate in the coming weeks will be crucial to understanding the state of the market and miners’ confidence in the sustainability of the current price cycle. Meanwhile, the market continues to closely monitor fluctuations in this indicator and its impact on the Bitcoin ecosystem