TL;DR

- Bitcoin reaches a new ATH, surpassing its previous high of $73,737.94 recorded in March 2024, driven by institutional interest and macroeconomic factors.

- Donald Trump’s U.S. election victory, along with the “Trump Trade”, have boosted demand for BTC as a safe haven asset.

- Open interest in BTC options and futures has reached record levels, with demand in $80,000 strikes, showing strong bullish positioning for the end of the year.

Bitcoin (BTC) continues to make history. The industry’s most important cryptocurrency has once again broken all limits, reaching a new ATH of $75,358, according to CoinGeko data, after Trum’s victory in the presidential election was confirmed .

Its previous all-time high was recorded on March 14, 2024, when it reached $73,737.94. At that time, just over two months had passed since the launch of Bitcoin ETFs in the United States. These financial products were highly anticipated by institutional investors, and their arrival fueled a massive capital inflow into BTC and the crypto market.

Another fundamental factor in understanding the bullish run was the halving, a phenomenon that occurs approximately every four years. In each halving, the reward received by BTC miners is cut in half. This leads to a reduction in the available BTC supply, and with demand soaring, the conditions are set for sharp price increases.

Although BTC ETFs began trading on January 11 of that year, Bitcoin initially experienced an abrupt drop, falling from nearly $47,000 to below $40,000. However, in early February, BTC began to rise rapidly. By February 4, its price was around $42,500. By March 4, it had reached $68,000, and after a brief and slight correction, it reached its all-time high.

Decisive Factors

The new ATH is due to a combination of geopolitical, economic, and financial factors. First of all, Donald Trump’s Victory in the U.S. presidential election has elevated the demand for Bitcoin as a safe haven asset. As the new president has recently shown strong support for Bitcoin and the crypto market in general.

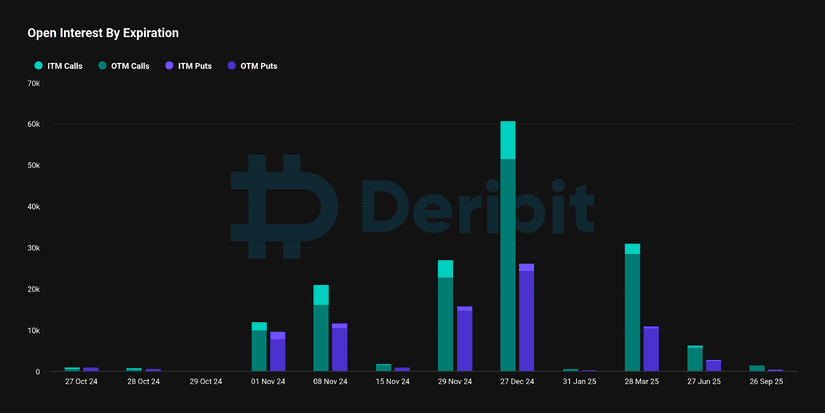

On the other hand, open interest in Bitcoin futures and options reached record levels, surpassing $41.7 billion. There was a significant increase in leveraged exposure from investors expecting an additional rally in BTC’s price. The accumulation of BTC call options, with expirations set for the end of December and strikes at $80,000, suggests a clear positioning, anticipating that Bitcoin’s price will not only surpass its ATH but continue to rise in the medium term.

How High Can Bitcoin Go?

Analysts forecast that, after this new ATH, Bitcoin could continue its ascent, fueled by institutional interest and speculation regarding U.S. politics. The increased demand for options with strike prices at $80,000 is a clear indication that the market expects a potential rise to that level by year-end.

The projection is supported not only by speculative interest but also by the typical bullish seasonality of the fourth quarter in halving years, which has historically shown positive returns with a median of 31.34%. However, the price trend will be strongly influenced by geopolitical and economic stability, factors that could cause short-term volatility but that consolidate a positive scenario for Bitcoin in the long term