TL;DR

- Analysts from QCP Capital warn about the vulnerability of the crypto market to downward movements, due to the increase in funding rates for perpetual futures.

- The increase in long positions and speculative activity in memecoins could increase the risk of unexpected corrections in a bullish trend environment.

- Despite these warnings, QCP Capital maintains an optimistic medium- and long-term outlook for Bitcoin, recommending accumulation strategies.

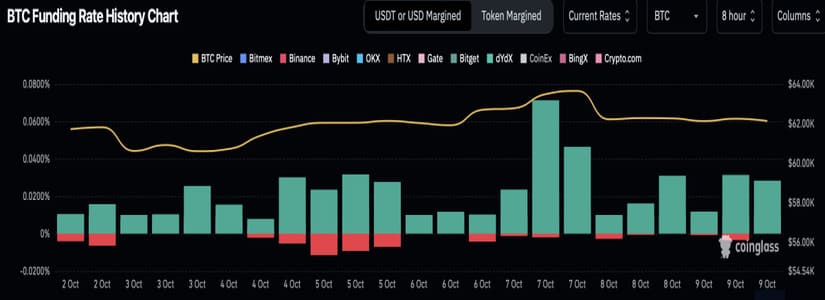

Analysts from QCP Capital have issued a warning about the growing vulnerability of the crypto market to potential downward movements, given that funding rates for perpetual futures have experienced a strong increase.

This phenomenon has been observed on platforms such as Deribit and Binance, suggesting that there is a reduction in short bets and an increase in long positions by operators. Activity in the memecoin market has also been noted as an indication of intense speculation, which could increase the risk of unexpected corrections in a market that has shown bullish trends.

The Crypto Market Could Suffer Unexpected Corrections

Despite these concerns, analysts from QCP Capital maintain an optimistic medium- and long-term outlook for Bitcoin and other cryptocurrencies. They recommend that investors implement accumulation strategies that allow them to gradually increase their positions, even amid short-term uncertainties. This recommendation is based on the expectation that any forced selling driven by excessive leverage could be temporary and, therefore, should not discourage investors.

The macroeconomic context also plays a crucial role in the current market dynamics. Reports on the Consumer Price Index (CPI) and the Producer Price Index (PPI) in the United States, which will be published this week, are potential sources of volatility.

An Additional Boost for Bitcoin

The CPI report is expected to show a slowdown in inflation, driven by falling energy prices. This could provide an additional boost to Bitcoin’s price, which has already shown signs of stability in its funding rate, remaining mostly positive since the beginning of October.

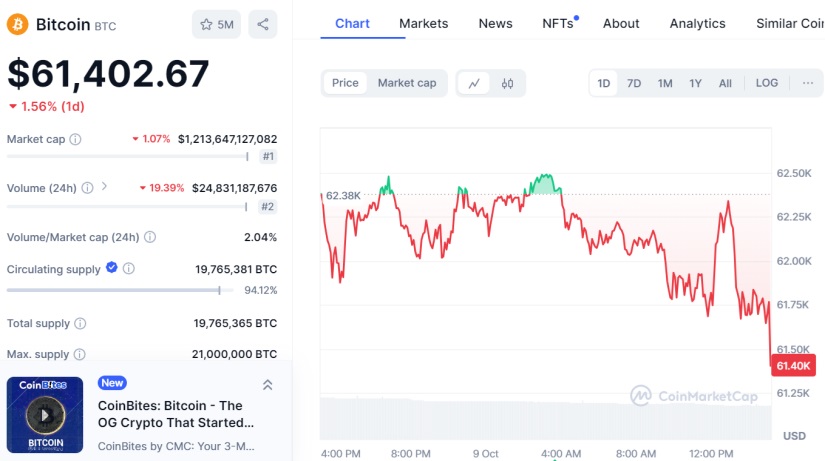

Currently, Bitcoin has recorded a slight drop of approximately 1.56% in the last 24 hours, hovering around $61,400. The total market capitalization of the crypto market stands at $2.15 trillion, reflecting a 1% decrease during the same period. The daily trading volume has remained around $63 billion, with Bitcoin dominating 56.7% of the market and Ethereum representing 13.6%.