TL;DR

- The cryptocurrency market has been volatile due to uncertainty about potential adjustments in the Federal Reserve’s policy following U.S. employment data.

- Bitcoin (BTC) fell 4% in the last 24 hours, trading just above $54,000, while Ethereum (ETH) plummeted 4.75%.

- Bitcoin ETFs are experiencing massive outflows, accumulating $900 million in the past week, reflecting market instability.

The crypto market has shown notable volatility following the release of U.S. employment data for August. Additionally, instability had been gradually intensifying in recent days, primarily due to uncertainty surrounding potential adjustments in the Federal Reserve’s monetary policy.

Bitcoin (BTC) is currently trading just above $54,000, having suffered a 4% drop in the last 24 hours. Ethereum (ETH) also plummeted 4.75% during the same period and is trading at $2,258, according to data from CoinMarketCap.

Instability in the Crypto Market

Here is the performance of the main cryptocurrencies in the last 24 hours: BNB (BNB) fell 2%, with a current value of $489.6. Solana (SOL) also lost 2.1% of its value, hovering around $127.3. XRP (XRP) suffered a harder blow, dropping 4.15% to a current value of $0.5207. Dogecoin (DOGE) plummeted 5.8%, trading at $0.0925. Cardano (ADA) was less affected but still lost 1.9% of its price, with a current value of $0.3163.

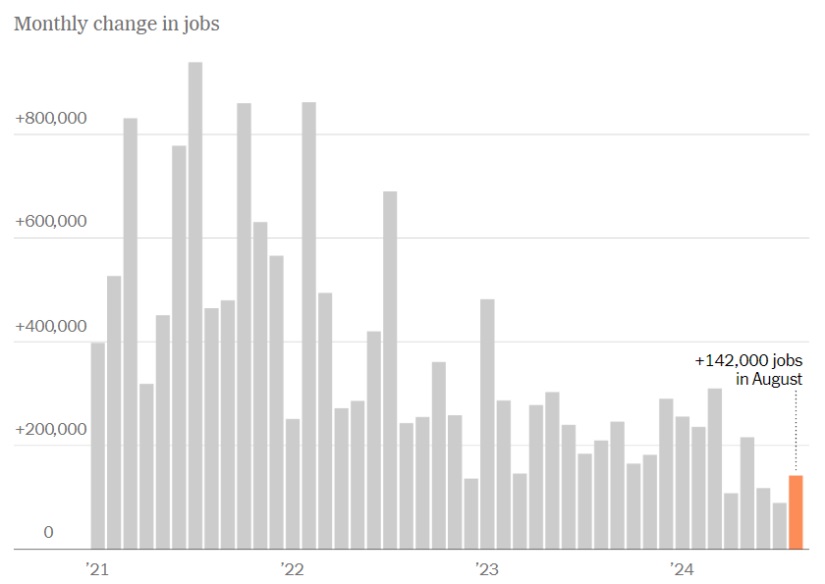

The instability in the cryptocurrency market coincided with a critical week for U.S. labor data. The ADP private payroll report, published today, revealed a slowdown in job growth in August, marking the weakest monthly growth since 2021. This slowdown has raised fears of a potential economic recession and increased expectations that the Federal Reserve could take preventive measures.

Employment Data

The official employment report, published by the Bureau of Labor Statistics, showed that nonfarm payrolls increased by 165,000 in August, and the unemployment rate fell to 4.2%. These data are considered key to determining the size of any potential interest rate cuts that the Federal Reserve may announce at its meeting on September 18.

With the Federal Open Market Committee meeting in sight, CME FedWatch projections suggest that interest rate traders see a 59% probability of a 25 basis point cut and a 41% possibility of a 50 basis point cut. The expectation of a possible rate reduction is generating uncertainty in financial markets.

Significant Outflows from Bitcoin ETFs

Brian Dixon, CEO of OTC Capital, commented that volatility in the Bitcoin market is likely to continue. Although institutional investments and exchange-traded funds (ETFs) could play an important role in stabilizing the market, volatility will remain dominant.

Valentin Fournier, an analyst at BRN, noted that Bitcoin ETFs are experiencing a wave of outflows, totaling $900 million in the past week. Additionally, in the last 24 hours, the global cryptocurrency market capitalization has decreased by 3.4%, standing at $1.9 trillion. Bitcoin’s dominance is at 53.8%, while Ethereum’s dominance is at 13.8%.