Race for safe havens-Bitcoin, the Digital gold, stands out

There is confidence in the cryptocurrency sphere. While the world economy is slowing down and the wave of politicking and “financial war” mongering flattening, the real question is whether Bitcoin price would edge higher.

For a while now, proponents have been on the fore front, and “raring” to let the world know that the world’s most valuable digital asset is battling with the yellow metal and treasuries as a safe haven.

Available data is overwhelmingly pro-gold. However, how BTC would be the asset of the future is well defined. There is enough data to justify that going by the trend, cryptocurrencies—and even alternative assets derived from blockchain, is shaping.

Therefore, holders of the assets have a strategic advantage over no-coiners in part thanks to the asset’s scarcity and other advantages it possesses as political immunity and transferability.

Jay Clayton response indicative of SEC’s Position on a Bitcoin ETF Approval

Add that to regulators’ understanding the advantages of the underlying tech and the demand for BTC derivatives, it’s quite obvious that the part of the least resistance, by all means, is northwards.

Just recently, Jay Clayton, the chairperson of the US SEC said there is a chance that the agency would approve a Bitcoin ETF but “there’s work left to be done.” Presently, a joint Bitcoin ETF proposal by VanEck and SolidX stands a chance to be approved come 2020.

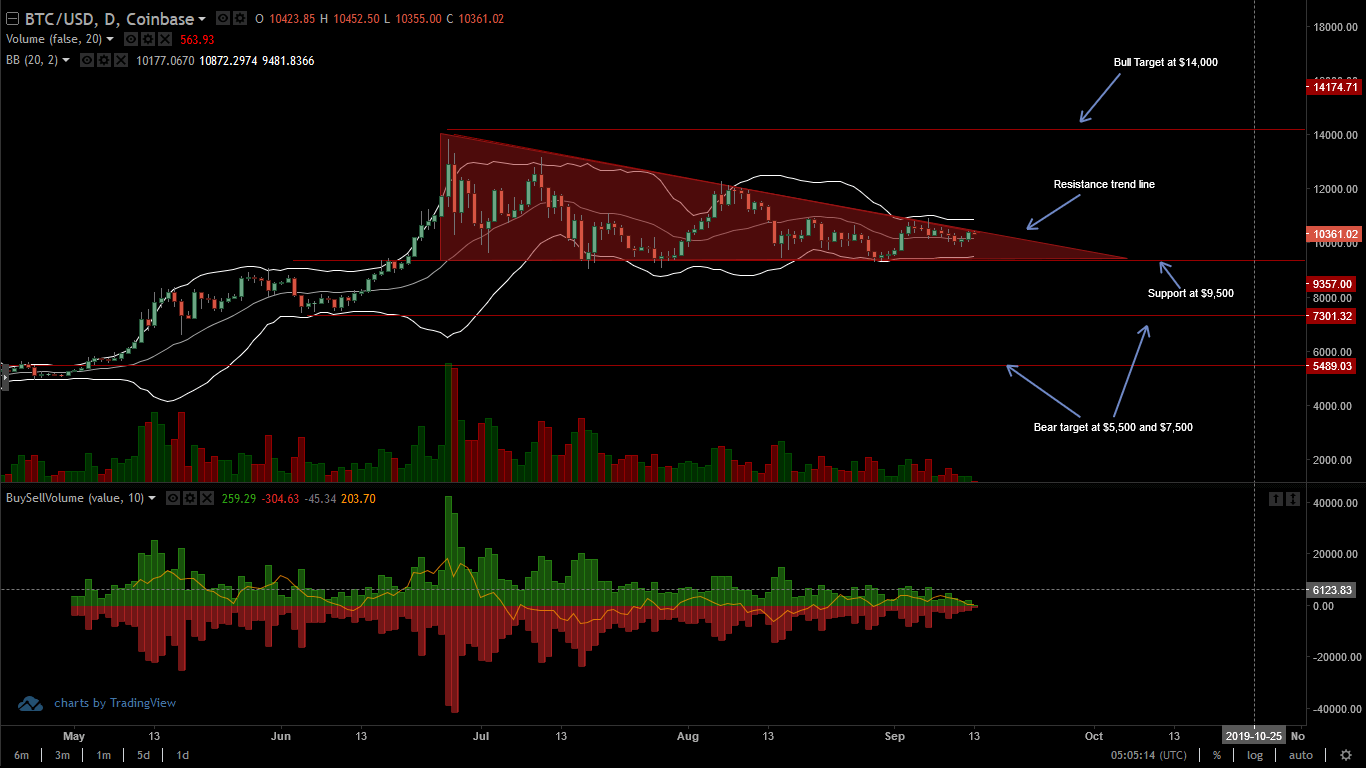

BTC/USD Price Analysis

At the time of press, Bitcoin price is down 2.67 and 3.72 percent in the last week against the green back and ETH. However, from candlestick arrangement and technical indicators, bulls are flowing back. Odds are, comments from Jay Clayton is reinvigorating bulls subsequently supporting prices.

Given, the best course of action for risk-averse traders is to wait for a firm close above the main resistance trend line before initiating longs on pullbacks with first target at $14,000, or June 2019 highs. That would be a conservative approach.

On the flip side, risk-off traders can short the coin on every high with stop-loss orders at Sep 6 high of $11,000, a round number. This is so because prices have been printing lower inside a wedge albeit in a pronounced bullish market anchored by gains of Q2-3 2019.

Mentioned in previous BTC/USD price analysis, any strong uptick above $11,000, or dips below $9,500, at the back of strong trading volumes surpassing 27k of Aug 15-or ideally 82k of June 26, could either see BTC soar to $14,000-or better, or tank to $7,500 or $5,500 in a retest.

Chart courtesy of TradingView – Coinanalyze

Disclaimer: Views and opinions expressed are those of the author and is not investment advice. Trading of any form involves risk. Do your research.