TL;DR

- Bitcoin has reached a 56% dominance in the total cryptocurrency market capitalization, up from 38% since November 2022.

- Short-term holders face substantial losses, which could lead to a potential overreaction in the market.

- Despite the volatility, long-term holders maintain a steady accumulation, with an average sell-side pressure of approximately $138 million per day.

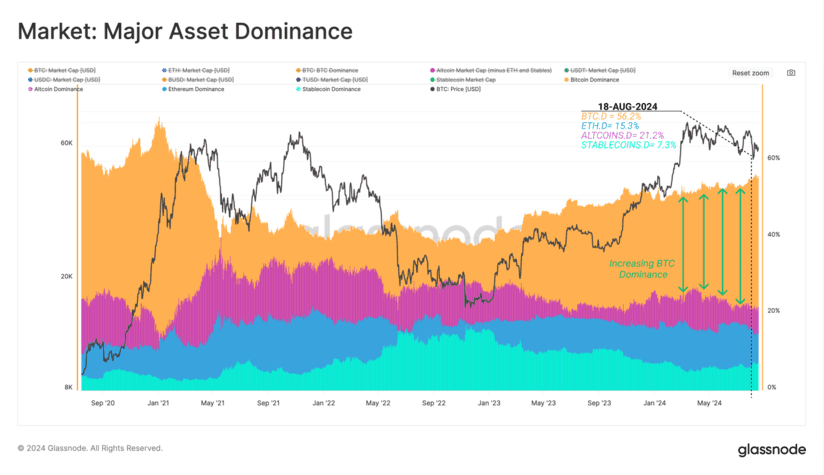

Bitcoin continues to solidify its position as the strongest asset, achieving an impressive 56% dominance in the total cryptocurrency market capitalization. Since the cycle low established in November 2022, Bitcoin’s dominance has shown an upward trend, increasing from 38% to 56% during this period. This expansion reflects a trend of accumulation by long-term holders, who remain steadfast despite market volatility.

In contrast, short-term holders have borne the brunt of recent losses. These investors have experienced a painful cycle, with unrealized losses that appear to have led to a potential overreaction in the market.

Despite the turbulence and irregular prices, long-term holders have managed to maintain a steady flow of accumulation, with an average sell-side pressure of approximately $138 million per day.

On the other hand, the Ethereum market, the second largest asset, has shown a slight decrease in dominance, dropping from 16.8% to 15.2%, while the dominance of stablecoins and altcoins has decreased by 9.9% and 5.9% respectively. However, despite the overall market contraction since the March peak, capital flow towards Bitcoin, Ethereum, and stablecoins remains positive.

Bitcoin Gains Traction and Investors Remain Resilient

The analysis of the major asset buy-side and sell-side indicators shows a positive trend in capital flow, with sell-side pressure decreasing and recording the first positive point since June 2023. Although the realized profit and loss ratio for long-term holders remains elevated, it is experiencing a marked decline from its peak, indicating a possible slowdown in profit-taking activities.

For short-term holders, the MVRV ratio shows that they are bearing unrealized losses, which could increase the likelihood of investor panic and precede a more severe bearish trend. The measure of realized and unrealized losses for new investors indicates that the magnitude of losses is relatively low compared to previous capitulation events, suggesting that the pressure on market sentiment may not be as severe as it seems.

Despite the market uncertainty and Bitcoin’s growing dominance, long-term holders have demonstrated clear resilience. Short-term losses are causing an overreaction that could influence the future direction of the market. The evolution of these factors will be crucial to understanding upcoming movements in the crypto market.