TL;DR

- Digital asset investment fund outflows amounted to US$251 million, marking the fourth consecutive negative period.

- ETFs debuted in Hong Kong with resounding success, attracting fund inflows of US$307 million in the first week.

- Ethereum broke a seven-week streak of net outflows with inflows totaling US$30 million, while Bitcoin recorded net outflows of US$284 million.

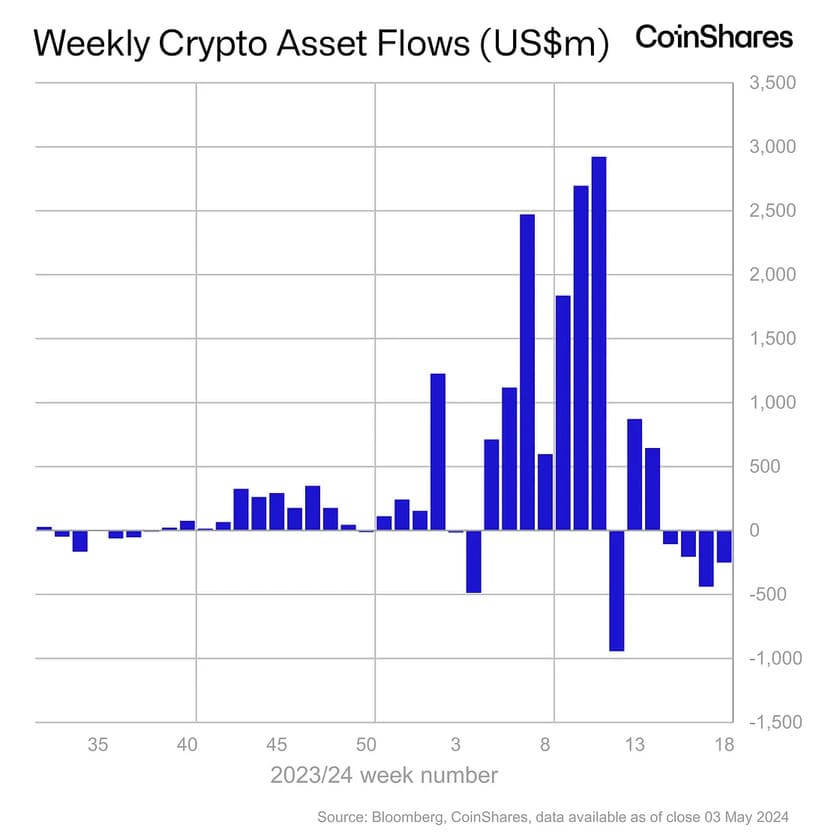

During the past week, the digital asset investment market experienced significant movements, as outlined in the weekly report by CoinShares Research.

Firstly, there was a concerning trend of outflows from digital asset investment funds, totaling US$251 million. This marked the fourth consecutive period of fund outflows, which could indicate a sense of caution or uncertainty among investors.

However, amidst the pessimistic trends, there was a ray of hope. The successful launch of spot-based ETFs for Bitcoin and Ethereum in Hong Kong attracted a massive influx of funds, amounting to US$307 million during the first week of trading. This success may indicate a renewed interest and confidence in the crypto industry among investors in the Asia-Pacific region.

Another notable development was the shift in Ethereum fund flows, breaking a seven-week streak of net outflows with inflows totaling US$30 million. ETH continues to strive to reach its long-term growth prospects.

Market Uncertainty in Digital Assets

Regarding fund outflows, Bitcoin was the hardest hit, with net outflows totaling US$284 million. This could suggest a possible profit-taking by investors, especially after the prolonged bullish trend in BTC price.

On the other hand, fund inflows were observed in several altcoins, including Avalanche, Cardano, and Polkadot, which recorded inflows totaling US$1.2 million.

Fund outflows in digital asset investment products continue to be a concerning trend. However, the success of ETFs in Hong Kong and the change in Ethereum fund flows offer a slightly more positive outlook for investors. It is important to note that the digital asset market remains highly volatile, and investors should proceed with caution and conduct thorough research before making any moves.