TL;DR

- ViaBTC mined and sold the first satoshi after Bitcoin’s latest halving, causing a sensation in the community.

- The Ordinals protocol allows for the identification and trading of individual sats, classifying them into different categories of rarity and therefore, value.

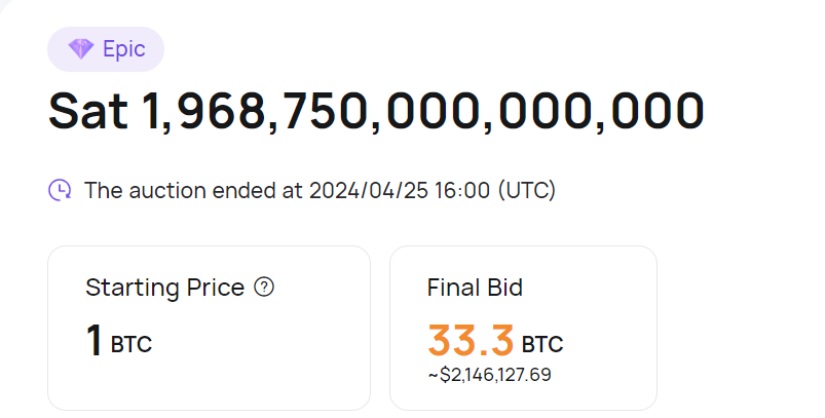

- The auction of the “epic satoshi” took place on CoinEx and reached a price of $2.13 million, despite its nominal value being only $0.0006.

ViaBTC has mined and sold the first satoshi after Bitcoin’s latest halving, causing a stir in the community. On April 20th, the company mined the first BTC block after the halving, and with it, the first satoshi.

ViaBTC sold this “epic satoshi” in an auction for about $2.13 million. An unprecedented event, as the nominal value of a satoshi is only $0.0006. However, the uniqueness and rarity of this specific satoshi, along with the interest of crypto collectors, drove its price to astronomical figures.

The auction took place on the CoinEx exchange and generated a fierce amount of bids, it was a unique event that caught the attention of the entire community. The auction ended at 16:00 UTC, after several hours of intense bidding by participants.

Ordinals Opens New Markets for Bitcoin

The Ordinals protocol played a key role in this event by allowing the identification and trading of individual sats. Developed by Casey Rodarmor, Ordinals classifies sats into different categories of rarity, such as “uncommon,” “rare,” and “epic.” This provides a new dimension in the Bitcoin ecosystem, as sats can now be treated as unique tokens of different values, similar to non-fungible tokens (NFTs) on other networks.

Before the development of the Ordinals protocol, Bitcoin halvings only granted bragging rights for mining the first block. However, now, with the ability to identify and trade individual sats, a new market and a new way of valuing the first blocks mined after a halving have been created.

This particular event marks an important milestone in BTC’s history. Not only does it show that there is still a lot of potential for innovation and growth within the crypto ecosystem, but it also highlights the increasing strength of sats and the Ordinals protocol in the market.