TL;DR

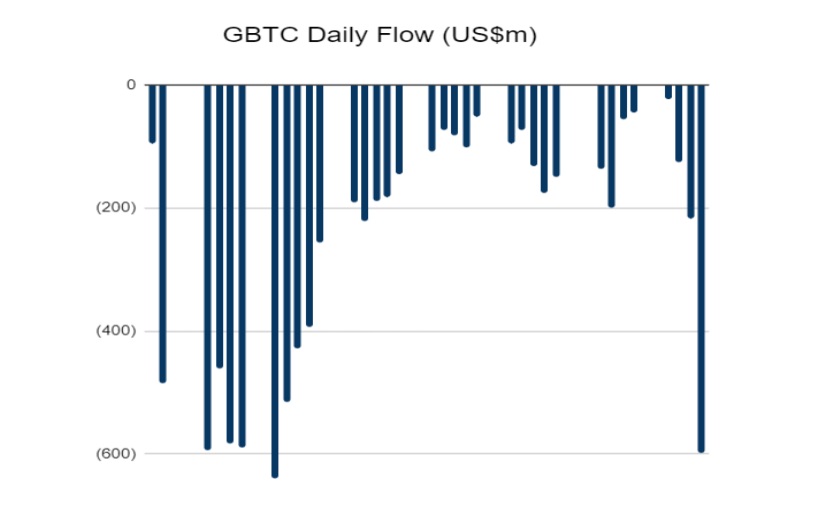

- The Grayscale Bitcoin Trust (GBTC) has experienced significant capital outflows, with over $600 million and a total accumulated of approximately $8.4 billion since the fund’s inception on January 11.

- Other BTC ETFs recorded record inflows on the same day, collectively adding 14,934 BTC valued at $940 million.

- The outflow of funds from GBTC highlights a growing trend of investors opting to change their portfolio, despite the recent increase in Bitcoin’s price.

The Grayscale Bitcoin Trust (GBTC), a digital asset management firm, has experienced significant capital outflows in its ETF, with over $600 million leaving GBTC on February 29. This outflow marks a total accumulated of approximately $8.4 billion since the fund’s inception on January 11.

This movement contrasts with the record inflows that several other BTC ETFs recorded on the same day. In total, eight ETFs collectively added 14,934 BTC valued at $940 million. The iShares Bitcoin Trust (IBIT) by BlackRock, the world’s largest asset management firm, stands out, adding 10,140 BTC valued at $638 million, followed by Fidelity’s FBTC, which added 4,066 BTC valued at $255.9 million.

The outflow of funds from GBTC underscores a growing trend of investors opting to change their portfolio, despite the recent increase in Bitcoin’s price. This phenomenon raises questions about investors’ sentiment towards the fund and its perceived performance and utility.

Grayscale Appeals to the SEC in Search of Tools to Attract More Investors

In an effort to enhance its appeal to a broader spectrum of investors, Grayscale Investments has appealed to the SEC to approve options in its spot Bitcoin ETF.

The increase in trading volumes of spot Bitcoin ETFs reflects a growing interest and participation in these regulated investment vehicles. On Wednesday, trading volume reached $7.69 billion, surpassing previous records by more than one and a half times.

Despite the outflows from GBTC, Bitcoin continues its upward trend, reaching a two-year high. In the last seven days, BTC has increased by over 22%, with a market capitalization of $1.2 trillion. This solid performance reaffirms Bitcoin’s status as one of the most valuable assets in the world.