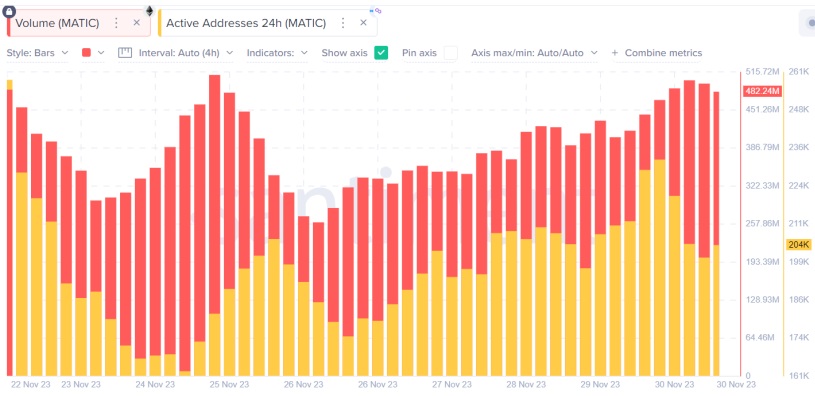

Amid uncertainty surrounding the previous trend of MATIC, the Polygon network experienced a significant surge in activity, according to the latest Santiment data. This increase is evident in both trading volume and the number of active addresses in the last 24 hours.

Regarding active addresses, they reached 224,000, indicating significant participation from market participants in transactions within the Polygon network. This uptick in activity serves as a positive indicator of the growing utilization of the network.

MATIC’s trading volume also followed this upward trend, reaching 491.79 million at the time of writing. The substantial increase in volume suggests that MATIC tokens are widely being used in transactions conducted on the Polygon network.

However, a notable discrepancy arose between apparent demand and network activity. There is widespread concern that the rise in MATIC’s value may not be directly linked to an organic increase in demand. An analysis suggests that the bullish pressure could be the result of internal purchases by some exchanges.

Uncertainty in the Polygon Network

Despite the initial positivity, sentiment around MATIC underwent significant changes. The Weighted Sentiment Index rose to 4.14 on November 15, indicating considerable optimism in price action. However, a day later, the index dropped to -0.306, signaling a rapid transition from bullish to bearish sentiment.

This shift in sentiment, combined with the divergence between the increase in MATIC reserves on exchanges and public interest in Polygon, raised questions about the sustainability of the recent bullish trend. Although the outflow of tokens from exchanges exceeds the inflow, suggesting a long-term commitment from market participants, uncertainty persists in the community and among investors.

Under these premises, the price of MATIC could experience a recovery if certain current patterns persist. However, the situation underscores the complexity and influence of internal factors in price dynamics.