Latest Ripple [XRP] News

No doubt, what Ripple Inc propose will shape lives and change the financial landscape. With xRapid’s speed and xCurrent end-to-end transaction tracking within an immutable, transparent and distributed network in RippleNet, the incumbent, SWIFT, is facing stiff competition. Well, many banks are yet to press the shift button but what we do know is that financial institutions leveraging any of the three core products fronted by Ripple Inc are reaping benefits.

Brad Garlinghouse wants to see global banks use the network and so is the vocal Yoshitaka Kitao of SBI Holdings who recently launched an exchange with XRP as base. However, before we have XRP and xRapid dominant the charts, there should be regulatory certainty and that is what the team at Ripple is working on.

Remember, they have a good rapport with the Trump administration wary of Chinese influence, the level of Bitcoin centralization and energy demands needed to maintain the most valuable coin in the space. But we may have a breakthrough in days ahead. Since Borse Stuttgart’s NGM rolled out the first of its kind ETP allowing for unbridled investment in an ETF drawing the performance of the underlying asset from approved exchanges, all pointers indicate that XRP is a utility.

All the same, Ripple Inc has bases in the US and the SEC is the main regulator calling the shots. Any nod that assets what Ripple executives have been talking about would see the coin rally to new highs.

XRP/USD Price Analysis

Price wise and Ripple (XRP), despite all the optimism, utility calls and developments through InterLedger Protocol, is lagging, underperforming against competitors as XLM. By close of yesterday’s bar, XRP was up 14.1 percent and building on gains of Apr 2.

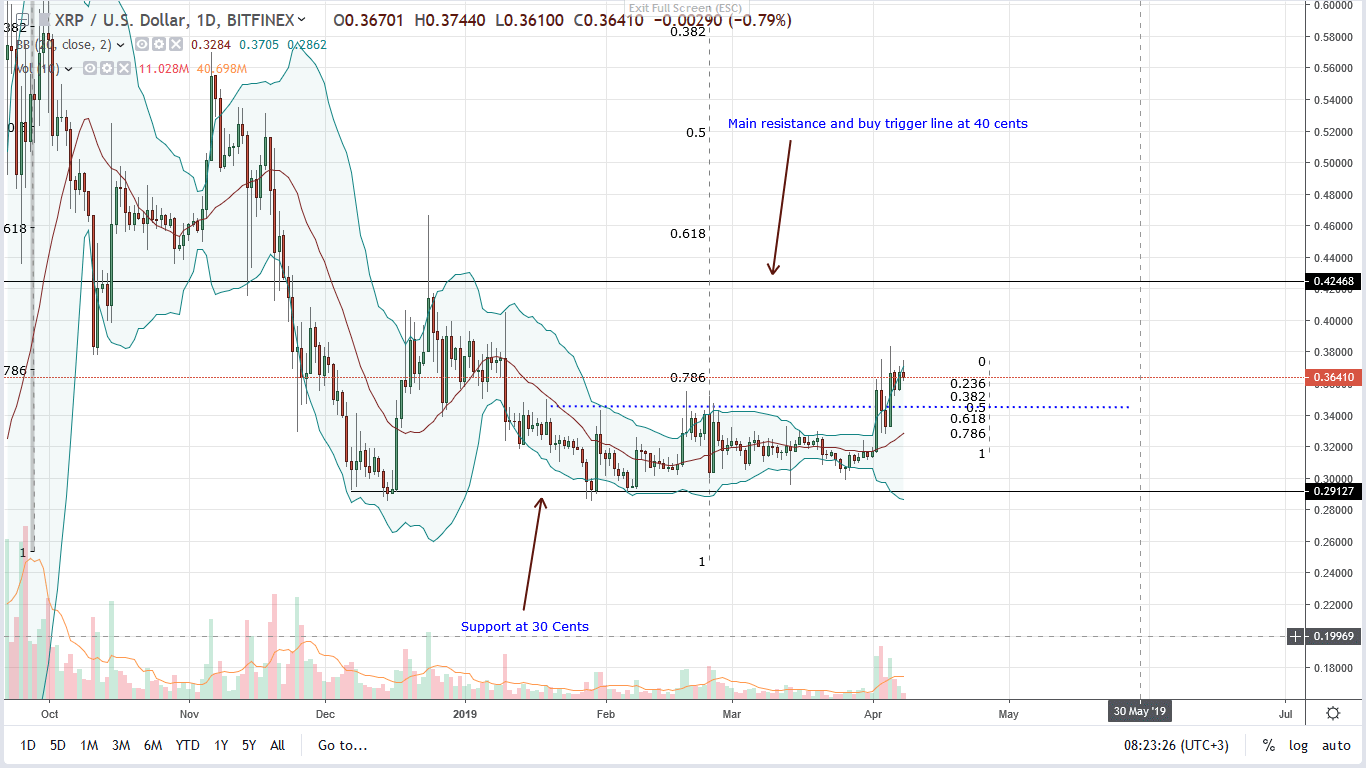

A standout though is the close above 34 cents meaning the trade conditions of our last XRP/USD trade plan is valid and risk off traders can begin loading up in lower timeframes with first target at 40 cents.

It’s easy to see why we are optimistic expecting prices to inch higher in days ahead. Not only are participation levels highs—shooting four folds from Mar 26 to yesterday’s close, but the underlying momentum mean XRP bull bars are banding along the upper BB hinting of a possible bull trend continuation in days ahead.

Even so, it is likely that momentum will slow down as prices cool off; retesting the middle BB and even 36 cents before 40 cents is hit. Every low in that case is an opportunity for risk-off, aggressive type of traders to load up with first targets at 40 cents, 60 cents and later 80 cents.

All Charts Courtesy of TradingView—BitFinex

Disclaimer: Views and opinions expressed are those of the author and aren’t investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision.