TL;DR

- Arbitrum moved from being an efficient L2 to a production-grade financial infrastructure, with institutional adoption, sustained volume, and large-scale operational use.

- The network concentrates the issuance and settlement of tokenized assets from firms such as Robinhood, BlackRock, and Franklin Templeton.

- It surpassed 2.1 billion transactions, maintains more than $20 billion in TVS, and supports an active ecosystem with deep liquidity and its own economic engine.

Arbitrum is no longer just an efficient layer 2 and has taken on a structural role within onchain financial infrastructure. Throughout 2025, the network concentrated institutional adoption, steadily growing and consistent volume, and productive use cases. These factors show a clear transition from testing to execution. The focus is no longer on experimentation, but on operating at scale.

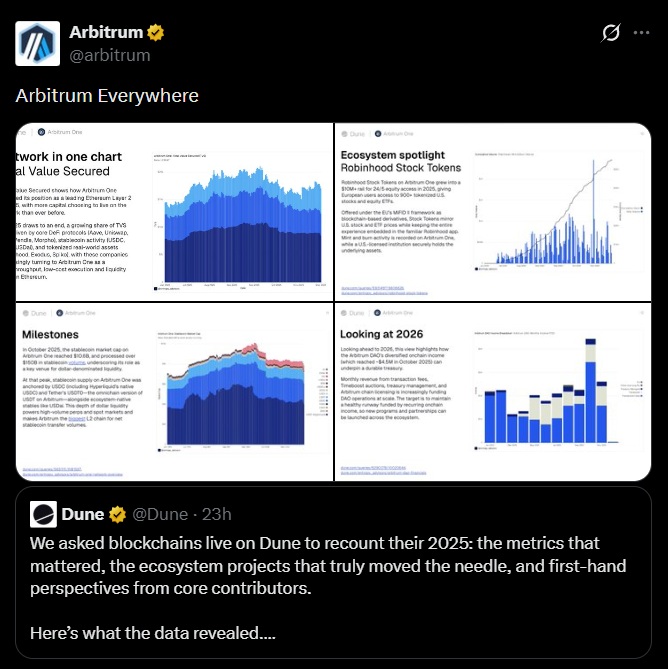

Institutional adoption has been central to the network. Arbitrum became the technical foundation for tokenized financial products used by top-tier players. Robinhood launched tokenized stocks and ETFs for European customers on Arbitrum One and, in less than six months, expanded the offering to nearly 2,000 assets. Franklin Templeton, BlackRock, WisdomTree, and Spiko also chose the network to issue and settle real financial products. Spiko, in particular, surpassed $200 million in assets under management in under a year.

Arbitrum Succeeded Across All Industry Segments

Network activity followed the same growth path. Arbitrum One surpassed 2.1 billion cumulative transactions. The key data point is acceleration, as the second billion was processed in less than 12 months. The network maintained its leadership among L2s by total value secured, with more than $20 billion in TVS, reflecting deep liquidity and continuous usage.

The ecosystem has continued to scale. More than 1,000 projects operate on Arbitrum, and over 100 chains are live or in development. In 2025, the network generated more than $600 million in application revenue, with year-over-year growth above 30%. This combination of active builders and fee generation shows a functional economy that does not rely on subsidies.

Growth in DeFi and Stablecoins

In the DeFi and stablecoin segment, ARB established itself as a central settlement layer. Stablecoin supply grew 82% year over year to exceed $8 billion. Programs such as DRIP accelerated liquidity inflows, while Aave and Uniswap recorded their largest deployments outside Ethereum on ARB. Active loans also reached $1.5 billion.

On the financial side, the DAO closed 2025 with gross margins above 90% and a treasury holding more than $150 million in non-native assets. Arbitrum enters 2026 as infrastructure in active use, with institutional adoption, deep liquidity, and an economic model that enables continuous reinvestment. It is already an operating financial system in motion