TL;DR

- Ripple moved 200 million XRP worth $445M to an unknown wallet, and the transfer was interpreted as part of its routine operations.

- There are reports that U.S. banks may soon be authorized to hold crypto to cover blockchain network fees.

- XRP dropped again after an initial rebound, and only 58.5% of the supply is currently in profit.

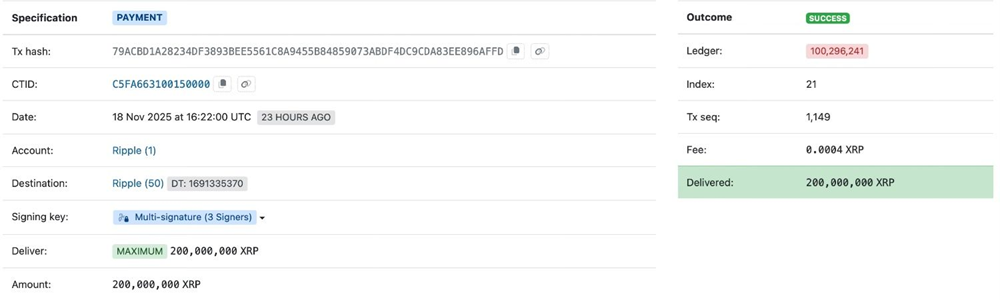

Ripple transferred 200 million XRP, worth approximately $445 million, from a company-controlled wallet to an unidentified address.

What Is Behind Ripple’s Move?

The transaction was recorded on XRPSCAN on Tuesday, November 18, at 16:22 UTC. It took place as the broader market began to show a general rebound after several days of corrections. Ripple did not disclose the destination or purpose of the funds, but analysts view the transfer as part of the company’s ongoing liquidity and infrastructure operations to support its activity in the crypto industry.

The move also coincided with reports that U.S. banking regulators are considering allowing financial institutions to hold cryptocurrencies to cover usage fees on blockchain networks. This would expand the list of permitted functions for banks in the digital sector and signal a more favorable regulatory environment for institutional adoption.

The market received another positive indication: a proposed policy confirming that transactions on the XRP Ledger would remain exempt from taxes, allowing companies and users to operate without additional charges.

XRP Drops 8 Percent

Despite the improved regulatory signals, XRP continues to show weakness. Its price jumped more than 5 percent after the transfer but lost momentum in the following hours, returning to the $2.05 area with a daily decline of roughly 8%.

This volatility comes during a difficult week for the cryptocurrency, which has shed nearly $19 billion in market capitalization over seven days, dropping from $147.08 billion on November 12 to $128.50 billion on November 19.

Data also shows that only 58.5% of the XRP supply is currently in profit, the lowest level in a year. This ratio reduces the asset’s appeal for new buyers and leads long-term holders to act more cautiously. If conditions do not improve, selling pressure could increase and push the price down toward $1.73.