TL;DR

- The Layer-2 platform ZKsync (ZK) has experienced a significant decline in network activity, with a 66% drop in daily active addresses.

- The number of daily transactions has decreased considerably, reaching a low of 293,000 on July 23.

- The native token of the protocol, ZK, has fallen nearly 9% in the past week, settling at $0.15, with technical indicators suggesting a possible continuation of the bearish trend.

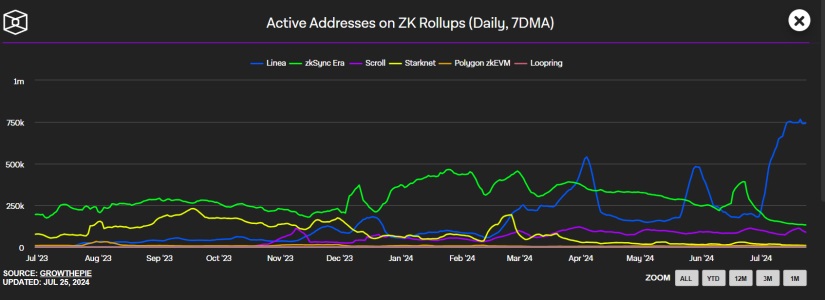

The Layer-2 platform ZKsync (ZK) has experienced a significant decline in network activity over the past few months, reaching its lowest point year-to-date. The protocol is facing a sharp drop in user demand, reflected in the decrease in daily active addresses and total value locked (TVL), which has fallen to levels not seen since April 2023.

Since June 23, user demand has been in constant decline. The seven-day moving average of daily active addresses has fallen by 66%. This decrease in active addresses has led to a considerable reduction in the number of daily transactions on the ZKsync network. On July 23, the number of completed transactions dropped to its lowest level of the year, recording 293,000 transactions.

The decline in activity not only reflects less user interaction with the platform for activities such as NFT trading or participation in the DeFi economy, but also a fall in TVL. Despite other networks experiencing an increase in TVL due to the recent market rally, ZKsync has shown a contrary trend. Currently, the network’s TVL stands at $96 million.

The Bearish Trend of ZKsync (ZK) Deepens

The impact of these trends has been reflected in the price of ZKsync’s native token, ZK. After hitting an all-time low of $0.13 on July 5, the token experienced a brief 21% rally. However, in the past week, it has fallen nearly 9%, settling at $0.15. According to CoinMarketCap, the token dropped 11.33% in the last 24 hours and is trading at $0.1552. Technical indicators such as the Relative Strength Index (RSI) show a decrease in buying pressure, with a value of 42.10, below the neutral line of 50, indicating a possible continuation of the bearish trend.

Additionally, the Directional Movement Index (DMI) reveals that the negative directional indicator has crossed above the positive, signaling a market trend shift from bullish to bearish. The downward trend of the token could strengthen, potentially driving the price of ZK to its all-time low of $0.13 or even $0.09 if the trend persists.

Despite the projections, if buying pressure regains momentum, ZK’s price could rise to $0.17. The protocol community remains attentive to developments and possible changes in market dynamics that could influence the future performance of the token and the network.