TL;DR

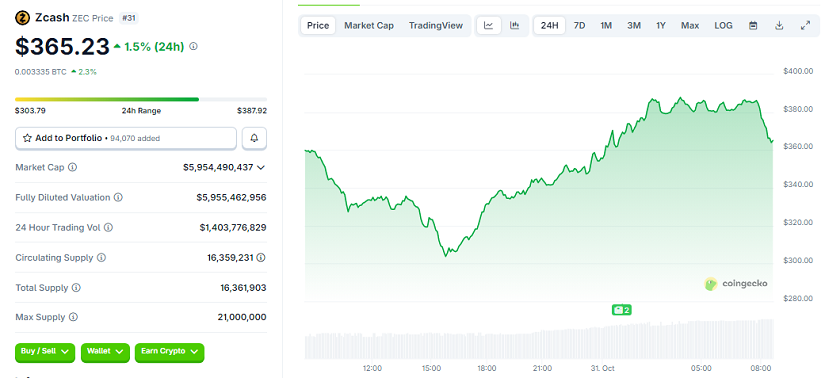

- Zcash (ZEC) is trading at $365.23, showing a 24-hour gain of +1.5%, while Bitcoin (BTC) is at $109,519.54 with a -0.39% change over the same period.

- ZEC continues to decouple from the dominant Bitcoin market, holding a market capitalization of $5.9 B.

- Despite the lack of institutional support, ZEC leverages its privacy features and emerging DeFi use cases to gain momentum and approach the $400 threshold.

ZEC is moving strongly while Bitcoin remains relatively flat, attracting traders seeking alternatives to BTC’s path. At $109,519.54 for BTC and $365.23 for ZEC, the contrast in performance is evident. Over the past 24 hours, ZEC gained +1.5%, while BTC declined -0.39%, signaling a clear decoupling trend. Market participants note that ZEC’s relative independence from BTC provides a unique opportunity for short-term traders and long-term holders alike. Its liquid trading markets on Binance and other exchanges make it easier to enter and exit positions.

Divergence Visible Between ZEC And BTC

During recent market corrections, ZEC only dipped to around $300 while BTC fell under $107,000, demonstrating ZEC’s resilience. Open interest for ZEC has returned to over $434 M, though short positions now account for more than 62% of total open interest. This dynamic suggests potential short squeezes and highlights ZEC’s growing independence from Bitcoin’s movements. Analysts point out that ZEC’s price structure allows for stronger rebounds, as small dips often attract new buyers and trigger momentum-driven rallies.

ZEC Advances Its Privacy And DeFi Use Cases

Beyond market action, ZEC’s privacy-focused design appeals to investors seeking discretion. Its emerging presence in DeFi platforms, such as Near Protocol with 6,239 active wallets, reinforces utility despite limited institutional participation. Retail accumulation and whale activity are driving price growth, positioning ZEC as a confidential, functional tool for decentralized finance. Developers are exploring integrations with more DeFi protocols, aiming to increase transaction volume and usability.

ZEC recently surpassed Monero (XMR) to become the leading privacy coin, challenging Litecoin (LTC), which maintains a market cap above $7 B. Other privacy assets like DASH and Railgun (RAIL) are also gaining traction, reflecting growing demand for privacy-oriented cryptocurrencies. Investors are watching ZEC carefully, anticipating that its combination of privacy, liquidity, and active DeFi applications may support continued price growth over the coming months.

Approaching the $400 mark is more than symbolic—it underscores ZEC’s potential as a privacy-focused DeFi asset. With a market cap of $5.9 B, resilient price action, and growing adoption, ZEC demonstrates that independent altcoins can thrive alongside major cryptocurrencies.