TL;DR

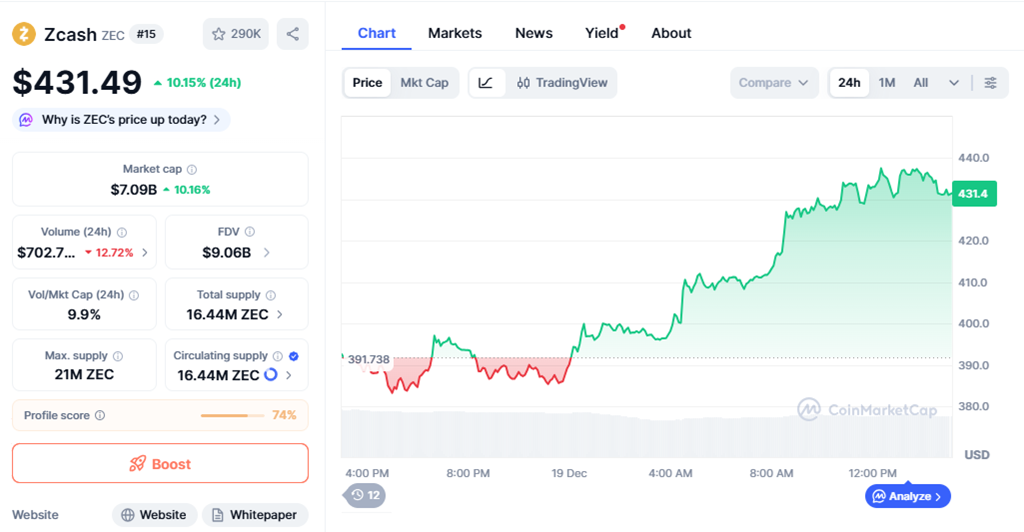

- Zcash rebounded from range lows with a 10.15% gain in the last 24 hours, trading near $431.49.

- The technical structure suggests stabilization after weeks of consolidation, supporting the idea of a potential higher-timeframe base rather than a short-lived bounce.

- The move came with strong participation, as 24-hour volume reached $703 million and market capitalization stood near $7.09 billions, underlining sustained interest in privacy-focused crypto assets.

Zcash has returned to focus after a decisive rebound from recent lows. The latest price action combines short-term momentum with broader structural signals that point toward a possible base formation following an extended corrective phase.

$ZEC looks pretty good overall, I think you just saw a high time frame bottom get put in. If so, this goes to $500+ as long as BTC is stable pic.twitter.com/X6s5vgj2C1

— Altcoin Sherpa (@AltcoinSherpa) December 19, 2025

Zcash Recovers From Range Lows As Structure Improves

Zcash currently trades at $431.49, up 10.15% in the last 24 hours. The recovery followed a prolonged period of sideways movement, during which ZEC rotated within a broad range and gradually absorbed selling pressure. Rather than a sudden reversal, the move reflects a steady loss of downside control, as buyers began defending lower levels more consistently.

From a technical standpoint, price reclaimed zones that previously acted as resistance, shifting attention from further downside risk toward validation of the rebound. Volume recorded $703 million traded in a single day, signaling broad market participation rather than thin liquidity. This contrasts with earlier sessions marked by choppy price action and limited follow-through.

Zcash’s market capitalization near $7.09 billions places it among established digital assets despite recent volatility. Its size adds relevance to structural shifts, as larger-cap assets typically require sustained demand to alter trend behavior.

Network Context And Market Positioning

Beyond price action, Zcash continues to operate without protocol disruptions. The network remains defined by its use of zero-knowledge proofs, enabling transactions that preserve privacy while remaining verifiable. This characteristic keeps ZEC relevant as digital markets increasingly weigh user privacy alongside compliance and transparency.

In the broader market, Zcash’s rebound aligns with renewed risk appetite across several major cryptocurrencies. Traders are now monitoring whether ZEC can hold above reclaimed levels, a key condition for confirming that the move represents stabilization rather than a simple range rotation.

As price approaches the upper boundary of the prior range, activity has begun to moderate, hinting at near-term consolidation. Such pauses often accompany base-building processes, where balance forms before the market defines its next direction.

Zcash’s rebound from key range lows marks a shift from weakness toward market reassessment. With improved momentum, solid trading volume, and a technical structure favoring stabilization, attention now centers on price behavior around recovered levels.