TL;DR

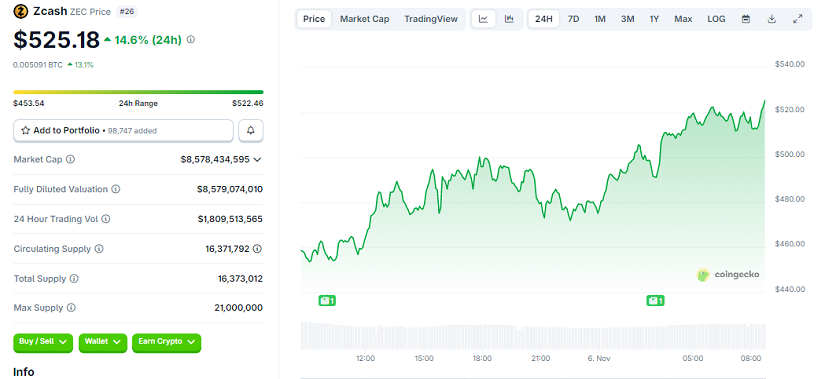

- Zcash climbed above $500, reaching $525.18 with a daily gain of 14.6%, while market capitalization hit $8.57B.

- Derivatives demand pushed open interest above $674M, with funding rates turning deeply negative as traders maintained short positions.

- The growing use of tokenized ZEC on Solana and BNB Chain, plus 4.96M ZEC shielded in private pools, is fueling renewed optimism.

Zcash pushed through $500 once again and extended its strong recovery, trading at $525.18 with 24-hour performance of 14.6%. Market cap reached $8.57B and volume surged to $1.8B, helping ZEC move back toward levels last seen during its breakout run in 2018. Interest from both long-term holders and high-volume traders has helped revive activity on major centralized venues, especially Binance and Coinbase, which had seen lower demand for years. Recent improvements in liquidity depth and tighter spreads are also drawing additional participants, making ZEC increasingly attractive for both retail and institutional traders.

While many traders focus on price speculation, a segment of ZEC supporters continues to secure coins in privacy-enabled pools. A total of 4.96M ZEC has been shielded, reflecting strong conviction in the asset’s mission of financial privacy. Renewed participation from long-oriented traders has raised expectations that ZEC could revisit or even surpass the historic $700 area reached seven years ago. Analysts also note that if ZEC continues gaining exposure across new trading rails and integrations, it could accelerate momentum during the ongoing market cycle.

Growth Of Tokenized ZEC Across Chains

Zcash trading is no longer limited to its native chain. Tokenized forms of ZEC are gaining relevance across decentralized finance. A Binance-pegged ZEC on BNB Chain has been adopted by more than 16,000 wallets, while another version circulates actively on Solana. These representations of ZEC, although not private, are adding utility by integrating the asset into swaps, liquidity pools, and lending platforms. Activity remains moderate, yet it opens a pathway for ZEC to participate in DeFi flows and attract new users beyond its original base.

Surging Open Interest And Derivatives Pressure

Open interest for ZEC jumped above $674M, reflecting heavy appetite for leveraged exposure. A large portion of traders continue to bet against the rally, keeping funding rates in negative territory as shorts pay to keep their positions open. Even so, ZEC has repeatedly moved past liquidation levels and recently found liquidity toward $529. On Hyperliquid, 53% of traders favor long positions, and one wallet recorded unrealized gains above $2.8M after holding a winning long.