As traditional financial services evolve, crypto-based banking platforms are increasingly being evaluated as alternatives to legacy systems. Rising account closures, higher fees, and stricter compliance requirements have prompted renewed interest in blockchain-enabled financial tools. Within this landscape, projects such as Ripple (XRP) and Digitap ($TAP) represent two distinct approaches to crypto banking.

Ripple continues to focus on institutional-grade infrastructure, while Digitap positions itself around retail accessibility through an omni-bank model. This contrast has led analysts and market observers to compare how each ecosystem addresses banking functionality, user access, and long-term adaptability.

XRP’s Institutional Banking Focus and Its Limitations

XRP has historically positioned itself as a bridge asset for cross-border payments, targeting financial institutions, liquidity providers, and settlement networks. This institutional orientation helped establish XRP’s early relevance within enterprise payment systems, but it has limited direct engagement with retail users.

Ripple’s recent strategic moves, including acquisitions and a broader focus on custody, treasury, and brokerage services, further reinforce its institutional direction. While this infrastructure plays an important role in enterprise finance, its benefits remain largely indirect for everyday users.

From a market perspective, XRP’s price activity has often reflected macroeconomic developments or regulatory news rather than consistent user-driven demand. This dynamic highlights how adoption within a narrow institutional corridor can influence growth characteristics over time.

Digitap’s Retail-Centric Banking Model

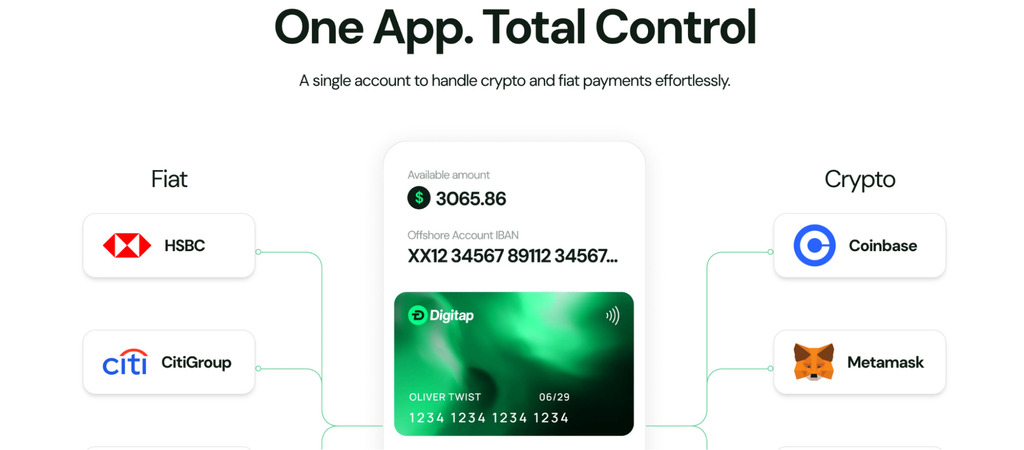

Digitap approaches crypto banking from a different angle, emphasizing direct usability for individuals and small businesses. Its platform is designed to integrate crypto and fiat services within a single application, allowing users to manage transfers, balances, and payments without relying on third-party intermediaries.

The Digitap app is currently available on major mobile platforms and offers tiered verification options depending on user needs and jurisdictional requirements. This flexible onboarding structure is intended to support a wide range of users, including freelancers, remote professionals, small enterprises, and individuals in regions with limited access to traditional banking.

Rather than focusing on backend settlement systems, Digitap emphasizes front-end functionality, positioning itself as a consumer-facing financial platform rather than an institutional settlement layer.

Different Token Models, Different Use Cases

The contrast between XRP and Digitap also extends to token design and ecosystem structure. XRP operates within a centralized supply framework managed by Ripple Labs, reflecting its enterprise-oriented deployment strategy. Token utility is closely linked to institutional liquidity and settlement use cases.

Digitap’s model, by comparison, links its token to platform activity within its banking ecosystem. According to project documentation, a portion of platform revenues is allocated toward ecosystem mechanisms designed to align user activity with token circulation. This structure emphasizes participation and usage rather than speculative holding, though outcomes depend on broader adoption and execution.

Evolving Banking Needs and Crypto Alternatives

While Ripple’s technology continues to serve a defined purpose within institutional finance, broader shifts in user expectations are influencing how crypto banking platforms are evaluated. Increasing demand for accessible, digital-first financial tools has driven interest in omni-bank models that blend usability with blockchain infrastructure.

Digitap reflects this trend by focusing on consumer accessibility and integrated financial services, rather than acting as a middleware layer for banks. This approach aligns with the growing interest in alternative financial platforms that operate alongside or independently of traditional banking systems.

XRP and Digitap: Two Paths Within Crypto Finance

XRP remains a well-established asset within cross-border settlement infrastructure, offering efficiency improvements for institutional finance. However, its reliance on enterprise adoption shapes both its utility and growth dynamics.

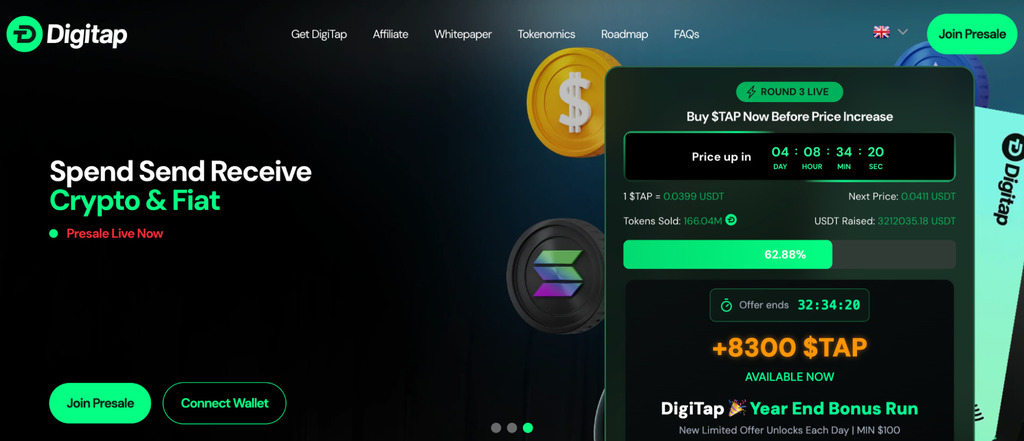

Digitap represents an alternative approach centered on retail functionality and integrated banking services. Its presale has drawn attention from observers tracking emerging financial platforms, though, as with any early-stage project, outcomes depend on adoption, regulatory alignment, and long-term execution.

Learn More About Digitap:

Presale: https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Promotion: https://gleam.io/bfpzx/digitap-250000-giveaway

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.