TL;DR

- Futures open interest grows 11-15% in five days and the funding rate remains positive.

- Technical structure shows support at $1.72 and $1.58; resistance at $1.95 and $2.10.

- Statistical projection places price at $2.06 in seven days and $2.34 in thirty.

XRP operates at $1.84 on February 13, 2026, showing increasing volatility over the past 48 hours alongside elevated daily volume. The daily RSI sits at 63, within moderate bullish territory without reaching overbought conditions (>70), leaving room for momentum continuation before overheating.

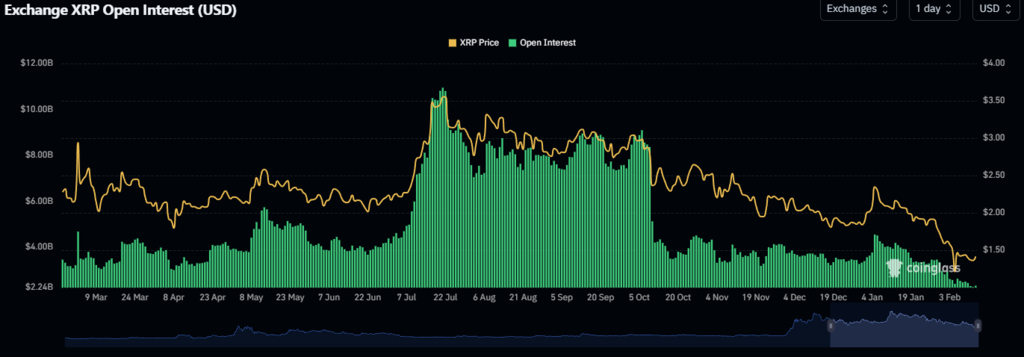

Open Interest (OI) in XRP futures registered sustained growth over the past five days, climbing approximately 11-15%. The funding rate remains slightly positive, indicating speculative capital entry and greater long positioning. When price rises together with OI, analysts consider the signal healthy bullish. Risk appears if price falls with high OI, a scenario potentially triggering long liquidations.

Current momentum shows absent bearish divergences on the daily timeframe, reinforcing the bullish reading from expanding RSI. The technical structure supports upward movement continuation with brief pullbacks expected toward the $1.78 zone before attempting breakout.

Key Levels and Statistical Projection for the Next 30 Days

Strong supports sit at $1.72 and $1.58, while resistances appear at $1.95 (immediate) and $2.10 (psychological). Statistical projection using linear regression on the 30-day trend points to $2.06 in 7 days and $2.34 in 30 days, with majority probability for bullish continuation.

The risk scenario activates if XRP loses $1.72 with high volume, opening rapid decline toward $1.60 and possible mass liquidation if OI fails to reduce.

Aggressive profiles can consider entry on confirmed breakout above $1.95, while conservative profiles would wait for pullback to the $1.75-$1.78 zone. Technical stop loss recommended below $1.58.

EGRAG Challenges XRP Holders with Two Brutal Scenarios

Influential technical analyst EGRAG CRYPTO, a prominent voice in the XRP community, shared a thought-provoking post on X this Friday, February 13, 2026, sparking widespread discussion among investors and traders.

The first scenario, labeled “Chart 1,” depicts the more painful path. It projects a significant correction with support at $0.60, a level likely to trigger intense fear, disbelief, and the forced liquidation of weak hands.

EGRAG argues that this deeper “max pain” early on would cleanse the market of fragile speculative positions, setting the stage for a much more explosive upside move targeting $11. This outlook emphasizes conviction over comfort, consistent with the analyst’s recurring theme across previous market cycles.

In contrast, “Chart 2” illustrates a milder correction, with a potential bottom around $0.90. This route would involve less downside volatility, allowing more investors to hold through the dip and creating a more “comfortable” environment overall.

However, EGRAG cautions that the resulting upside would be capped at approximately $8.5, as the lack of aggressive shakeout limits the rally’s strength. He stresses that markets rarely reward ease, and overly crowded trades often lead to subdued gains in the long run.

Accompanied by two annotated charts highlighting key support/resistance levels, Fibonacci retracements, and wave structures, the post concludes with powerful statements: “Markets don’t reward comfort. They reward conviction under pressure” and “Choose your pain or pain will choose you.”

The message hits home as XRP currently trades in the $1.36 to $1.41 range (per real-time data from sources like CoinGecko, Yahoo Finance, and Investing.com as of February 13, 2026), following a pullback from highs above $2 in recent months.

Although the current price remains well above both projected supports ($0.60 and $0.90), XRP has exhibited signs of weakness lately, with limited rebounds and ongoing selling pressure. Independent observers note that a decisive break below $1.30–$1.35 could quickly test $0.90, while a sharper breakdown might confirm the more bearish Chart 1 scenario toward $0.60. On the flip side, sustained holding above $1.40 could delay or temporarily negate either path.

The tweet garnered hundreds of engagements within hours, with the XRP community split: some users called for even more bullish “Chart 3″ targets ($20+), while others acknowledged the psychological and structural logic despite reluctance to face further declines.

EGRAG, renowned for his rational, data-backed approach since gaining prominence years ago, avoids cheap optimism—he challenges holders to assess their risk tolerance and long-term belief in XRP.