TL;DR

- XRP has staged a strong recovery after the sharpest market drop in months, regaining over $75B in market value following a steep plunge to multi-month lows.

- Trading volume and long positioning surged as buyers stepped in aggressively after the correction.

- Technical indicators point to additional upside if key resistance areas are cleared in upcoming sessions.

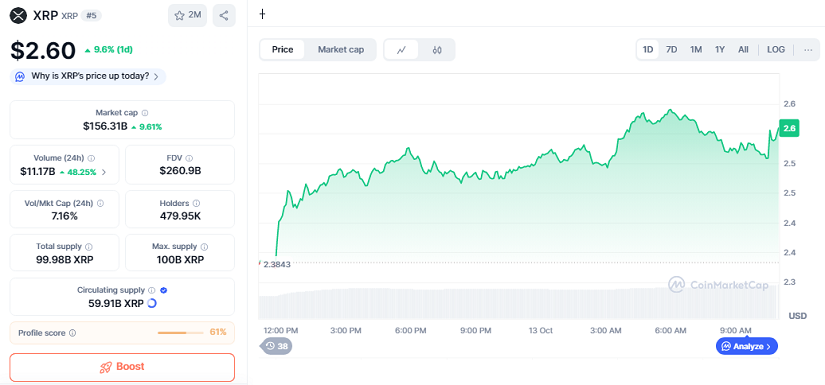

XRP fell below the $2 mark after the announcement of 100% tariffs on Chinese imports triggered broad selling pressure across major digital assets. The token dropped to $1.58 on Bitstamp, its lowest point in ten months, before sentiment reversed. It has since climbed to $2.60, reflecting a 9.60% gain in the last 24 hours. Some traders pointed out that automated liquidation cascades exaggerated the initial decline, creating unusually discounted entries across top-tier exchanges.

Market capitalization now stands at $156.31B, and 24-hour trading volume has reached $11.17B, a 48% increase that signals determined buying interest. The recovery has pushed valuations close to pre-crash levels, supported by renewed activity in the derivatives market. Open interest and leveraged positioning confirm that bullish momentum remains in play. Several desks also reported increased spot accumulation from Asian trading hours.

Technical Signals Favor Further Upside

The weekly Stoch RSI sits at 8, a zone historically linked to strong reversals in XRP. In late 2024 the token rallied over 400% after touching similar conditions, while another surge above 90% began in mid-2025. Traders are closely tracking this indicator as a potential trigger for extended upside. Some long-term holders argue that structural liquidity has improved since the previous cycle.

Chart Nerd noted that every dip into oversold territory since mid-2024 preceded significant rallies. Several analysts now consider a move toward $5 achievable if momentum continues and supply zones are surpassed. Confidence has stayed firm despite the severity of last week’s sell-off and the policy-driven market shock.

Key Resistance Zones In Focus

The $2.70 to $2.80 range is the first critical test, having acted as support in previous sessions and containing roughly 3.8B XRP accumulated at those levels. A secondary pocket lies between $2.88 and $2.95, where both the 50-day and 100-day simple moving averages intersect. Clearing either band with conviction could attract larger allocations from institutional desks.

CryptoBull argues that a weekly close above the 2025 uptrend line would keep the broader bullish structure intact. Regaining the 200-day simple moving average has also strengthened sentiment and reinforced medium-term positioning. With volume expanding and buyers active on dips, XRP retains strong potential to extend its recovery.