TL;DR

- XRP Ledger activated the XLS-81 “Permissioned DEX” amendment, enabling the creation of controlled versions of its native DEX with restricted access.

- The network also implemented XLS-85 Token Escrow, extending the escrow system beyond XRP to trustline-based tokens, Multi-Purpose Tokens, stablecoins, and RWAs.

- The infrastructure is aimed at banks and brokers that require onchain settlement with counterparty control.

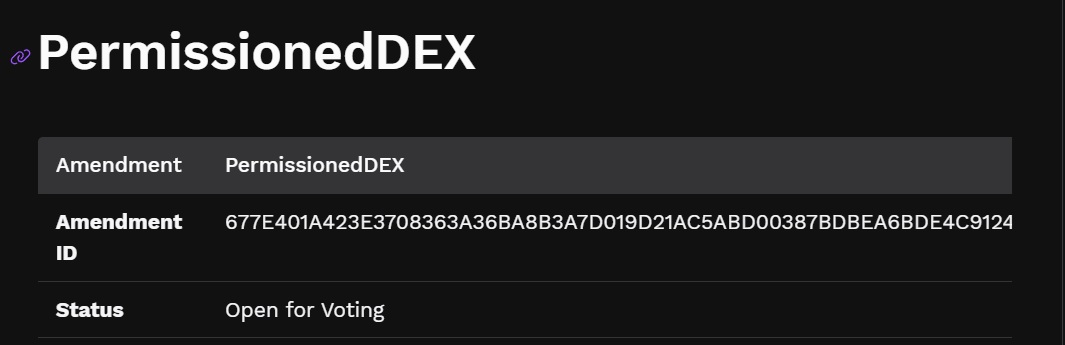

XRP Ledger activated the XLS-81 amendment, known as “Permissioned DEX,” an upgrade that allows the creation of decentralized exchanges with restricted access directly on the network. The new feature enables controlled versions of the protocol’s native DEX while keeping the trading mechanics within the ledger itself.

Unlike the existing open order book, the new model allows designated administrators to determine who can place offers and who can accept them. This creates a “members-only” marketplace tied to compliance requirements such as KYC and AML processes. Access is therefore limited to previously approved users.

The design proposed by XRP targets regulated institutions such as banks and brokers that require onchain settlement and blockchain-based liquidity, but with control over counterparty eligibility. The structure allows participants to operate within the public ledger infrastructure without opening markets to all users.

Debate Over Native XRP Staking and Design Changes

In addition, the network recently implemented XLS-85 Token Escrow. This upgrade extended the native escrow system beyond XRP, incorporating trustline-based tokens and Multi-Purpose Tokens, including stablecoins and tokenized real-world assets. With this expansion, the network enables conditional settlement agreements for a broad range of assets issued on the platform.

The combination of an expanded escrow system and a permissioned DEX creates a toolkit geared toward regulated tokenized markets. The framework covers issuance, conditional custody, and secondary trading within a controlled environment.

The Ledger was designed for payments, token issuance, and decentralized exchange functionality built into the base layer. In recent months, a RippleX engineer explored the possibility of introducing native staking, while David Schwartz took part in discussions about potential design changes.