TL;DR

- XRP’s network velocity spiked 40% in 24 hours, signaling renewed on-chain activity.

- The price is consolidating around $1.88, below key moving averages.

- A decisive break above the $2.00-$2.20 resistance zone is needed to confirm a rally.

XRP begins to see renewed interest as key on-chain metrics show bullish signals, hinting at a possible price resurgence after a prolonged market correction. The token trades in red territory despite the broader crypto market showing signs of a potential rally.

Bitcoin and Solana already show mild price increases over the last day, while XRP remains lagging. Nonetheless, a key on-chain indicator on the XRP Ledger emits a bullish signal, suggesting XRP’s rally could be near.

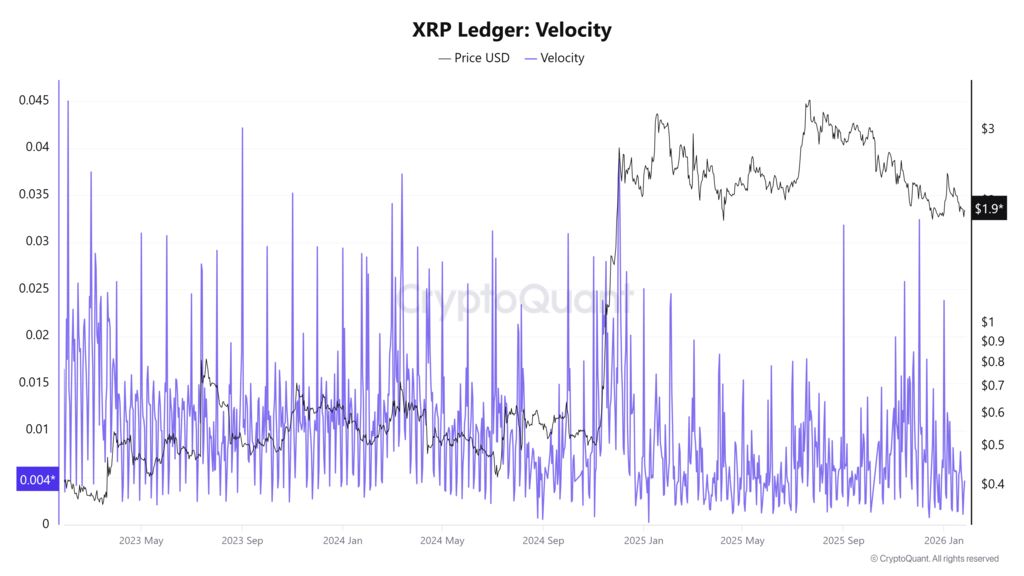

According to data from on-chain analytics platform Cryptoquant, XRP network velocity increased 40.88% in the last 24 hours, showing signs of renewed activity as momentum appears to be returning to the market.

The 40% increase in XRP’s velocity seen over the last 24 hours has restored hopes for a potential rally in XRP’s price in the near term. Despite the spike in activity, XRP’s total supply remains unchanged at 99.9857 billion tokens, indicating the increase is not driven by new token issuance but by existing coins circulating more actively.

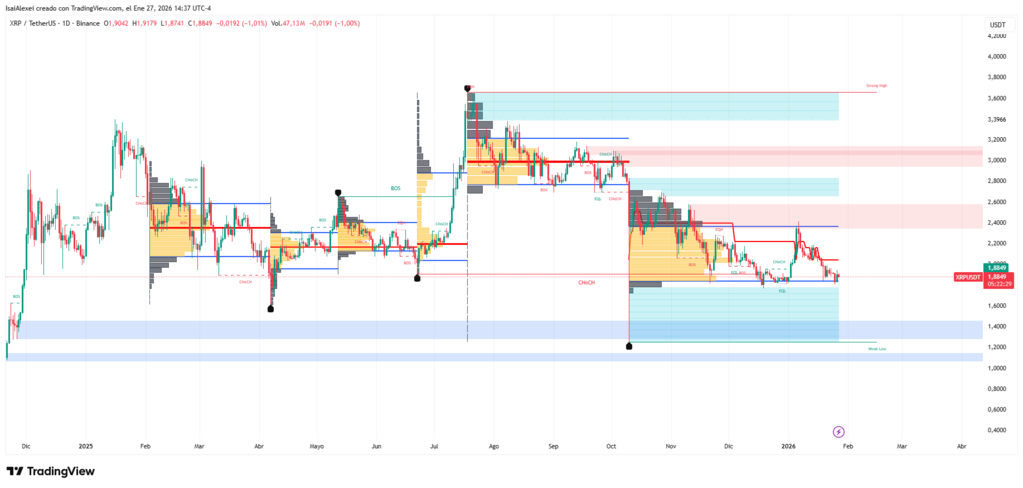

XRP currently trades around $1.88 per unit against the U.S. dollar, with an intraday drop near 1% and a daily range approximately between $1.87 and $1.92.

40% Metric Increase in XRP Generates Price Reaction Expectations

In the very short term, XRP moves in a consolidation phase after a previous bullish stretch, with the current price situated below its 50-day moving average (approximately $1.98) and clearly below the 200-day average (approximately $2.55), which reflects a still-corrective technical bias for the medium term.

The relatively narrow daily range, with a minimum at $1.874 and maximum at $1.917, suggests contained short-term volatility. The situation is typical of pause stages before a new directional impulse.

From a momentum perspective, the negative daily variation (around -1%) contrasts with a market that comes from years with much higher annual highs. The annual maximum near $3.65 leaves ample room for rebounds if buyer flow reappears.

At the support and resistance level, price maintains above annual lows near $1.53, which act as a medium-term support zone. Meanwhile, the immediate relevant ceiling sits in the $2.00-$2.20 zone, coinciding with the 50-day average and with previous congestion areas.

A clear and sustained break of the range, accompanied by a solid volume increase relative to the average, would signal that a new impulsive stretch is underway. Today’s volume hovers around 2.1 billion versus an average of approximately 3.75 billion, indicating somewhat depressed levels.

In a typical technical scenario, a 40% increase in volume or buyer interest would reinforce a possible breakout if it coincides with an attack on resistances. However, it can also remain a false start if price fails to close above key daily or weekly levels.

Looking toward the short and medium term, projection models from some houses and exchanges contemplate for 2026 average price ranges substantially higher than current levels. Estimates oscillate between approximately $2.3 and $4.3 in specific months, which indicates the market’s base scenario remains bullishly biased despite the ongoing correction.

From a purely technical standpoint, as long as XRP continues trading below its 50 and 200-day averages, any rally born from a strong metric surge should initially be considered a bounce within a still-corrective structure. Price needs to confirm consistent closes above said averages and the $2.0-$2.2 zone to validate a trend change.

Volume remains below average, which tempers immediate breakout expectations. A true rally would require volume to exceed the 3.75 billion average consistently, confirming broad market participation.

The $2.00-$2.20 resistance zone represents a good test

Price has attempted to reclaim the level multiple times in recent weeks without success. A decisive break would likely trigger stops and attract fresh buying interest.

Support at $1.53 provides a floor for bulls defending. As long as price holds above the level, the medium-term structure remains intact despite short-term weakness.

Market projections for 2026 suggest institutional analysts maintain constructive views on XRP despite current consolidation. The wide range between $2.3 and $4.3 reflects uncertainty about timing rather than direction.