TL;DR

- XRP consolidates at $1.92 after weeks of sideways trading between $1.83 and $1.92.

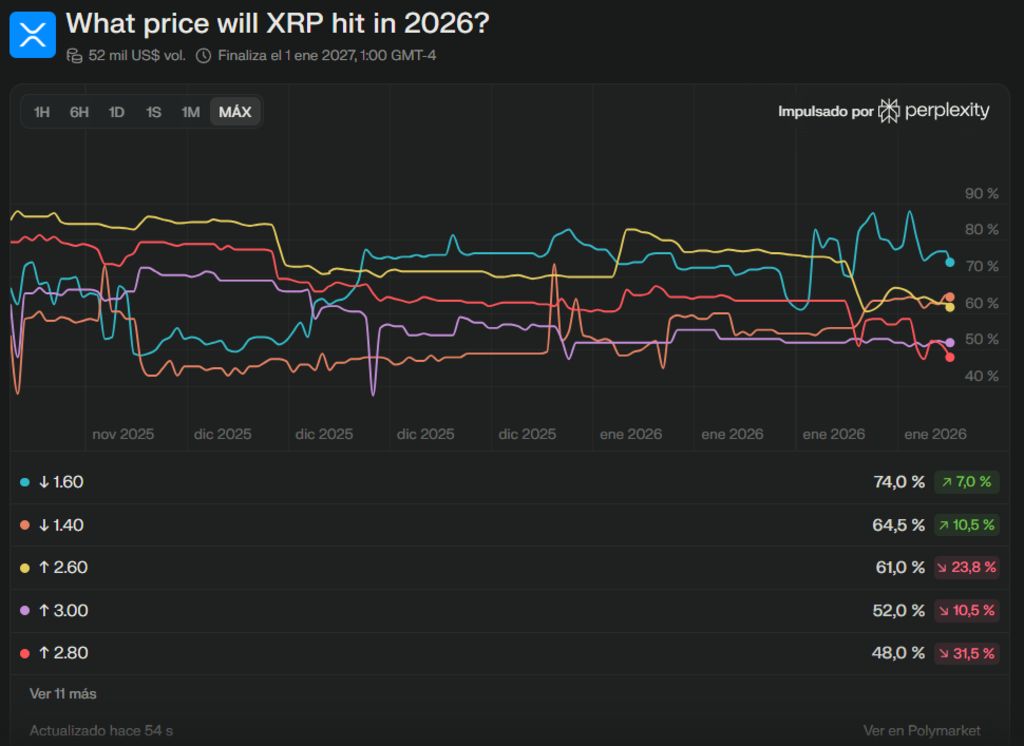

- Prediction markets assign a 50-61% probability to XRP reaching the $2.60-$3.00 price bracket.

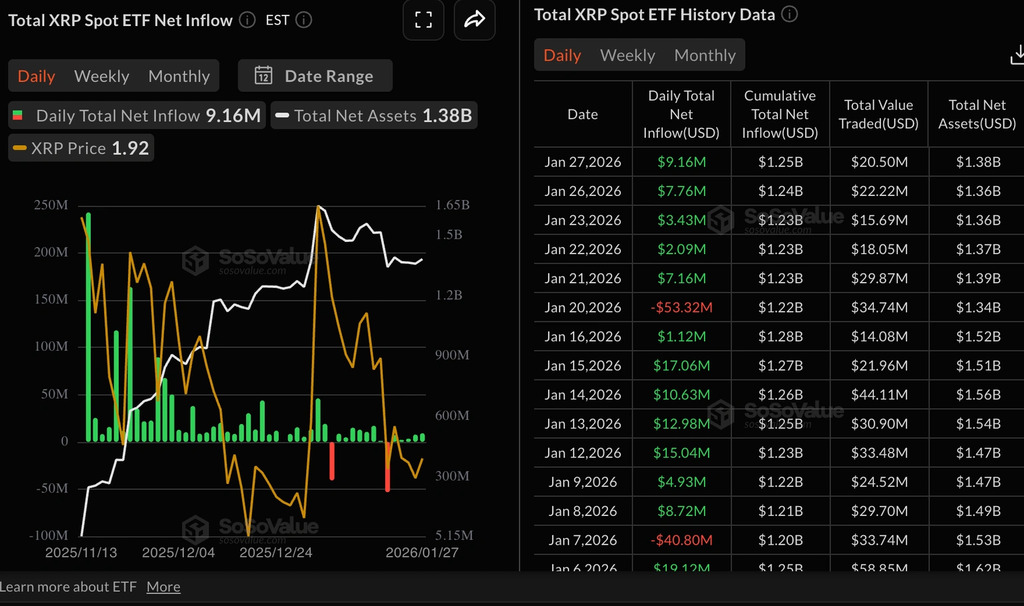

- XRP spot ETFs see net inflows, contrasting with outflows from broader Bitcoin and Ethereum funds.

The crypto market tracks XRP’s current position after registered $1.916 on January 28, 2026. The price climbed 0.61% from the prior session, following several weeks of sideways action between $1.83 and $1.92.

Traders identify $1.90 as the immediate technical floor, an area the asset tested repeatedly since late 2025. The current range marks a consolidation phase after XRP pulled back from peaks near $2.00 recorded in early January.

Technical charts display symmetrical triangle formations on daily timeframes, with the RSI positioned at 45 points. The RSI reading suggests selling pressure has weakened, though caution persists among market participants. A breakdown below $1.88 would activate bearish targets toward $1.80, the monthly low seen days ago.

On-chain data reveals large holders absorbed recent selling activity, which raises the chances of recovery toward $2.00. Still, the MACD remains in negative territory, a signal that maintains uncertainty ahead of Federal Reserve decisions on interest rates.

A daily close above $1.92 with rising volume could shift near-term sentiment. Technical analysts map resistance levels at $2.15 and $2.28, zones aligned with exponential moving averages and previous rejection areas.

XRP Prediction Markets Price in Multiple Scenarios

Prediction markets show concentration in already-resolved ranges between $1.80 and $2.40, all marked at 100% probability with trading volume of $51,800. The battle now centers on the $2.60 to $3.00 bracket, where contracts assign between 50% and 61% probability of fulfillment.

Standard Chartered modeled scenarios where XRP reaches $8 by year-end, contingent on massive flows into crypto ETFs and accelerated institutional adoption. The consensus among analysis firms places a more conservative range between $2.40 and $5.00, with base expectations around $3.80 to $4.20.

21Shares proposes targets of $2.45 to $2.69 under a scenario of steady growth without explosive jumps. The conservative case establishes $3.00 as the objective, assuming modest ETF success and limited gains in cross-border payment adoption.

The base scenario of $3.90 to $5.12 contemplates consistent inflows to exchange-traded funds and moderate expansion in international payment usage. The bullish case requires $10 billion in institutional flows, clear regulatory backing and greater legal clarity in the United States.

Jeff Anderson, Head of Asia at STS Digital, uses options-based analysis to calculate market-implied probabilities. Current volatility data assigns a 25% chance for XRP to close above $2.40 on December 31, 2026, while only 10% of contracts project prices exceeding $3.90.

XRP Holds $1.92 as Spot ETFs Record $9 Million in Net Inflows

Ripple’s token trades at $1.92 on Wednesday, January 28, consolidating above support at $1.90. Buyers showed relative strength since Monday, driving XRP upward from the weekly open at $1.84.

Investors assess the balance between institutional optimism and macroeconomic pressures, particularly ahead of market consensus that the Federal Reserve will keep interest rates unchanged in Wednesday’s monetary policy decision.

Interest in XRP exchange-traded funds remained stable since launch, despite price volatility. ETFs authorized to operate in the United States recorded approximately $9 million in inflows on Tuesday, raising cumulative net inflows to $1.25 billion, with assets under management near $1.38 billion.

Consistent institutional demand for XRP spot ETFs contrasts with broader crypto market weakness. Bitcoin and Ethereum funds faced outflows of approximately $147 million and $64 million respectively during the same period.

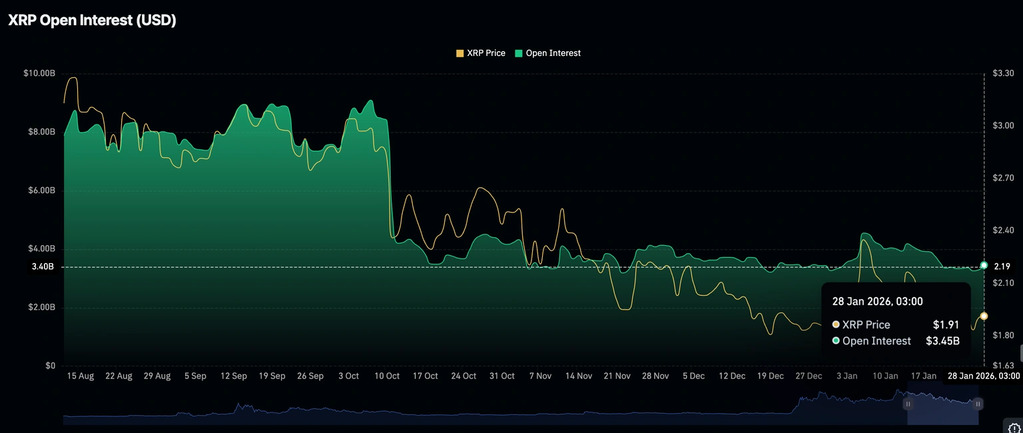

The derivatives market backs investor optimism for a potential bullish breakout

Open interest in XRP futures increased to $3.45 billion on Wednesday from $3.29 billion the previous day. The rise in OI reflects renewed confidence among retail investors about XRP’s near-term prospects.

Open interest tracks the notional value of outstanding futures contracts. For XRP to sustain its uptrend, traders need to continue opening new positions. A decline in OI while price rises would indicate long position closures and underlying weakness.

Data shows institutional investors maintain their XRP bet even as other digital assets experience capital outflows. The difference between flows into XRP ETFs and Bitcoin suggests selective appetite in the current market.

Stability above $1.90 establishes a technical foundation for recovery attempts. Bulls seek to defend the zone between $1.88 and $1.92, an area that functioned as resistance in prior weeks and now acts as a support floor.

Trading volume in futures rose alongside open interest, a signal analysts interpret as genuine market participation. When OI and volume climb simultaneously, it indicates fresh capital entry rather than simple rotation between existing positions.

XRP ETFs accumulated $1.25 billion in net inflows since debut, a figure representing sustained institutional adoption. Total assets under management of $1.38 billion position XRP funds as competitive products within the regulated cryptocurrency space.