Crypto markets have been volatile, with investors reducing exposure to higher-risk assets. BTC has traded below $90,000, ETH has fallen from earlier levels, and XRP has moved below $2.

Alongside the broader pullback, some projects are continuing early-stage fundraising efforts aimed at 2026. A number of these projects focus on payments and consumer finance use cases, such as transfers and card-linked spending, although outcomes and adoption remain uncertain.

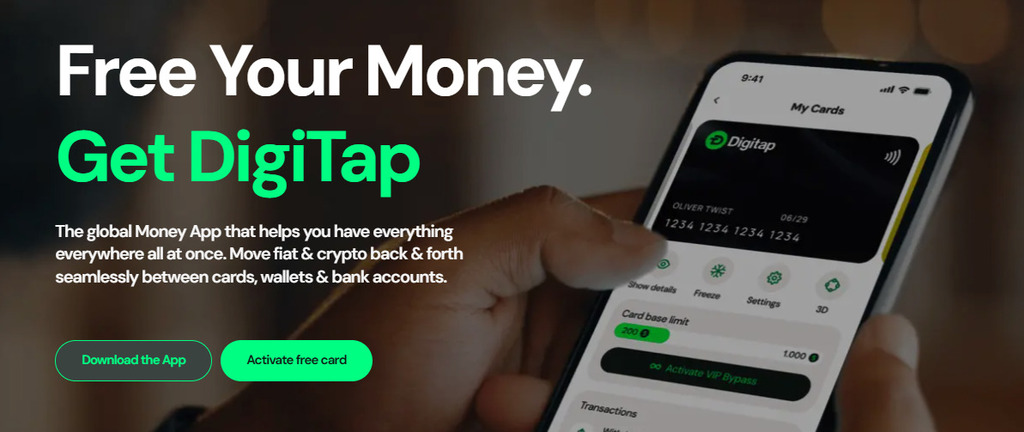

Digitap ($TAP) is one such project. The team says it has raised more than $2.4 million and is building an omni-banking app that combines payments functionality with a token model tied to platform activity. The project’s materials also describe mechanisms intended to support long-term token holding, but these features depend on execution and user uptake.

XRP at $1.90: Great Thesis, Ongoing Adoption Questions

XRP has traded lower since July, with limited periods of relief. While it was one of the earlier crypto assets to focus on payments—particularly cross-border payments—competition has increased, including from stablecoins used for settlement.

The goal of faster and cheaper settlement targets a real-world issue, but adoption and on-ledger activity remain debated topics. In a market-wide drawdown, XRP has also shown sensitivity to broader risk sentiment.

During prolonged downturns, market participants often focus more on supply dynamics, utility, and sustainable demand than on momentum alone. Some commentators argue that XRP’s valuation depends heavily on future adoption, which is uncertain.

Digitap’s Token Sale: Positioning Around Payments Utility

Digitap describes itself as a global money app that aims to make stablecoin transfers accessible through a neobank-style interface. The project positions its offering around payments and consumer-facing features, though these claims should be evaluated independently.

According to Digitap’s documentation, the project allocates a portion of profits toward token burns and staking rewards, including a stated figure of 50%. These mechanisms are project-reported, and their impact depends on revenue generation, participation, and governance or implementation details.

The project says the app allows users to hold fiat and crypto and move between them within the same interface. It also states that it offers different account tiers, including a lower-friction wallet option and a more fully verified path for additional services. As with any financial product, users may wish to review terms, fees, eligibility requirements, and compliance limitations in their jurisdiction.

Seasonal Promotion Mentioned by Digitap

Digitap has advertised a seasonal promotion tied to its token sale, including time-limited marketing incentives such as bonuses and account-related upgrades. The availability, terms, and eligibility for such promotions can change and should be checked in the project’s own materials.

$TAP vs. XRP: Different Approaches, Different Risk Profiles

XRP is widely associated with cross-border payments narratives, while Digitap’s team says it is building a consumer-focused payments product that uses both stablecoin rails and traditional banking infrastructure. The two assets differ substantially in maturity, liquidity, and market structure, making direct comparisons inherently limited.

Digitap’s materials frame $TAP as a token connected to platform usage and supply mechanics. Whether that translates into durable demand depends on product-market fit, regulatory considerations, competitive pressures, and execution.

Stablecoins have seen increased adoption in payments and on-chain settlement in recent years, but it is unclear how individual applications will capture value from that trend.

Project links (for reference):

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

This article contains information about a token sale. This outlet is not affiliated with the project mentioned. This article is for informational purposes only and does not constitute financial or investment advice.