TL;DR

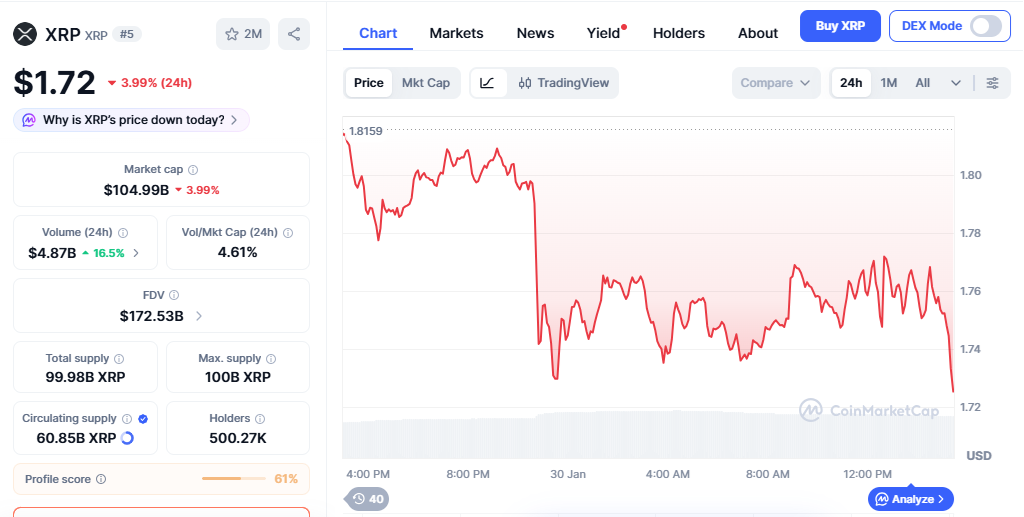

- XRP trades at $1.72, posting a 3.99% decline over the past 24 hours amid rising selling pressure.

- XRP-linked ETFs record their largest single-day outflow, close to $93 million, signaling short-term institutional caution.

- Despite the drop, XRP maintains strong positioning as a payment-focused digital asset, supported by ongoing real-world adoption and long-term relevance.

Ripple’s XRP extends its decline on Friday as heavy ETF outflows add pressure to an already cautious crypto market. The move reflects a broader risk-off environment rather than structural weakness in the asset, with traders reassessing exposure after recent volatility.

XRP is currently priced at $1.72, down 3.99% in the last 24 hours. The decline follows a sharp reversal in fund flows tied to XRP investment products, marking the most significant capital exit since these ETFs began trading.

XRP ETF Outflows Signal Tactical Repositioning

XRP-focused ETFs register nearly $93 million in net outflows in a single session, a record daily figure. Such movements typically point to short-term portfolio adjustments by institutional investors rather than a breakdown in the asset’s fundamentals. Similar dynamics have appeared across other crypto-linked products during phases of macroeconomic uncertainty.

From a pro-crypto perspective, these outflows underscore how digital assets are increasingly integrated into active risk management strategies. XRP remains embedded in cross-border payment solutions, and its underlying utility continues to set it apart from purely speculative tokens.

Derivatives markets also feel the impact. Liquidations on leveraged XRP positions reach approximately $57 million, the highest level in around three months. This wave of forced closures intensifies downside moves as overleveraged positions unwind, a common feature of corrective market phases.

XRP Price Dynamics And Market Behavior

Open interest in XRP futures declines alongside price, indicating that traders are reducing exposure rather than aggressively building short positions. This contraction often helps stabilize market structure by clearing excess leverage and allowing price action to better align with spot demand.

Technically, XRP hovers near the $1.70 support zone after testing lower levels earlier in the session. Momentum indicators remain weak but approach areas where selling pressure has eased in previous cycles. Historically, such conditions tend to favor consolidation over extended declines.

Beyond short-term price movements, XRP continues to benefit from gradual regulatory clarity across several jurisdictions. Financial institutions and payment providers keep exploring blockchain-based settlement tools, reinforcing XRP’s role in real-world financial infrastructure.