TL;DR

- Trump-backed World Liberty Financial is under investigation for alleged “token sales” and preferential deals with investors.

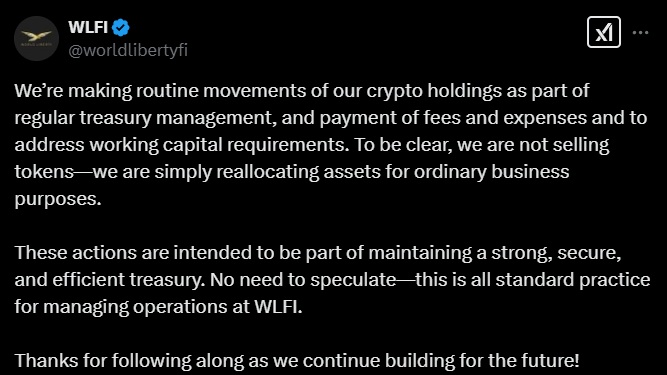

- The protocol denied the allegations, clarifying that its token movements are part of routine treasury management, not active sales.

- World Liberty Financial’s treasury exceeds $364 million in cryptocurrencies but is facing difficulties due to the fall in Ethereum.

World Liberty Financial, the crypto project backed by Donald Trump, has come under scrutiny due to reports suggesting the protocol may be offering “token sales” and preferential deals with investors.

It is alleged that the organization has been seeking swaps agreements, offering cryptocurrency teams the possibility to swap their tokens for other assets, which has raised concerns in the market.

In response to these accusations, World Liberty Financial denied the claims, clarifying that its token movements are part of the routine management of its treasury. The organization explained that, while it reallocates assets, these actions do not constitute active token sales but rather a strategy to manage its resources and meet operational needs.

However, the report noted that, during the market downturn, World Liberty Financial allegedly offered to swap at least $10 million in unlaunched WLFI tokens for native tokens from other blockchains, and was also charging a 10% fee for the transaction.

Trouble for World Liberty Financial

In addition to these controversies, concerns have also arisen about the nature of WLFI’s relationships with certain investors and projects. It has been reported that the protocol is offering special conditions to those who invest large sums, promising “preferential treatment” for those investing over $15 million. This approach has led to comparisons with “quid pro quo” practices, which have been criticized in the past, especially in relation to the Trump administration.

World Liberty Financial holds a treasury exceeding $364 million in cryptocurrencies, with the majority in Ethereum (ETH), Wrapped Bitcoin (WBTC), and USDC. Despite the investments, the protocol is struggling, particularly due to the drop in the value of Ethereum, its largest investment. Additionally, the relationship with Justin Sun, the project’s largest investor, has raised concerns about potential conflicts of interest.

The future of World Liberty Financial appears uncertain, as the protocol must deal with the controversy while moving towards its planned launch in the third quarter of 2025