TL;DR

- World Liberty Financial has purchased 3,473 ETH for roughly $13 million, staking the entire amount on Aave to generate DeFi returns.

- This brings the company’s total Ethereum holdings to an impressive 73,616 ETH, worth over $265 million at current prices.

- A new WLFI coin is set to launch within two months, aiming to strengthen the firm’s foothold in the expanding decentralised finance ecosystem.

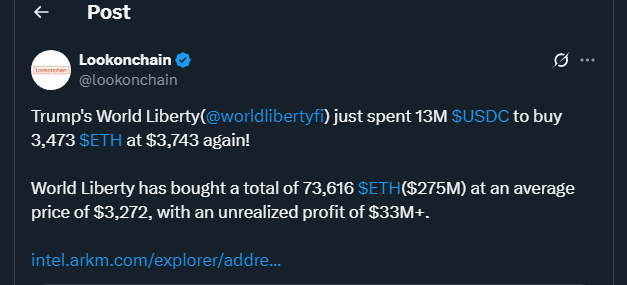

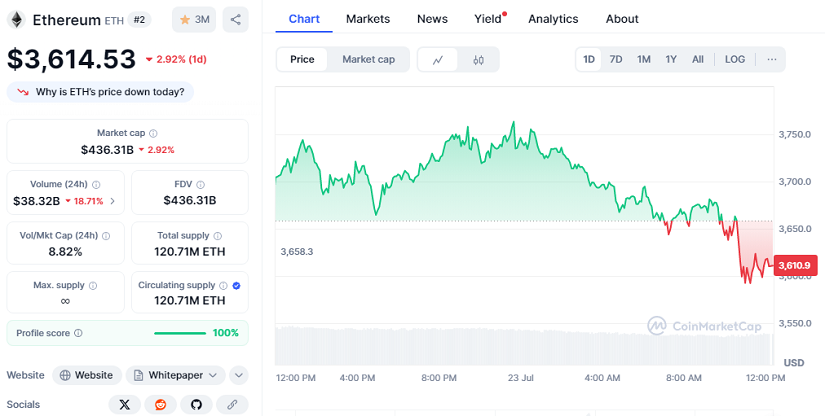

World Liberty Financial has strengthened its crypto playbook by acquiring 3,473 ETH at an average of $3,743 per coin, totalling nearly $13 million. This large acquisition was swiftly staked on Aave, one of the most trusted DeFi platforms, signalling a deliberate strategy to maximise returns through decentralised yield opportunities instead of merely holding assets. This move lifts the firm’s total Ethereum reserves to about 73,616 ETH, valued at approximately $265.9 million at the current ETH price of $3,614.53.

Institutional Moves Drive Ethereum Momentum

Institutional interest in Ethereum has been on the rise as more corporate treasuries look for exposure to digital assets with reliable staking frameworks. World Liberty Financial’s aggressive approach places it alongside other big players like Sharplink Gaming, which recently added $250 million worth of ETH to its balance sheet. This trend aligns with a shift in institutional capital away from Bitcoin. Just on July 22, spot Ethereum ETFs recorded $533.9 million in net inflows while Bitcoin ETFs saw $67.9 million in net outflows, highlighting how confidence is leaning towards Ethereum’s smart contract capabilities and staking yield potential.

Despite Ethereum’s current price hovering at $3,614.53 with a slight 2.92% dip over the last 24 hours, the broader outlook remains bullish. The market capitalisation for Ethereum now stands at around $436.31 billion, reinforcing its strong standing as the top smart contract platform. Notably, large-scale purchases like World Liberty Financial’s often influence price trends by tightening supply on exchanges and feeding into staking pools that reduce available circulating supply.

WLFI Coin Launch Expected Soon

Adding to its staking strategy, World Liberty Financial plans to roll out its own WLFI token within six to eight weeks. The team behind the project has hinted that the token will play a central role in expanding its DeFi operations and unlocking new income streams for partners and investors. With Ethereum climbing over 62% in the last month and major institutions ramping up exposure, World Liberty Financial’s combined approach of staking and token development could position it for even greater influence in the DeFi sector.