Ethereum is currently testing key psychological levels near $2,000. As market volatility intensifies, many investors are re-evaluating their portfolios in search of stability. ETH has experienced significant price pressure, declining over 30% since mid-January, leading even long-term supporters to adopt a more cautious stance.

The recent shift toward a “risk-off” environment has been influenced by macroeconomic shifts, including high-profile appointments at the Federal Reserve. With a focus on tighter monetary policy and restricted balance sheet expansion—factors that traditionally serve as catalysts for major digital assets—liquidity has become more selective.

In contrast to the pressure on large-cap assets, Digitap ($TAP), a fintech-focused crypto presale, has reported over $5 million in contributions. The project’s ability to attract interest during a market correction is largely attributed to its functional application and growing user base. As the 2026 market begins to favor projects with clear utility, Digitap is being monitored as a notable contender in the emerging “crypto-fintech” sector.

Ethereum (ETH): Will it Revisit Previous Lows?

Ethereum has evolved into a macro asset, meaning its valuation is increasingly sensitive to global liquidity trends. When investors move toward safer havens, ETH often faces immediate selling pressure. This momentum is reflected in the current charts, where ETH has recently touched the $2,100 range, leading to discussions about whether it will retest its April lows.

Technical analysis suggests that staying below the 200-week moving average could signal a sustained bearish trend rather than a temporary pullback. Furthermore, the network faces ongoing debates regarding its long-term scaling roadmap and the role of Layer 2 solutions. While Ethereum remains a fundamentally strong network, the asset faces a challenging macro environment, prompting some investors to look toward smaller projects with active product development.

Digitap ($TAP): Introducing the “Omni-Bank” Concept

Digitap is a financial product designed to leverage blockchain technology to provide enhanced banking services to the 1.4 billion underbanked individuals globally. Unlike the speculative rallies of 2021, the 2026 market landscape prioritizes utility and tangible value—qualities that are particularly sought after during market downturns.

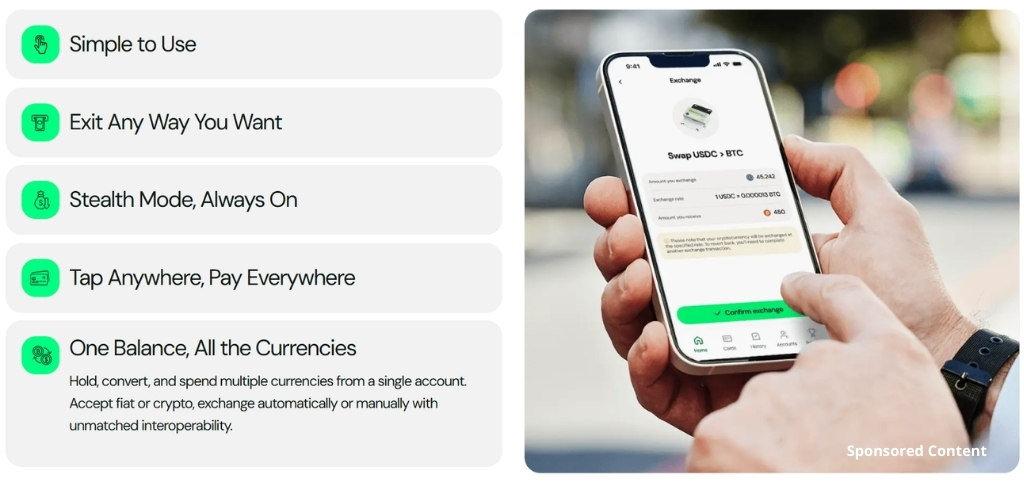

The rollout of Digitap’s “omni-banking” app has gained traction by integrating crypto and fiat services into a single, global interface. This “omni-bank” approach is designed for the modern digital economy, catering to remote workers, international remitters, and users seeking decentralized financial alternatives.

The ecosystem includes a suite of practical tools, such as a Visa card that allows users to utilize digital asset balances for everyday purchases. By combining traditional banking rails with blockchain speed, Digitap serves as a bridge for non-crypto natives to adopt stablecoins and other digital assets within a familiar banking framework.

Why Market Participants are Monitoring $TAP During the Correction

Challenging market conditions often force a flight to quality. Digitap’s recent integration with Solana—providing high-speed settlement—signals the team’s commitment to continuous development.

The project’s success in raising $5 million is also linked to its structured tokenomics. Currently available at $0.0467 during the presale, with a planned listing price of $0.14, the project offers significant growth potential for early participants.

The $TAP token features a deflationary model: 50% of platform profits are allocated toward staking rewards and token burns. This mechanism is designed to align the token’s circulating supply with the platform’s scaling efforts. Additionally, the presale offers a 124% APY for those participating in the staking pool, providing a potential source of rewards while the broader market undergoes consolidation.

Conclusion: Is $TAP a Leading Presale Opportunity for 2026?

While a move for ETH below $2,000 remains a possibility, the rotation toward emerging presales and specialized fintech projects appears to be accelerating.

Digitap’s progress stands out because it operates like an early-stage fintech disruptor with a live product and a clear value-capture model. By entering at the presale stage, participants have the opportunity to engage with the project before it reaches a larger market capitalization.

With the current price of $0.0467 set to increase to $0.0478 shortly, those interested in the project’s roadmap are moving quickly. As the saying goes, “bear markets are for builders,” and Digitap is positioning itself as a project capable of maintaining momentum regardless of major market trends.

Learn more about Digitap and their live projects here:

-

Presale: https://presale.digitap.app

-

Website: https://digitap.app

-

Social: https://linktr.ee/digitap.app

-

Giveaway Campaign: https://gleam.io/bfpzx/digitap-250000-giveaway

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.