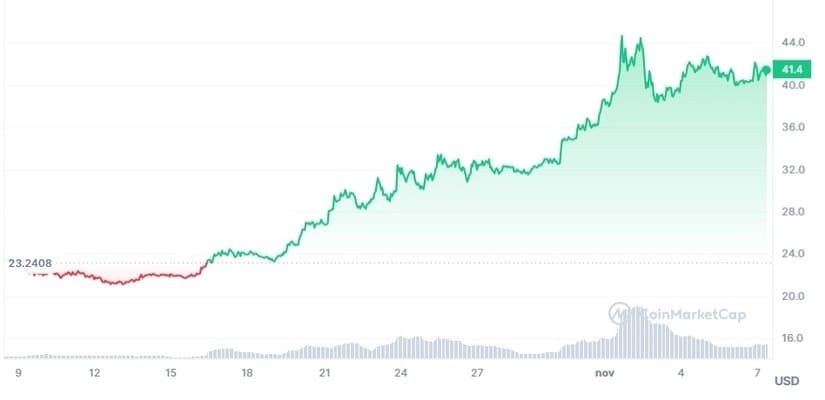

The market has witnessed an impressive rally in the price of Solana (SOL) over the past 30 days, which has garnered the interest of investors and analysts. Since October 18, the price of SOL has increased by more than 70%, capturing the attention of the community and market enthusiasts.

In this context, the cryptocurrency analysis company Kaiko conducted a study to trace the origins of this extended bullish period and analyze the factors contributing to it and sustaining it to this day.

One of the most prominent findings in Kaiko’s report is the influence of United States investors, particularly users of the Coinbase exchange.

According to the analysis, users of Coinbase acquired a net total of 2.2 million SOL tokens, indicating strong interest from American investors in this cryptocurrency.

Another relevant aspect of the study is the relationship between the price of SOL and Ethereum (ETH).

The report points out that the relative increase in SOL compared to ETH has led to a change in the relationship between these two cryptocurrencies.

In October, the ratio was 0.011, but it now stands at around 0.025, suggesting that SOL has gained strength against ETH in the market.

In this week’s Data Debrief we explore:

📌 Solana's rally, one-year post-FTX collapse

📊The persistence of the Alameda Gap

📏A mysterious Zcash premium on YobitAnd much more…🔽

Check it out below: https://t.co/l4OEdd1aSG pic.twitter.com/HsolgxKwMu

— Kaiko (@KaikoData) November 6, 2023

Binance, one of the major exchanges, also played a significant role in the increase in SOL’s price.

The report highlights that Binance closely followed Coinbase in acquiring SOL, and in November, it experienced a substantial increase in buying volume, reaching a cumulative volume of 1.9 million since October 18.

South Koreans Selling Off Solana

However, the South Korean market, represented by the Upbit exchange, exhibited a different behavior.

While the U.S. and Binance markets were acquiring SOL, Upbit saw a net sale of approximately 4 million SOL tokens.

This behavior highlights the variability of markets and different trends in various regions.

In terms of transaction volume, SOL stood out as one of the most traded cryptocurrencies on existing exchanges in the United States during this period.

It surpassed other popular altcoins like Litecoin (LTC), Polygon (MATIC), and Ripple (XRP), demonstrating a significant increase in trading activity around SOL.

Furthermore, the report mentions that SOL was under selling pressure due to assets valued at over $1 billion under the new management of the FTX cryptocurrency exchange, which had previously experienced financial difficulties.

At the time of writing this note, according to Coinmarketcap data, Solana is trading at approximately $41.39, showing a 2.6% increase in the last day. On November 1st, it reached its peak at $45.02.

Its market capitalization is $17.42 billion, with a growth rate of around 3%, and its 24-hour trading volume is $1.1 billion, representing a notable increase of nearly 22% compared to the previous day.