As markets move sideways in January, many crypto participants are exploring different ways to generate yield from digital assets. Yield mechanisms in crypto allow users to earn returns on existing holdings rather than relying solely on price appreciation.

Two frequently discussed approaches are Ethereum staking and early-stage staking models tied to new crypto platforms, such as the Digitap ($TAP) presale. Both operate under very different structures and risk profiles, making comparison useful for understanding how yield is generated across the ecosystem.

In recent years, yield in decentralized finance has shifted away from inflation-heavy reward models toward structures linked to usage, fees, or platform activity. This shift has led market observers to focus more closely on how sustainable yield mechanisms are designed and maintained.

Ethereum Staking: Established and Predictable

Ethereum staking remains one of the most established on-chain yield mechanisms. Validators stake ETH to help secure the network and receive staking rewards in return. Users can participate directly by running a validator, delegating ETH, or using liquid staking solutions, which simplify access.

Following network upgrades aimed at improving scalability and efficiency, Ethereum staking continues to function as a core yield reference point within the broader DeFi landscape. Participation has increased steadily, with approximately 36 million ETH currently staked, representing a significant portion of circulating supply.

As participation has grown, average staking yields have declined over time. Current rates are generally lower than in earlier phases, reflecting Ethereum’s maturity and broad adoption. While returns are modest compared to newer models, Ethereum staking is often viewed as relatively stable within the crypto market, though it remains subject to market and protocol risks.

Digitap Presale Staking: An Early-Stage Yield Model

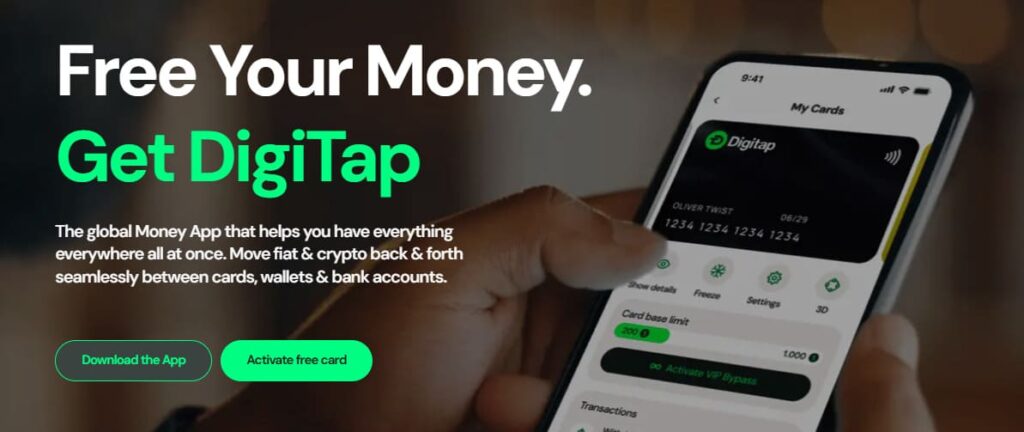

Digitap is an early-stage crypto banking platform that is currently running a public token presale for its native asset, $TAP. The platform positions itself as an omni-banking application that integrates both fiat and crypto functionality within a single interface, available on iOS and Android.

As part of the presale structure, Digitap offers a dedicated staking pool for early participants. The platform outlines that staking rewards are sourced from a predefined pool rather than ongoing token emissions. According to project documentation, the $TAP token is designed to be linked to platform activity, with a portion of operational revenue allocated toward token-related mechanisms, including staking incentives and supply reduction.

Unlike established staking systems, presale-based yield models operate before a token enters open markets. As a result, yields, token utility, and long-term sustainability depend on future platform usage, adoption, and execution. These factors typically introduce higher uncertainty compared to mature networks.

What Is Digitap Building?

Digitap has already launched a global financial application that allows users to manage crypto and fiat balances within a unified account. The product features a neobank-style user experience combined with blockchain-based settlement under the hood.

Key features outlined by the project include a Visa card linked to on-chain balances, multi-rail payment options across traditional banking systems and blockchains, and a focus on simplifying digital asset usage for everyday transactions. The platform’s design emphasizes abstraction of blockchain complexity while maintaining access to crypto-native functionality.

According to the project’s token model, a portion of platform revenue is intended to support token-related mechanisms, including incentives for participants who stake $TAP. The effectiveness of this model depends on sustained platform activity and user adoption.

ETH vs. $TAP: Comparing Yield Structures

Ethereum staking represents a mature, widely adopted yield mechanism with relatively predictable behavior over time. Its yields reflect network participation and long-term protocol economics rather than platform-specific revenue models.

Digitap’s presale staking, by contrast, reflects an early-stage approach where yield is tied to projected platform activity and predefined incentive pools. While this structure may appear attractive to some participants, it also carries higher execution and adoption risk, which is typical for projects at this stage of development.

Evaluating yield opportunities involves weighing stability, transparency, and long-term viability rather than focusing solely on headline figures. Different models may appeal to different risk profiles and investment strategies.

Final Thoughts

Yield opportunities in crypto vary significantly depending on maturity, design, and underlying economic models. Ethereum staking continues to serve as a benchmark for on-chain yield, while newer projects like Digitap illustrate how early-stage platforms experiment with alternative incentive structures.

As always, early-stage crypto projects involve elevated risk, and outcomes depend on market conditions, execution, and user adoption. Understanding how yield is generated, rather than focusing solely on projected returns, remains essential when assessing any crypto-related opportunity.

Learn More About Digitap

Presale: https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.