Yield farming is the hottest topic besides decentralized finance (DeFi) itself. It is a way to make earn crypto with crypto simply. It involves lending your crypto holdings to others through the magic of computer programs called smart contracts. In return, they receive earn fees in form of crypto for their services.

The process looks simple in basic definition but in DeFi, this is not the case. Yield farming also referred to as liquidity mining, is a new way to earn rewards with cryptocurrency holdings using permissionless liquidity protocols. It looks like staking where crypto holders stake their assets with a validator of proof of stake (POS) blockchain to earn block rewards each time a new block is added to the chain of blocks.

To earn yield farm, users called liquidity providers to lend their funds to a smart contract called liquidity pool. In return, they earn rewards that may come from fees generated by the underlying DeFi platform. Some DeFi protocols pay rewards in multiple tokens that can be deposited to other liquidity pools to earn more rewards, and so on.

Most DeFi protocols allow yield farmers to earn passive income based on the amount of liquidity they provide to their liquidity pools. But there exists a DeFi protocol on Ethereum by Alpha Finance Lab that allows liquidity providers (LPs) to leverage their yield farming position just like the stock market or forex broker does. The protocol is called Alpha Homora. Let’s take a brief look at this protocol.

What is Alpha Homora?

Alpha Homora is the first leveraged yield farming and leveraged liquidity providing product in DeFi and the second product by Alpha Finance Lab, the firm focused on research and innovation in DeFi. The company launched v1 of Alpha Homora in October of 2020.

The protocol was initially launched on Ethereum and now is also available on Binance Smart Chain (BSC). In simple terms, Alpha Homora is a leveraged yield aggregator designed to make leveraged yield farming simple and unlock various yield farming enhancements.

According to its documentation, Alpha Homora is currently generating the highest lending APY on ETH in the market. Yield farmers can get even higher farming APY and trading fees APY from taking on leveraged yield farming positions. By taking leverage, Alpha Homora would borrow ETH on users’ behalf to yield farm.

Similarly, liquidity providers can also get even higher trading fees APY from taking on leveraged liquidity-providing positions. Furthermore, ETH lenders can also earn high interest on ETH. The lending interest rate comes from leveraged yield farmers/liquidity providers borrowing these ETH to yield farm/provide liquidity.

This means that three types of users can earn passive income on Alpha Homora: ETH lenders, yield farmers, and liquidity providers.

What is Inside Alpha Homora?

The web interface of Alpha Homora shows that there are three main sections on Alpha Homora. Let’s take a look at these sections.

Farm Section

The farm section consists of two parts: farm pools and status. In farm pools, yield farmers and liquidity providers (LPs) select a pool they want to yield farm with leverage or provide liquidity with leverage.

In status, liquidators and bounty hunters can earn the rewards. Details about how they earn are coming below.

Earn Section

This section consists of three parts: Earn on ETH, Earn on Aave + ibETH, and Earn on Compound + ibETH.

On “Earn on ETH” ETH holders can lend their ETH and earn a very high lending interest rate. “Earn on Aave + ibETH” is integration between Aave and Alpha Homora where users can lend their assets on Aave. These assets are used as collateral to borrow ETH from Aave. These borrowed ETH then can be lent on Alpha Homora.

“Earn on Compound + ibETH” is similar to “Earn on Aave+ibETH” with integration between Compound and Alpha Homora. Users lend their assets on Compound, have those assets be used as collateral, borrow ETH from Compound, and lend ETH borrowed on Alpha Homora.

Alpha Section

This section contains Alpha Pools and Swap functionality. Alpha Pools are separate from the core functionality of Alpha Homora product offering. Users who lend ETH on Alpha Homora, receive ibETH tokens. Lenders can use ibETH tokens to provide liquidity to the ibETH/ALPHA pool. Similarly, ALPHA token holders can earn from becoming a liquidity provider to this pool.

There are two Alpha pools with the same “Uniswap ibETH/ALPHA” name but one accepts ETH and Alpha, and the other accepts ibETH and Alpha. This means that ETH holders who want to benefit from providing liquidity can do so by supplying to the “ibETH/ALPHA “pool accepting ETH and ALPHA.

In Swap, users can swap between ETH to ALPHA and vice versa.

How Does It work?

From the above discussion, we can see that Alpha Homora can generate the highest lending interest rate on ETH by innovating on the borrowing side. The simple working of Alpha Homora can be described as:

- ETH lenders lend their ETH holdings.

- Yield farmers and liquidity providers borrow these lent ETH to create leveraged positions on yield farming and liquidity providing.

But apart from these three types of users, there also exist liquidators and bounty hunters.

ETH Lenders

Through Alpha Homora, it’s possible to earn interest on your ether holdings through an interest-bearing position. ETH lenders deposit their ETH holdings to an Alpha Bank and receive a proportional amount of ibETH token, a tradable and interest-bearing asset that represents their shares of ETH in the bank pool.

Interest paid by ETH borrowers is paid to ETH lenders, proportionally to their share of the pool. The interest rate is determined by the utilization rate of the Bank. The higher it is, the higher the interest rate will be. 10% of the borrower’s interest goes into Bank Reserves, which can be used as an insurance fund for lenders in case of unexpected scenarios.

Yield Farmers

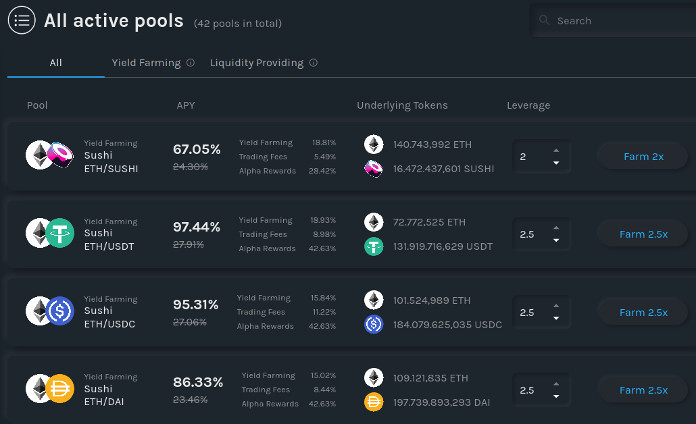

On Alpha Homora, users can borrow ETH from Alpha Bank with up to 2.5x leverage to yield farm on supported leveraged yield farming pool to earn higher trading fees APY and farming APY.

In this protocol, yield farmers can farm by just supplying one token to a farming pool. Alpha Homora will automatically and optimally swap the tokens to make sure that users have equal value of tokens in a farming pool.

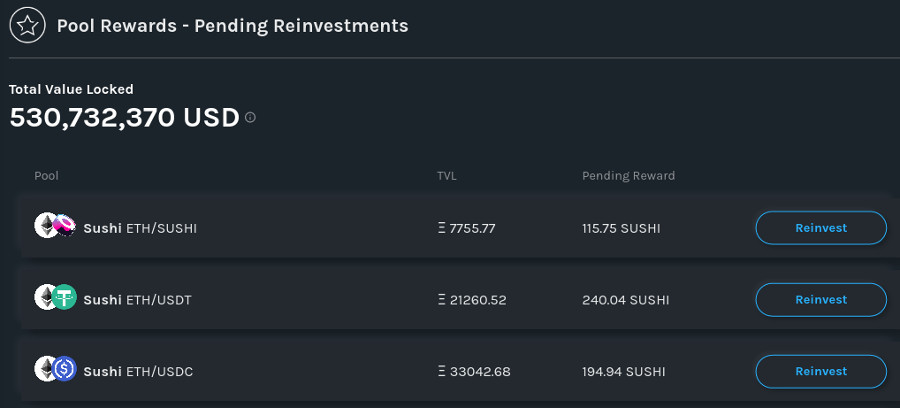

Alpha Homora will automatically stake LP tokens to get farmed tokens for users. These farmed tokens will automatically be added to users’ positions every 24 hours or will be automatically reinvested when the reinvestor takes action. This makes sure all yields are reinvested to further maximize the user’s profit.

The documentation reads:

“Position stays solvent as long as the debt is worth less than killFactor of the position value. Liquidation takes place when debt ratio exceeds the killFactor.”

Users can at any time choose to add more ETH or another token to save their position from reaching killFactor. It is important to note that users can not withdraw anything without closing a position.

Liquidity Providers

Just like yield farmers, LPs can borrow ETH from Alpha Bank with up to 2.5x leverage to provide liquidity on supported leveraged liquidity providing pool to earn higher trading fees APY.

LPs can provide liquidity with just one token and the protocol will automatically and optimally swap the tokens to make sure users have equal value of both tokens in an LP. Leveraged LP position stays solvent as long as the debt is worth less than killFactor of the position value. LPs can add more tokens to keep the position solvent.

Liquidators

They come into play when the debt exceeds the killFactor of the position’s value. LPs and yield farmers borrow ETH from Alpha Bank to take leveraged positions. When the total value of that position falls below the killFactor of a pool, debt exceeds the killFactor of the position’s value. The debt is calculated by dividing the total of ETH borrowed from Alpha Bank with the current value of the position.

When liquidation takes place, position value is used to pay debt first. 5% of the position value is then paid to the liquidator. The remaining amount is returned to the yield farmer.

Bounty Hunters

They are also called reinvestors. According to documentation:

“Bounty hunters can call reinvest function to sell all yield farmed tokens in Alpha Homora portfolio for ETH, and reinvest into the yield farming pool, earning 3% of the total reward in the process.”

ALPHA Token

ALPHA tokens not only govern Alpha Homora protocol but also a portfolio of Alpha Finance products. It provides many benefits to its holders like voting power to govern Alpha Finance products, staking to receive discounts on protocol fees, and more functionalities on Alpha products.

Alpha Finance has recently announced new ALPHA Tokenimics that allow ALPHA stakers to unlock products based on their Tier. The new tokenomics divides ALPHA stakers into five tiers based on the amount they stake.

The first ALPHA tier is “Alpha Woof Woof” where anyone who stakes 0 – 1,000 ALPHA tokens will be in the Alpha Woof Woof tier. The second tier is Alpha Wolf Pup that includes users staking between 1,000 – 10,000 ALPHA tokens. Second-tier stakers can have access to 10% higher leverage on Alpha Homora v2.

Staking 10,000 – 100,000 ALPHA tokens will stakers Alpha Wolf Warrior status. This tier unlocks 20% higher leverage. Anyone who stakes 100,000 – 1,000,000 ALPHA tokens will join the Alpha Wolf Elder tier with access to 30% higher leverage. Finally, stakers with more than 1,000,000 ALPHA tokens are in the Alpha Pack Leader tier and can access 40% higher leverage on Alpha Homora v2.

Alpha Homora V2

Alpha Homora v2 was launched on February 1, 2021. As reported, v2 is launched in partnership with Cream Finance, SushiSwap, Curve, and Balancer, and with the new logo, new user interface, and new functionalities.

In V2, lenders can lend ETH, USDT, USDC, and DAI to get corresponding ibtokens. V2 brings many new improvements to V1 including the addition of 4 new leveraged pools.

Important Links

Alpha Homora App: https://homora.alphafinance.io/alpha

Documentation: https://alphafinancelab.gitbook.io/alpha-homora/

FAQs: https://alphafinancelab.gitbook.io/alpha-homora/faq

Twitter: https://twitter.com/AlphaFinanceLab