As the Decentralized Finance (DeFi) space is evolving rapidly, an increasing number of novel DeFi platforms continue to emerge. Almost all other DeFi protocols came to existence through an organized process: publishing whitepaper, development stage, testnets, security audits, and finally mainnet. But a DeFi protocol, we are going to discuss, changed all that.

The introduction of smart contracts in blockchain technology made possible products that were never thought of before. So, the DeFi was born in 2018, and the UniSwap, a decentralized exchange (DEX) built on Ethereum, was one of the earliest DeFi projects.

Uniswap has been one of the most successful DeFi protocols for swapping tokens on Ethereum. The team, which developed the Uniswap, made the code open-source and available for anyone to fork.

At the start of September 2020, just days before the launch of Uniswap V3, a pseudonymous founder, Chef Nomi, copied Uniswap’s open-source code, added a new token, and then launched the project with the name of SushiSwap. The project managed to attract over $1.3 billion in value locked (TVL) in just one week after its launch.

Initially, the project was surrounded by some controversies but then moved away from Uniswap and was handed over to the community after it migrated to a multi-signature contract. SushiSwap is now running smoothly and according to DeFi Pulse, is ranked at number 6 in total value locked (TVL) with $3.84 billion locked in its liquidity pools. So, let’s take a look at SushiSwap.

What is SushiSwap Protocol?

SushiSwap is an automated market-making (AMM) decentralized exchange (DEX) running on the Ethereum blockchain. SushiSwap is a fork of Uniswap with some key differences, most notably the SUSHI token.

Like other decentralized exchanges (DEXes), SushiSwap facilitates the buying and selling of different crypto assets between users. But it does so by a model called automated market-making (AMM) instead of the orderbook model.

Users can add their tokens sitting idle in wallets into the liquidity pools and earn passive income According to their contribution. Traders can swap tokens from these liquidity pools. SushiSwap pools are AMMs that use constant x*y=k product algorithms to ensure that the amounts of tokens in pools are always balanced.

Although SushiSwap has a controversial history, it was and continues to be heavily community-driven and committed to the open-source ethos of cryptocurrency. The protocol merged with Yearn Finance (YFI) in December 2020. Since merging into the Yearn ecosystem, SushiSwap has been consistently eating into Uniswap’s dominance of the DeFi sector.

What are SushiSwap’s Core Products?

There are three products inside the SushiSwap ecosystem: SushiSwap Exchange, SushiSwap Liquidity Pools, SushiSwap SushiBar Staking (xSushi).

SushiSwap Exchange

It is a web-based application that provides necessary tools like Swap, Pool, stake. Users can swap the ERC-20 token of Ethereum using the Swap feature and connecting wallets. SushiSwap supports Metamask, WalletConnect, Coinbase Wallet, Fortmatic, Torus, Lattice, and Portis.

SushiSwap Exchange services come in three versions: SushiSwap Exchange, SushiSwap App, and SushiSwap Lite. All these versions provide similar services like swap, liquidity pools, Sushi staking. But SushiSwap lite uses limit and market orders to execute a trade.

Like Uniswap, SushiSwap exchange also features a protocol analytics dashboard for developers to export reports and status data about the protocol. SushiSwap Analytics dashboard provides information like total liquidity, trading volume, the top rewarding pool, and further deep insights into the protocol.

SushiSwap Liquidity Pools

SushiSwap’s liquidity pools allow anyone to provide liquidity via SushiSwap App or SushiSwap Lite. When they do so they will receive SLP tokens (Sushiswap Liquidity Provider tokens). For example, if a user deposited $SUSHI and $ETH into a pool they would receive SUSHI-ETH SLP tokens. A user can also create a new liquidity pool just by providing a new pair. The ratio of tokens the user adds will set the price of this new pool.

SushiSwap SushiBar Staking (xSushi)

When users provide liquidity to pools, they also receive Sushi tokens. The SushiBar product allows users to stake their Sushi and receive xSushi in return that can be staked in the xSushi pool.

How Does SushiSwap Work?

Swapping

Swapping on SushiSwap works similarly to other AMM DEXes. Traders can swap any ERC20 tokens. When users make trades on the SushiSwap Exchange, a 0.3% fee is charged. 0.25% of that trade goes back to the LP pool.

In exchange for maintaining liquidity in these pools, liquidity providers are rewarded with protocol fees, along with a portion of newly minted SUSHI daily. They also SLP tokens (Sushiswap Liquidity Provider tokens) that represent a proportional share of the pooled assets, allowing a user to reclaim their funds at any point.

SushiSwap protocol uses Uniswap’s like AMM model but also introduces limit orders to it. According to the team, typically AMMs only settle orders with the market price, which represents a significant limitation compared to orderbook driven exchanges. SushiSwap addresses this critical AMM pain point with the release of the limit order feature.

The limit order model on SushiSwap consists of two contracts: OrderBook and Settlement. OrderBook keeps limit orders that users have submitted. Anyone can call and create a limited order with the amount to sell and a minimum price. The settlement is in charge of swapping tokens for orders. This is done with the help of relayers Relayers need to fill an order with the proper parameters to meet the minimum price requirement set in the order. If the attempt is successful, a 0.2% fee goes to the relayer and xSUSHI holders. Out of 0.2% fee, 80% goes to the relayer while 20% to xSUSHI holders.

Staking

SushiSwap SushiBar product allows users to stake their received SUSHI tokens. By staking with SushiBar, they receive xSUSHI which can then be in the xSushi pool. As we know, when users make trades on the SushiSwap Exchange a 0.3% fee is charged. 0.05% of this fee is added to the SushiBar pool in the form of LP tokens for the relative pool.

The documentation provided by SushiSwap explains staking as:

“When the rewards contract is called (minimum once per day) all the LP tokens are sold for Sushi (on SushiSwap Exchange). The newly purchased Sushi is then divided up proportionally between the xSushi holders in the pool, meaning their xSushi is now worth more Sushi.”

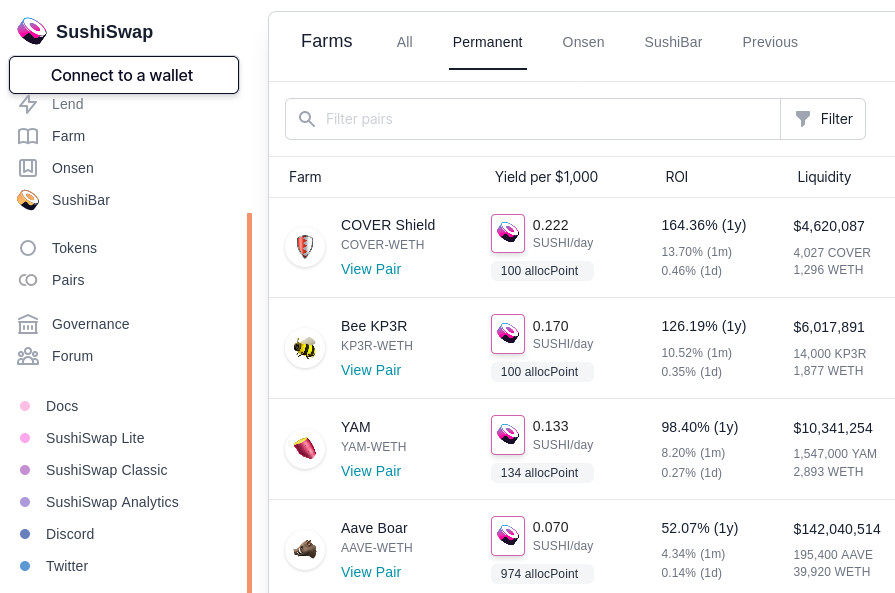

Yield Farming

SushiSwap provides users with multiple yield farming opportunities, not the least of which is SushiBar. The protocol allows users to stake their SLP tokens in many farms. Users can enter into the farms of their choice. Yield farming on SushiSwap offers a yield of more than 300% APY on some farms but is not fixed.

Sushi (SUSHI) Token

SUSHI is the native token of the SushiSwap protocol that plays a key role in maintaining and operating its network. Users who hold SUSHI can help govern the protocol by voting on proposals that might improve its ecosystem, and anyone can submit a proposal for SushiSwap users to vote on.

The tokenomics (SUSHINOMICS) includes a 250 million $SUSHI hard cap and the expected date to reach the hard cap is November 2023. 10% of all emissions will go to Multisig-controlled dev fund.

SUSHI token also powers the governance model of SushiSwap. Currently, major structural changes and use of the dev fund wallet are voted on by the community, whereas smaller changes affecting operations, as well as changes of SushiSwap menu farming pairs, are decided on by 0xMaki and the core team. The team is also working on establishing a DAO which will take effect somewhere in 2021.

Sushiswap Links

- Website: https://www.sushi.com/

- SushiSwap Exchange:

- SushiSwap App: https://app.sushi.com/experimental/beginner

- SushiSwap Lite: https://lite.sushi.com/#/

- Documentation: https://docs.sushi.com/

- Twitter: https://twitter.com/sushiswap

If you found this article interesting, here you can find more DeFi News