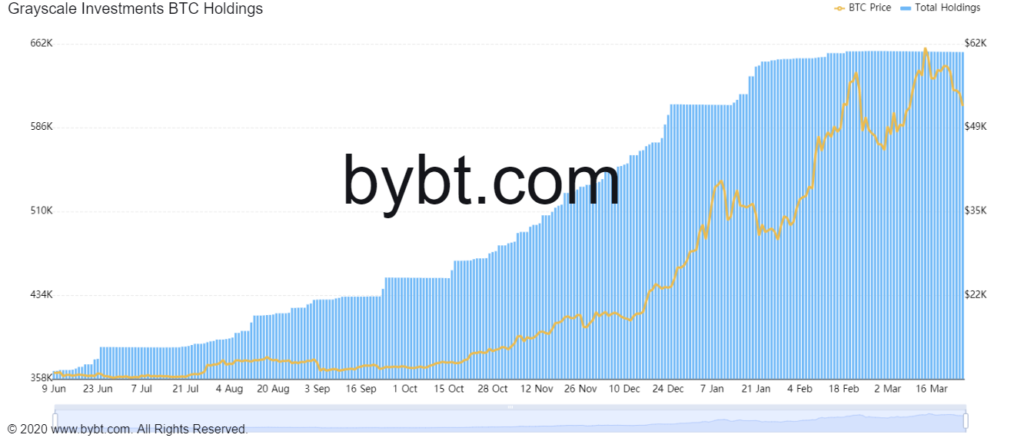

Bitcoin [BTC] has been facing its worst sell-off in a long time, its longest streak since December to be specific. It was down by almost 15% since establishing its all-time high above $61.3K. As the world’s largest crypto-asset fell to $53K, Grayscale Bitcoin Trust [GBTC] premium collapsed.

In the last seven days, more than $29 billion Grayscale Bitcoin Trust has recorded an astonishing fall of around 20%. A lot more than the underlying crypto-asset. The closing of GBTC more than 14% below the value of its underlying holdings on the 25th of March has triggered the discount to climb a record high.

What does this mean?

This implies that the shares of GBTC are lingering well-below their Net Asset Price [NAV] thus enabling the institutional investors to make a purchase at a discount.

Eyes All Set For Grayscale Bitcoin ETF?

There is a fleet of warships of Bitcoin fund products that are just one green light away from foraying into the market that has never been more hyped about adding cryptocurrency [indirectly] into their portfolio. Speculations regarding the capability of a Bitcoin ETF potentially expelling Grayscale’s Bitcoin Trust, GBTC product from its dominant position cannot be undermined.

ETF has an edge over GBTC. Here’s how:

Fundamentally, exchange-traded funds or ETFs are designed to have a zero NAV premium. This means that the position is supposed to be traded with Bitcoin for the ETF. Here comes an opportunity for Bitcoin’s price to recuperate.

Since the start of Feb this year, GBTC’s trade volume has depreciated by more than 20%. At the time of writing, the figure stands close to $525 million. On the other hand, Bitcoin trade volume is up by almost 50% in the last 24-hours. This could signify that retail investors are offloading BTC to buy alts and pour capital into DeFi.

It goes without saying that the premiums have been on a steady decline since the beginning of this year. But the recent surge in altcoin price as well as DeFi tokens, coupled with the movement of capital from the world’s largest cryptocurrency to the decentralized finance realm via Wrapped Bitcoin [WBTC] depicts that GBTC could face a threat from the rising alternative investment products.

Impact On Bitcoin?

Deducing the above, it can be said that the retail-driven crypto-mania is cooling down. Meaning, the retail investors could anticipate Bitcoin’s price to fall all the way to the $45000 level if the discount on GBTC continues to climb to new highs. Hence, a potential drop this weekend could very well be on the cards.

If you found this article interesting, here you can find more Bitcoin news