TL;DR

- Whales sell 510 million XRP, testing market liquidity and key $2.02 support.

- Buyers actively absorb selling pressure, preventing a breakdown below the trendline.

- XRP’s NVT Ratio drops 71%, signaling stronger transactional network support.

The current week turns XRP into a stress test for liquidity. Large wallets offload around 510 million XRP, and extra supply hits the market in several sessions. Each wave of selling adds pressure near short-term support and sparks debate over capacity to absorb the shock.

Even with heavy outflows from whales, XRP still trades above a rising trendline on the chart. Price action shows active defence from buyers, who refuse to clear out bids near support. At the same time, volatility shrinks. The token trades inside a compressed structure, and small changes in order flow quickly alter sentiment among short-term traders.

Two areas stand out on spot books and derivatives screens. The $2.02 zone marks a lower band where many participants test buying power against whale supply. The region around $2.25 concentrates interest near the upper edge of the current range. Liquidity on both sides prepares the ground for abrupt swings once price interacts with either level in an aggressive way.

Are buyers really absorbing whale pressure?

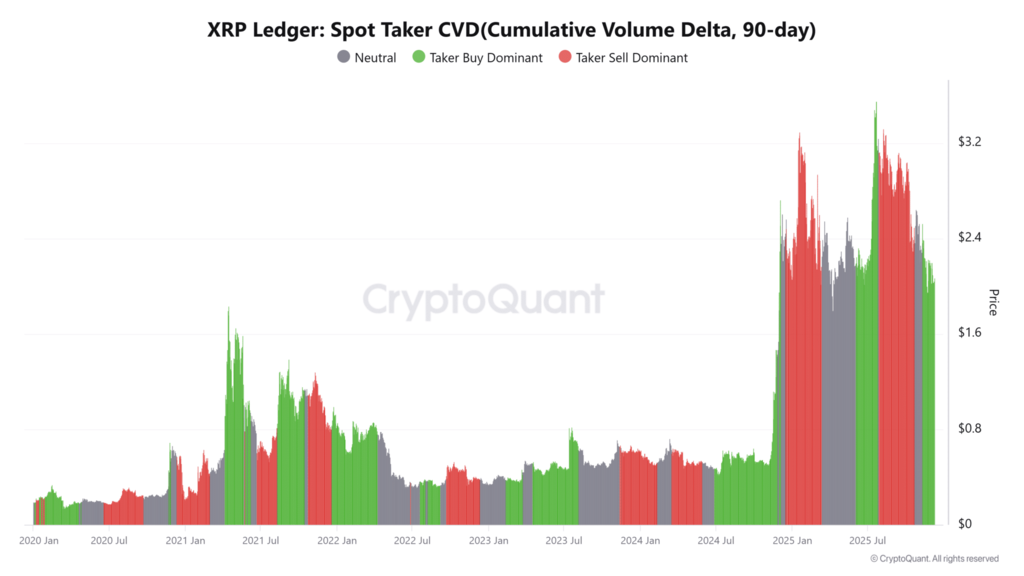

Order-flow data from Taker Buy CVD helps to answer that question. During the week, the metric climbs and shows steady dominance from aggressive buyers. Market orders on the bid side absorb coins from whales instead of stepping back and allowing a deeper slide.

Stronger Taker Buy CVD sends a clear signal: buyers keep control of key areas, at least for now. Each uptick in the line confirms active defence of support and reduces the chance of an immediate breakdown below the rising base. The pattern also suggests that many traders treat whale selling as an opportunity to build positions rather than a reason to exit.

Spot flows reinforce the message. Persistent buying on exchanges points to expectations of a rebound inside the current compression pattern. Even so, order-book absorption alone cannot carry XRP forever. Price needs new momentum in order to escape the range. Without a fresh impulse, heavy supply may eventually exhaust buyer strength and push the token below the trendline.

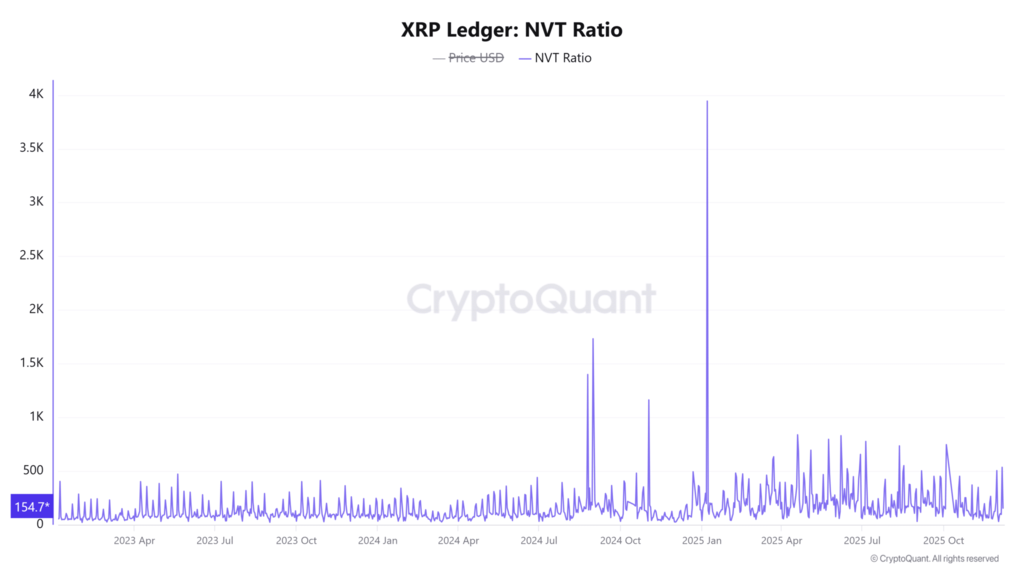

Why does a 71% drop in the NVT Ratio matter now?

On-chain metrics add an important layer. The NVT Ratio for XRP falls by around 71.13%, down to 154.70. That drop signals higher network activity relative to market value and improves on-chain efficiency during a delicate phase for price.

Lower NVT usually points to stronger transactional support. More value flows across the network per unit of capitalization. Under heavy whale selling, such an improvement helps maintain structural backing for the asset. Traders who monitor on-chain data see the change as a sign of healthier usage and better resilience in the medium term.

Even with a stronger network profile, technical confirmation still matters. On-chain strength alone rarely delivers a breakout. Chart structure, volume and trend need to align with improved fundamentals. For now, the NVT Ratio acts as a counterweight to short-term selling pressure and offers a base for recovery once technical signals line up.

Do surging long positions hint at a breakout?

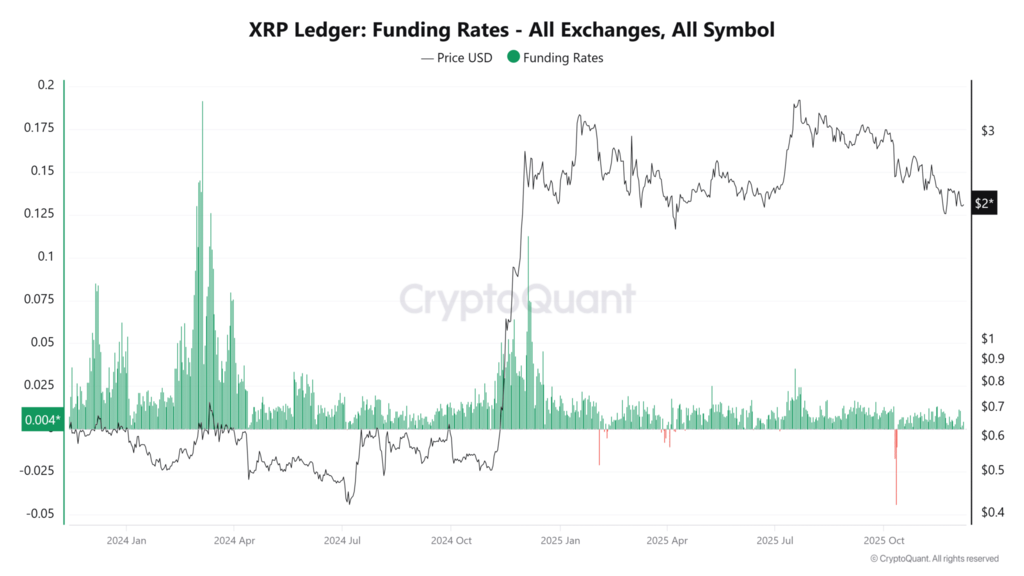

Derivatives markets complete the picture. Funding rates for XRP jump more than 127%, which reveals a clear tilt toward long exposure. Traders who hold long contracts pay higher fees and accept growing cost to maintain bullish bets.

Rising funding gives the token fresh speculative fuel during a period of tight compression. High long interest increases sensitivity near resistance. A sharp move above $2.218 could trigger liquidations of short positions and fuel fast upside spikes, especially while liquidity clusters sit near $2.25.

The same structure creates risk on the other side. Elevated funding and crowded longs also raise the chance of abrupt downward moves if XRP revisits support near $2.02. A decisive break under the lower band may trigger forced closures of leveraged longs and deepen the drop. Liquidity pockets around $2.02 and $2.25 therefore act as magnets for volatility, not only as static levels on a chart.

Current conditions in XRP combine three key forces. Whales reduce exposure and inject large blocks of supply. Spot buyers and Taker Buy CVD still show firm absorption near rising support. On-chain data improves through a steep decline in the NVT Ratio, while derivatives metrics reveal aggressive long positioning and higher funding rates.